Silence has emerged as a new VC firm with a mission to disrupt the world of climate tech investment. With an impressive $35 million already raised, Silence plans to make multiple small investments in climate startups and apply the playbook of tech startups to help them thrive.

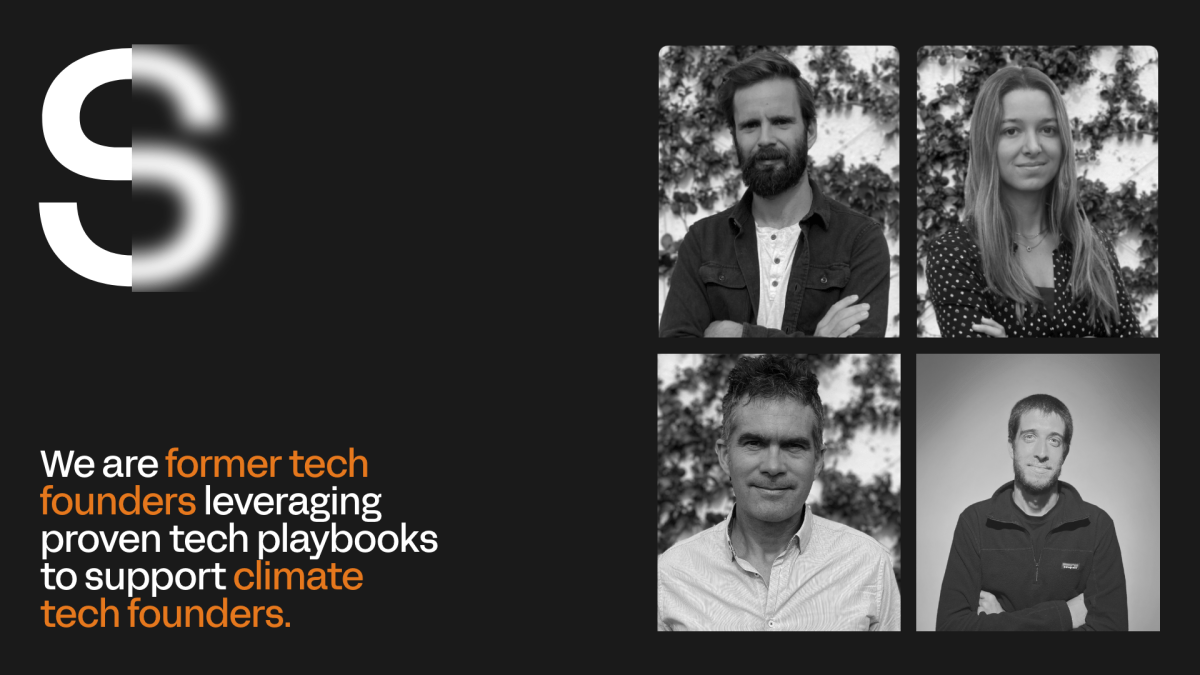

The driving force behind the Silence team is Borja Moreno de los Rios, a solo general partner for the original fund. Borja brings a wealth of experience to the table, having previously served as a venture partner at FJ Labs and founded Merlin, a marketplace for hourly jobs in the United States.

But Borja’s true passion lies in climate investment. He has surrounded himself with a team of tech experts who have all immersed themselves in the world of climate.

“I have always felt deeply connected to nature and the environment since I was a child,” Borja shared with me. “Growing up, I spent my weekends and vacations by lakes and in the countryside, competing in water skiing since a young age.”

As his tech career progressed, Borja made a conscious effort to learn as much as possible about the climate industry so he could make a meaningful impact. After his previous company was acquired, he knew he wanted to pursue something in the world of climate.

A silent partner

Since its first close in June 2022, Silence has already invested in 22 different companies. They follow a similar investment strategy, with some exceptions. Unlike traditional VC firms, Silence does not lead rounds or take board seats.

Their goal is to remain neutral and unbiased in the long run, much like an angel investor. However, their larger ticket size sets them apart, with an average investment of $300k. They invest anywhere from pre-seed to Series A, with a range of $100k to $700k per investment. They also plan to make follow-on investments for the most promising companies.

The team at Silence purposely does not compete with top-tier VC firms, allowing them to be invited to participate in highly competitive deals. As Borja explained, “We wanted to find a way to complement current VC firms, not compete with them.” They have already joined rounds with notable names such as Point Nine, FJ Labs, FifthWall, Firstmark Capital, and Lowercarbon Capital.

While we won’t list all of their portfolio companies, a quick glance at Silence’s portfolio page reveals a diverse group of companies focused on virtual power plants, energy management systems, home energy management, solar financing platforms, and circular marketplaces.

“One of our portfolio companies has been growing rapidly,” Borja proudly shared. “We invested in them at the pre-seed stage, which is not typical for us. But they were struggling to close a round because everyone wanted a lead investor, and no one was stepping up. So we decided to take the lead and invest in this company.”

The company, called Cardino, is a used EV marketplace and has already reached €72 million in GMV within just nine months. They recently closed a seed round with Point Nine as the lead investor, and Borja says things are looking promising.

Along with Borja, the Silence team includes Sara Ramos Colmenarejo, who left the Hummingbird team to join the firm. Guilherme Penna, previously with Global Founders Capital, is also an investor at Silence. And Brendan Hayes serves as the fund’s CFO and COO.

As for the limited partners at Silence, they include general partners from other VC firms such as Firstmark Capital, DST Global, FJ Labs, Point Nine, and Hummingbird, as well as family offices and successful founders.

Borja’s enthusiasm as an investor was palpable as he passionately discussed some of his portfolio companies with me. And even though Silence prides itself on being a small, angel-style investor, Borja couldn’t help but list a few of his favorites.

“We have a really early-stage company called Electryone that’s building virtual power plant software, and we are very excited about it,” he shared. “Another company we are invested in is Runwise in the U.S., which has created technology that integrates into building heating systems and uses sensors to optimize temperature.”

Interestingly, unlike many other climate funds, Silence does not seek to invest in deep tech projects with long-term timelines. Instead, they focus on SaaS and marketplace investments where they believe they can create the most value for climate.

“I know this may be a controversial statement, but I believe our safer investments in these areas will ultimately make a greater impact on the climate than investing in ten moonshots, which may all fail,” Borja stated.