Former CEO of FTX Sentenced to 25 Years in Prison for Fraud

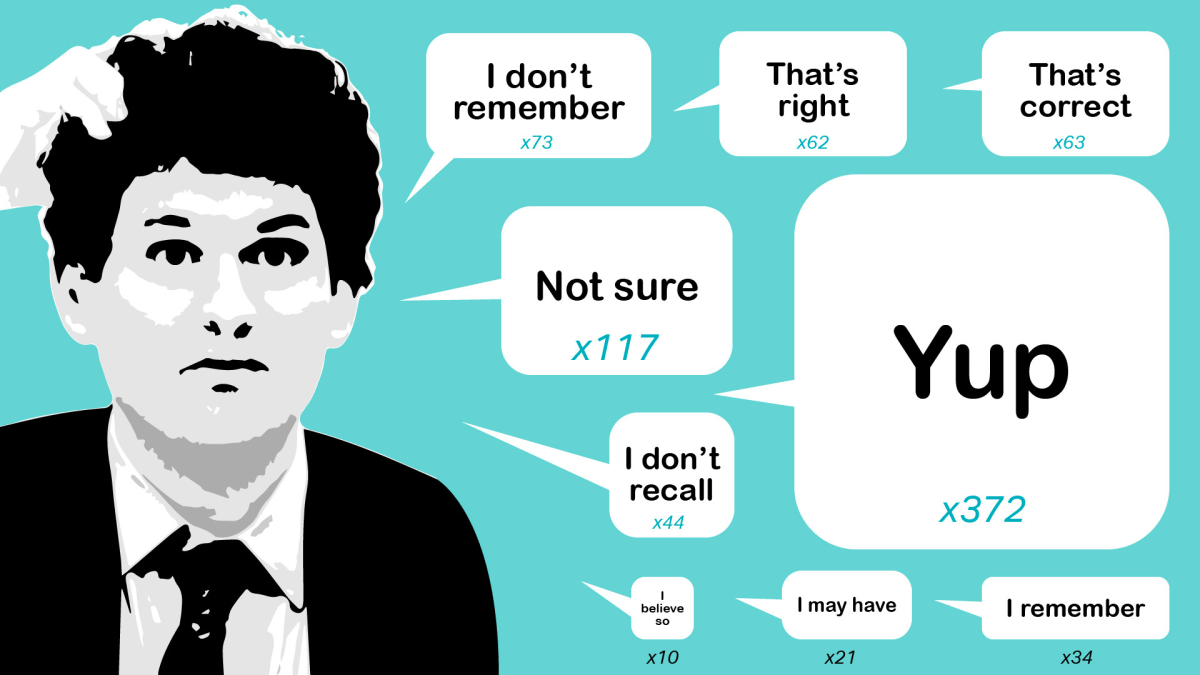

On Thursday, former CEO of FTX, Sam Bankman-Fried, was sentenced to 25 years in prison after being found guilty on seven counts of wire fraud and money-laundering.

The elaborate scam involved Bankman-Fried and his partners using their exchange, FTX, to secretly funnel customer deposits to their hedge fund, Alameda Research. According to the case presented by the government, the funds were used for various purposes, including investing in other cryptocurrency startups, purchasing high-end real estate, and supporting political campaigns. Most importantly, the funds were used to bolster FTX’s proprietary cryptocurrency token, FTT.

A series of document leaks and investigative work by journalists at Coindesk, as well as a timely tweet by Changpeng “CZ” Zhao, former CEO of rival exchange Binance, ultimately led to the unraveling of the scheme. In just a matter of days, billions of dollars in customer investments were lost. CZ himself has also been implicated in the scandal and is no longer running Binance, having pleaded guilty to money-laundering violations.

This sentencing marks the end of a turbulent era in the world of cryptocurrency. It was characterized by get-rich-quick schemes that preyed on unsuspecting investors, with promises of high returns on everything from digital art to volatile tokens.

However, there is hope for a more stable and sustainable phase in the crypto world, according to optimists like Andreessen-Horowitz’s Chris Dixon. They believe that software developers will now focus on building practical applications on the numerous blockchains that have emerged since bitcoin’s inception in 2008.

But skeptics argue that this optimistic view overlooks the fact that developers have already been building on various blockchains for years, with little success beyond speculation. Despite efforts to create digitally authenticated art and new decentralized organizational systems, nothing has proven to be a true “killer app” for blockchains.

Furthermore, there has yet to be a single blockchain-based startup that has been profitable enough to go public. While there are companies involved in mining and facilitating crypto trades, there is no clear success story of a company creating substantial economic value through innovative use of blockchain technology.

However, some argue that the true value and purpose of cryptocurrency lies in its original function as a decentralized alternative for storing and exchanging value outside of traditional nation-based currencies. In countries with volatile economies, corrupt governance, and social unrest, converting local currency to bitcoin and then to a more stable currency like the US dollar can be a valuable means of preserving wealth.

While some may argue that newer coins, such as Ethereum and Solana, offer similar opportunities, the underlying value of these coins is primarily based on faith and trust. On the other hand, bitcoin’s value is backed by something tangible: energy. The mining process for obtaining new bitcoins consumes energy, giving it a real-world value that could potentially stabilize its price in the long run.

Until a more efficient and reliable source of energy is discovered, bitcoin remains a valuable asset that can be used for remittances and as a means of conducting underground economic activity without the need for physical cash. And it’s no surprise that bitcoin’s mysterious creator, Satoshi Nakamoto, may have had connections to the energy industry.

The future of cryptocurrency and blockchain technology is uncertain, with arguments on both sides for its potential success or failure. But one thing is clear: the conviction of Sam Bankman-Fried and the downfall of FTX serve as a warning to potential scammers and reinforce the importance of ethical practices in this evolving industry.

[…] a lengthy trial and conviction, the verdict has finally been reached for former crypto tycoon, Sam Bankman-Fried. He has been sentenced to up to 25 years behind bars. This long and […]