The cross-border payments market is forecasted to reach over $250 trillion by 2027, according to the Bank of England.

So it’s no surprise that one of the trends among Y Combinator’s Winter 2024 batch of nearly 30 fintech startups is how to more easily move money globally.

Users get a U.S. bank account and access to low-cost local payment rails.

InfinityWhat it does: Cross-border banking for small businesses in IndiaWe heard from a lot of childhood friends during the past two days, so it was refreshing to see two siblings form a company.

Businesses in India account for $700 billion in cross-border trades per year, and Infinity makes 1% from those transactions.

When it comes to funding, the fintech sector didn’t have a very good start to the year.

Fintech funding slid by 16% quarter-over-quarter during the three-month period, according to CB Insights’ Q1 2024 State of Venture Report.

But even more troubling than the double-digit dip was the fact that the $7.3 billion raised globally by fintech startups in the three-month period marked the lowest level the sector has seen since early 2017, according to the report.

During the three-month period, 904 investments were made into fintech startups.

Dollars raised and deal count is also down compared to the fourth quarter of 2023, when 786 fintech startups raised $8.7 billion.

Flipkart co-founder Sachin Bansal is in talks to raise capital for his new startup, Indian fintech Navi.

Bansal is talking to investors to raise at a valuation of around $2 billion, three sources familiar with the matter told TechCrunch.

The Bengaluru-headquartered startup Navi has been largely self-funded up to now — Bansal owns 97% of the company — and this would be its first large outside fundraise since it was founded in 2018.

After a particularly rough 2023 in which overall startup funding fell 73% in the country, this could be a signal that growth stage funding rounds are back on the table.

Even if this might become Navi’s first external raise, that doesn’t mean Bansal has not been talking to interested parties.

Former president Donald Trump’s digital media company is losing money, and lots of it.

But why is that any different from other “startups,” which often struggle to post a profit for years, if they ever do?

Truth Social, the main business of TMTG, has failed to attract more than a few million users.

Truth Social, the main business of TMTG, has failed to attract more than a few million users.

By the time Trump is able to sell his shares, it’s likely this company will be worth anything like what it supposedly is today.

The modern world is dependent on a vast network for extracting, processing, transporting and ultimately consuming hydrocarbons like crude oil and natural gas.

Instead of reducing humanity’s dependence on hydrocarbons — which is impossible or undesirable or both, depending on who you ask — Terraform Industries’ solution is to produce this resource, using electricity and air, via a system it calls the Terraformer.

Today, the startup is announcing that it has commissioned a demonstrator Terraformer and produced synthetic natural gas for the first time.

Roughly the size of two shipping containers, the Terraformer consists of three subsystems: an electrolyzer, which converts solar power into hydrogen; a direct air capture system that captures CO2; and a chemical reactor that ingests both these inputs to produce pipeline-grade synthetic natural gas.

The startup says that improvements are already in the works to bring these prices down even further to ensure that its synthetic natural gas hits cost parity with conventionally sourced liquified natural gas.

This week, we’re looking at Robinhood’s new Gold Card, challenges in the BaaS space and how a tiny startup caught Stripe’s eye.

BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees.

The startup is not the only VC-backed BaaS company to have resorted to layoffs to preserve cash over the past year.

MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

It has more primary customers than ChaseInside a CEO’s bold claims about her hot fintech startup, which TC previously covered here.

And Manish wrote about the resignation of Stability AI founder and CEO Emad Mostaque late last week.

AI-powered itineraries: In an upgrade to its Search Generative Experience, Google has added the ability for users to ask Google Search to plan a travel itinerary.

Using AI, Search will draw on ideas from websites around the web along with reviews, photos and other details.

