The highly-anticipated IPO of Reddit has been a hot topic in the tech world. However, another company, Astera Labs, is also set to go public and may serve as a more important test of investors’ renewed appetite for tech IPOs.

Astera Labs recently announced that its public debut will be bigger and grander than previously planned. Not only will it sell more shares, from 17.8 million to 19.8 million, but it will also do so at a higher price, expecting a range of $32 to $34 per share compared to the initial $27 to $30 range. This increase in size and price will bring its expected total funds raised to a whopping $517.6 million, up from the previous $392.4 million. Experts predict the company will go public this week.

“While Reddit’s IPO may attract investors looking to invest in the popular social media company’s AI data business, Astera Labs is an AI hardware story,” said a source.

“And no, it’s not competing with Nvidia, the leading American chip giant known for its highly sought-after AI chip,” the source added.

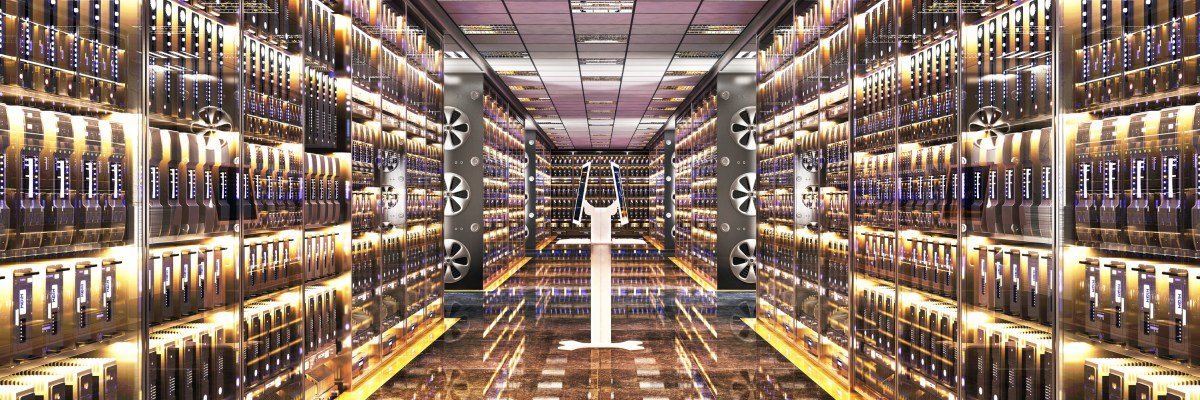

Astera Labs primarily manufactures connectivity hardware for data centers used in cloud computing. As AI technology requires massive amounts of data to be constantly transferred, Astera has seen a significant increase in revenue. In 2022, it generated $79.9 million, and this number skyrocketed by 45% in 2023 to reach $115.8 million.

With a whopping 271 mentions of “AI” in its latest public filing with the SEC, Astera Labs is working hard to convince investors of its strong foothold in the AI industry.

However, there are debates about the long-term success of Astera Labs in the AI market. Nick Einhorn, Vice President of research at Renaissance Capital, a company that tracks IPOs and offers IPO-focused ETFs, remains a bit skeptical. He stated, “Astera is not an AI company, but it is benefiting from the trend of increased data center spending driven by AI.” In 2022, Amazon also signed a warrant agreement that would allow them to purchase nearly 1.5 million shares, hinting at the possibility of Amazon Web Services as a potential customer.

“While Astera Labs does have an AI story to tell, its rapid growth and early profitability have attracted attention from potential investors in the public market,” said a source.

In the world of startups, it is common for growth and losses to go hand-in-hand. As startups often raise funds from private-market investors, they use these funds to expand their operations and build and sell products quickly. By the time a startup is ready to go public, it is usually still unprofitable and not expected to generate any profits in the near future, according to stricter accounting standards.

However, in the fourth quarter of 2023, Astera Labs proved to be an exception to this rule. While its business continued to grow rapidly, it also managed to demonstrate early profitability. In 2022, the company reported a net loss of $58.3 million on a revenue of $79.9 million. In 2023, its revenue increased to $115.8 million, and its net loss significantly decreased to $26.3 million. Even after excluding non-cash costs, the company still reported adjusted losses in 2023.

But further analysis shows that Astera Labs has begun to see a significant improvement in both its financial growth and profitability. In the third quarter of 2023, its revenue jumped from $10.7 million to $36.9 million, and then to $50.5 million in the fourth quarter. Simultaneously, its net loss decreased from $20.0 million in the second quarter of 2023 to a mere $3.1 million in the third quarter. In the fourth quarter, Astera Labs even managed to turn a profit, reporting net income of $14.3 million.

“Einhorn notes that the company’s impressive results in Q4 of 2023 may not represent its overall performance in the future, as customer buying patterns can be unpredictable,” a source revealed.

Another concerning factor is that in 2023, Astera Labs’ three largest customers made up 70% of its total revenue, as disclosed by the company.

After thoroughly analyzing Astera Labs’ financial performance, it is apparent that the company has managed to ride the AI data center spending wave, leading to remarkable growth. This success has resulted in its IPO being valued at approximately $5.2 billion, a significant increase from its final private-market valuation of $3.15 billion.

If Astera Labs’ IPO attracts strong investor interest on its first day of trading, it may open the doors for other businesses that have seen rapid growth due to AI to follow suit. This could potentially lead to more technology-focused IPOs this year.