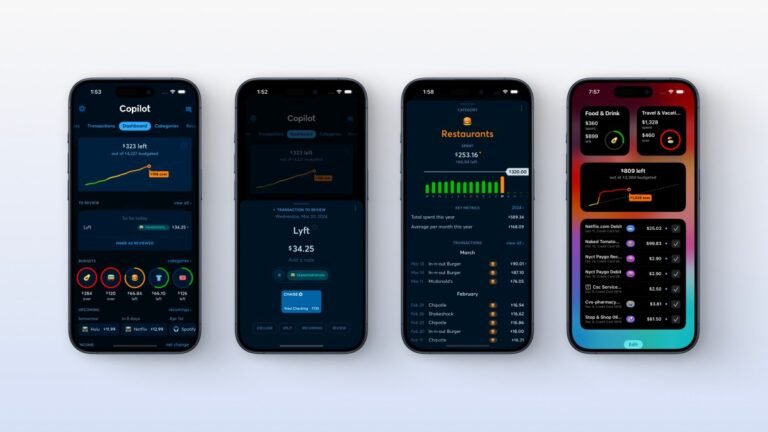

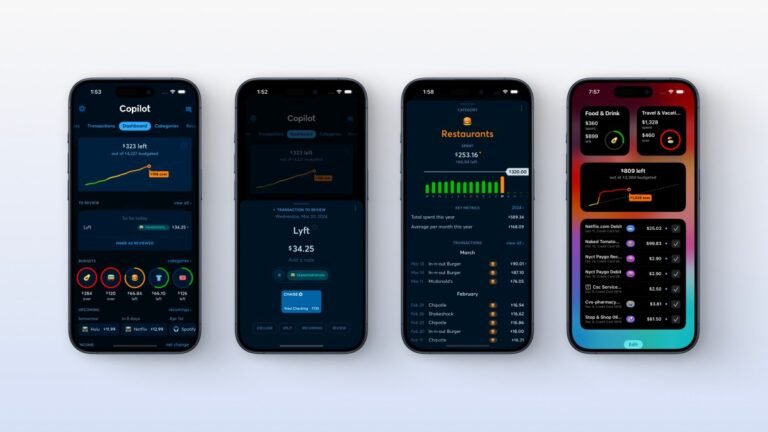

Intuit is winding down budgeting app Mint this week and that’s become good news for competitor Copilot.

The New York-based CEO started the subscription-based personal finance tracker in January 2020 to offer an alternative to Mint.

Users also save an average of 5% after starting with the app, Copilot calculates.

Beyond MintLike millions of others, Ugarte tried some personal finance apps, including Mint, yet found them to be lacking.

Other personal finance apps show where you are spending, even in categories that might not be relevant, he said.

VCs double down on fintech Coast, which aims to be the Brex for ‘real-world’ industriesThe expense management arena is a crowded one, with well-funded players such as Brex, Ramp and Navan all clamoring for market share.

While Coast declined to divulge hard revenue figures, CEO Simon told TechCrunch that it saw about 550% increase in annualized revenue and payment volume growth in 2023.

That growth prompted its existing investors to double down on the company, while attracting a new backer as well.

Today, Coast is announcing that it has raised an additional $25 million in venture capital and $67 million in debt financing.

Sign up for TechCrunch Fintech here.

How crypto exchange Backpack climbed its way to success after its major investor FTX died Backpack hit $27.5 billion in total trading volume during its beta phaseBackpack’s founders, who are building a crypto exchange and wallet, have experienced strong growth since launching in 2022.

There’s a bunch of lessons to learn from FTX, Ferrante said.

This is done in hopes that there’s no single point of failure and that the operations of the Backpack crypto exchange can be split up across multiple entities.

At the end of February, Backpack raised $17 million at a $120 million valuation in a Series A round led by Placeholder VC.

But product distribution is top of mind for the exchange as it hopes to get into every country around the world.

Despite all that growth, Eric Gylman, the co-founder and CEO of Ramp thinks that the industry, and companies like his, are just scratching the surface.

Glyman and his current co-founder Karim Atiyeh launched their first fintech startup, Paribus, back in 2014.

The company raised a mere $2 million before getting snapped up by Capital One.

When the team was building Paribus, the generative AI technology to craft the emails was still relatively rudimentary and the rest of the company’s AI technology was built on very simple language models.

The startup has raised more than $1.7 billion from venture capitalists and was last valued at $5.8 billion in August 2023.

Nala set out to offer remittance services, it’s building a B2B payment platform too It says, this is to guarantee reliability to its app users and businesses making payments into and out of AficaPayments company Nala pivoted to offer remittance service in 2021, tapping the growing money transfer market in Africa, and demand for reliable and affordable services.

For markets like Kenya, they have integrated with mobile money service M-Pesa enabling users living in the diaspora to pay local bills directly.

However, building the service on the payment rails of other providers meant that the fintech could not guarantee dependability.

This drove the decision to develop its own platform that directly integrates with banks and mobile money providers.

The remittance business growth coincides with reports that remittance flows to sub-Saharan Africa will continue on a growth trajectory.

