The concept of remote work is gaining widespread traction, leading organizations around the world to adapt and evolve, especially in terms of onboarding procedures for new employees and navigating complex cross-border payments. This modern era of work has triggered a high demand for startup companies providing human resources (HR), payroll, and compliance tools, catering to the needs of businesses with remote hiring.

One such business operating in the UAE is RemotePass, which recently secured a Series A funding of $5.5 million, led by the New York-based 212 VC. Other notable investors in this round include Endeavor Catalyst, Khwarizmi Ventures, Oraseya Capital, Flyer One Ventures, Access Bridge Ventures, A15, and the Swiss Founders Fund.

The company, founded in late 2020 by CEO Kamal Reggad and Karim Nadi, offers a platform for businesses to onboard, manage, and pay their talent base in countries where they have no local legal presence. Serving a diverse clientele, ranging from startups to large enterprises such as Spotify and Logitech, RemotePass enables the hiring of contractors and full-time employees in over 150 countries.However, RemotePass was not originally launched with this purpose in mind. A year prior to its official release, it was known as “SafarPass,” providing a SaaS platform dedicated to streamlining business travel and expense management through a designated app. The idea was born out of the prevalent chaos in corporate travel, which generated significant interest – but this was before the global pandemic struck.In an interview with TechCrunch, Reggad shared that as SafarPass encountered numerous challenges, it became increasingly evident that the recovery of business travel would be significantly prolonged due to the pandemic. This prompted a necessary pivot in the market for RemotePass. As a remote-first team with 18 employees spread across the UAE, Africa, and Europe, Reggad gained firsthand insight into the complexities of managing remote staff and navigating associated payment hurdles – an experience that laid the foundation for RemotePass.“We often struggled with payment issues at the end of each month. With contract work, there was always uncertainty around overall compliance. We realized that if we were facing these problems as a six-month-old startup, our clients might as well,” commented Reggad. “In the Middle East, each country has its own currency, laws, and complexities when it comes to financial services and benefits. This is when we decided to create a solution that would simplify the process for companies, making it easy for them to onboard, pay, and manage their team members in different locations.”

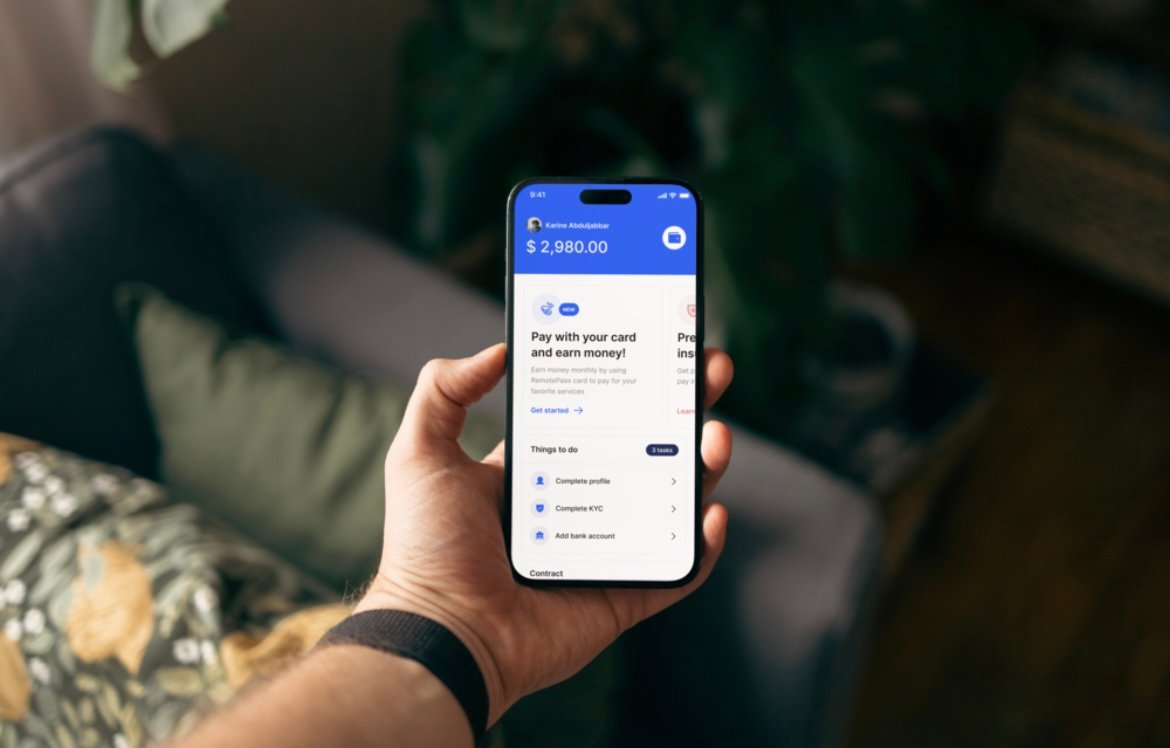

Taking advantage of the opportunities presented by the pandemic, as the world embraced remote work on a large scale, RemotePass witnessed a 35% month-over-month growth in its first two years, largely driven by client referrals. According to the CEO, the platform, which offers multiple payout options, experienced a two-fold increase in revenue between 2022 and 2023. This tremendous growth was supported by the $5.4 million raised before now, which was utilized to expand the platform’s reach to work with over 600 companies and 800 remote workers in emerging markets.Numerous companies are actively facilitating remote work and assisting employees in receiving payments from their employers. While established players like Deel and Remote dominate a significant share of the market, RemotePass is set apart by its focus on emerging markets, particularly in the Middle East and Africa.Reggad emphasizes RemotePass’s localized approach through its super app, which offers features tailored to the unique needs of end-users in these markets. This includes dollar debit cards that allow users to hold funds in USD, mitigating risks associated with currency fluctuations, and monthly health insurance benefits that extend to dependents. As a Dubai-based startup, RemotePass collaborates with third-party providers for its insurance products and also provides businesses with EoR services and relocation support.

“Our clients are not just hiring a remote worker, they are also concerned about their well-being. This is why they appreciate our financial services and benefits that cater specifically to remote workers,” says the CEO, who previously worked as a systems engineer in the U.S. before returning to Morocco in 2011 to start Hmizate, an e-commerce site for travel and shopping, which was eventually acquired.

In the end, everything boils down to employee retention. By providing contractors and full-time employees with a range of services, they are more satisfied and likely to stay with the company for a longer period.

RemotePass generates its revenue through a subscription-based model. The fee for engaging contractors is $40/month per active contractor, and for companies hiring full-time employees, the subscription rates range from $350 to $699/month per employee, depending on the country and specific requirements for immigration and relocation services. While contractors and full-time employees currently require their employers to be on RemotePass, the platform aims to provide independent access for end-users in the future, creating a new revenue stream for the company.With this new round of funding, RemotePass has two primary objectives. First, to enhance its product’s enterprise readiness, and secondly, to onboard more businesses in Saudi Arabia, where it has witnessed the most growth. The company also plans to intensify its efforts for product localization.“Having witnessed RemotePass’s remarkable product growth and exceptional customer service since early 2023, we are confident in their visionary team and business model,” said Ali Hikmet Karabey, managing director at 212 VC, in a statement. “RemotePass addresses significant workforce challenges, such as talent mobility and remote work, acting as a key enabler. It connects companies seeking a broader talent pool with emerging market talents who previously lacked access to global financial solutions and processes. This disruption positions them as game-changers in the UAE & KSA, two markets poised for global dominance.”