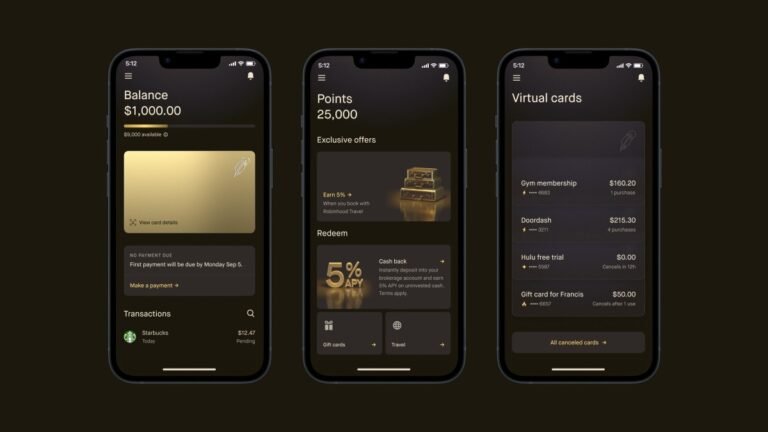

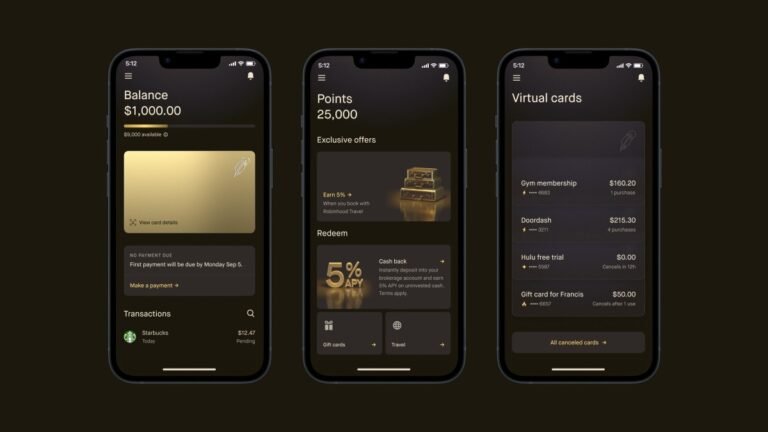

Robinhood’s new card: Nine months after acquiring credit card startup X1 for $95 million, Robinhood on Wednesday announced the launch of its new Gold Card, powered by X1’s technology, with a list of features that could make Apple Card users envious.

Bonus roundSpotify tests online learning: In its ongoing efforts to get its 600 million+ users to spend more time and money on its platform, Spotify is spinning up a new line of content: e-learning.

Hello, and welcome to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Friday episode, in which we dig through the most critical stories and themes from the week.

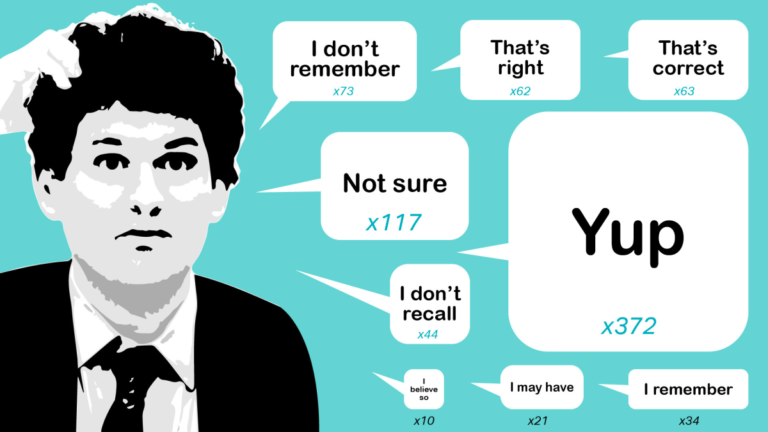

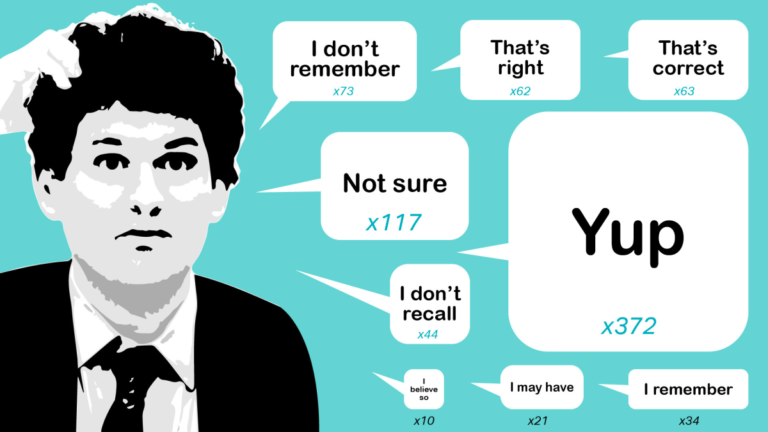

But while the SBF news was a big deal, there was so very much more to cover on today’s news roundup episode of Equity.

We also dug into two companies building startups focused around kids.

Then, to wrap up, a look at just who unicorn founders really are, and a new $100 million fund that to back climate tech.

Nearly everything else that’s being built on or enabled by blockchains replaces something that’s already being done fairly well.

Yes, there are companies that facilitate crypto trades like Coinbase and Block (formerly Square).

But there’s no actual company that’s developed economic value by doing something brand new or better on a blockchain.

Energy drives the real-world economy, and unless Sam Altman or somebody successfully unlocks fusion and delivers energy that’s truly “too cheap to meter,” it’s going to remain a real asset with real value for some time.

In fact, it wouldn’t surprise me in the least if Satoshi had some kind of connection to the energy industry.

Zaver now has $30 million to make it a realityWe last checked in on Zaver, a Swedish B2C Buy-Now-Pay-Later (BNPL) provider in Europe, when it raised a $5 million funding round in 2021.

The company has now closed a $10 million extension to its Series A funding round, bringing its total Series A to $20 million.

Total investment to date stands at $30 million.

In Europe, Zaver competes on BNPL with Klarna, PayPal, and incumbents such as Santander and BNP Paribas.

However, Zaver’s schtick is it claims it can assess the risk on BNPL cart sizes of up to €200,000 in real time due to its risk assessment algorithms.