Moove, an African mobility fintech that offers vehicle financing to ride-hailing and delivery app drivers, has raised $100 million in a funding round as it plots expansion into new markets.

Moove says it plans to use the new capital to expand its revenue-based vehicle financing platform to 16 markets by the end of 2025.

Moove takes a two-pronged approach to vehicle financing.

The vehicles provided to Moove customers vary from traditional options like Toyotas and Suzukis to electric vehicles (EVs) such as Teslas.

The vehicle financing startup operates large EV fleets in the UAE and the U.K.

Miami-based Onyx Private, a Y Combinator-backed digital bank that provided banking and investment services for high-earning Millennials and Gen Zers, is terminating its bank operations.

Y Combinator has listed the company as “inactive” on its on its website, something Santos could not explain.

Santos claimed that Onyx had been exploring the idea over the past year and had made developments with some partners.

Santos today declined to disclose how many banking customers Onyx had.

Although a source told TechCrunch that regulatory issues may have played a part in this decision, Santos dismissed that, telling us that no regulatory issues caused the startup to shut down its direct-to-consumer banking operations.

Appzone is one of the standout local fintech software providers for banks and fintechs, providing better pricing and flexibility.

As such, it rebranded to Zone, a licensed blockchain-enabled payment infrastructure company–and carved out its original banking-as-a-service business into a separate standalone company, Qore.

Today, Zone, its blockchain network that enables payments and acceptance of digital currencies, is announcing that it has raised $8.5 million in a seed round.

Therefore, the fintech is developing an interoperable payment infrastructure using blockchain technology — known for its ability to scale infinitely — to connect banks and fintech companies, facilitating transaction flow without intermediaries.

“We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.

This week, we look at Griffin Bank getting its license ahead of some heavy hitters, and we go inside Stripe’s annual letter, some funding rounds, and more!

The banking-as-a-service company managed to do something that even the region’s most valuable fintech company, Revolut, hasn’t been able to do yet — obtain a banking license.

Granted, as Mike Butcher writes, banking licenses are difficult to come by (Griffin’s took a year), but Revolut has talked about securing a banking license for the past three years.

Now that Griffin has a banking license, it offers a full-stack platform for fintech companies to offer banking, payments and wealth solutions via automated compliance and an integrated ledger.

In a new SEC filing, Reddit’s IPO involves around 22 million shares, priced between $31 and $34.

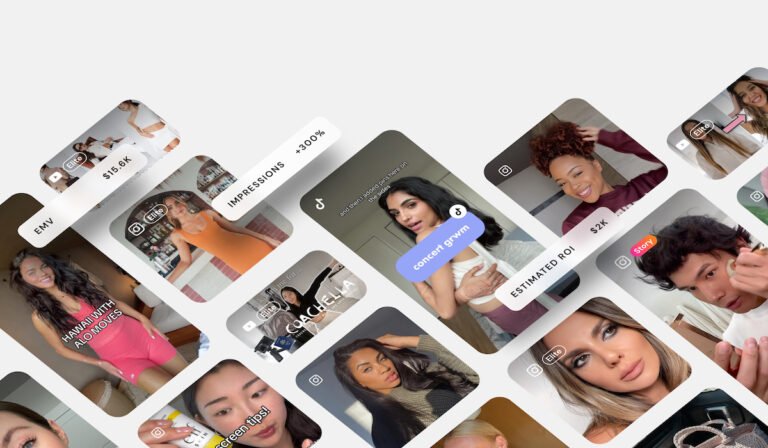

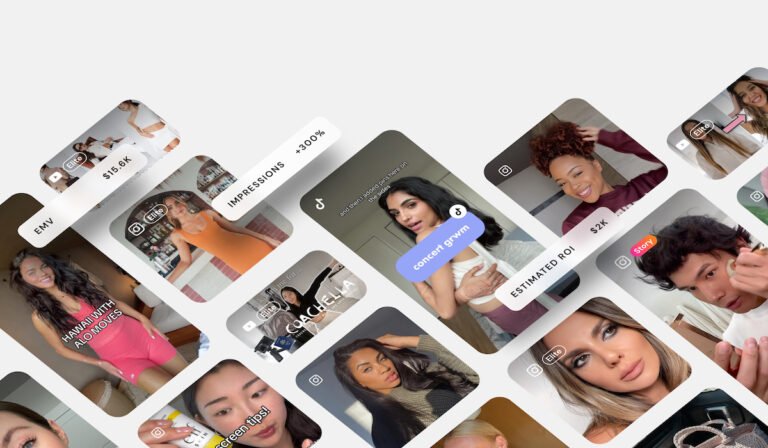

ShopMy, a marketing platform for content creators to connect with brands and monetize their content, announced today that it raised $18.5 million.

To date, creators have earned “tens of millions in commissions” on the platform, the company tells TechCrunch.

“He observed a significant disconnect in the social media ecosystem: influencers struggled to monetize their product recommendations effectively, and their followers didn’t have an easy path to purchase.

Chris viewed ShopMy as the solution, a bridge that transformed how influencers share and monetize their product recommendations,” Rein explains.

Even Instagram has embraced creator marketing, launching a marketplace tool for paid partnerships in 2022.