Former web3 gaming founders raise $2.5M for their NFT marketplace to retain users even when there ‘isn’t money to be made’Even though NFT sales volume is still down 88% from 2022 all time-highs (and down 38% year-to-date), Pallet Exchange is building a new type of NFT marketplace focused on user retention.

“It’s cool if there’s a lot of financial innovations happening, but at the same time we saw there’s pain points from a user experience,” Li said.

It’s using social media tactics like in-app messaging that lets people interested in the same NFT collections engage with each other on its marketplace.

That’s when Seiyans, an Sei-based NFT collection fueled by meme culture, capitulated the new blockchain and marketplace into the talk of the crypto world.

Down the line, Pallet plans to look into working with big partners in the art marketplace and create a separate marketplace for those creators.

Stripe is sufficiently large that when we consider its growth we have to weigh it against the overall growth in the payment space more generally.

Major growth pointsIn its annual missive, Stripe noted that it crossed the $1 trillion total payment volume metric in 2023, a figure that is large, and round, if imprecise.

Certainly the threshold is notable, but when paired with recent growth figures becomes all the more impressive.

Stripe said that in 2023 its payment volume rose 25%.

Any company processing that much total payment volume through Stripe could build their own in-house stack, or pursue a more DIY option.

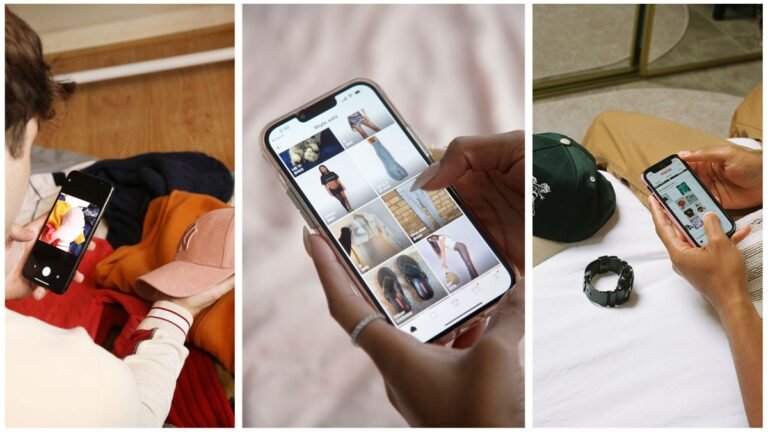

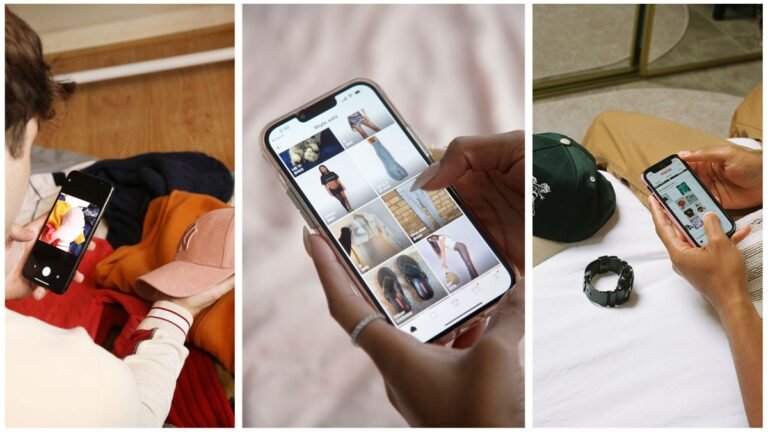

A streetwear seller, whose shop is @fentoozler791, told TechCrunch that they had a payment of $200 for multiple packages pushed back by over a week.

It seemed like they didn’t care until they realized they’d be losing my money from all the fees they’ve charged me,” @fentoozler791 told TechCrunch.

After further requests for comment, Depop told TechCrunch on Wednesday that it had uncovered an issue that caused these delayed payments.

We identified an issue in our automated payouts system that has now been fixed, and all pending payments have been sent out to affected sellers,” Depop said.

Depop told TechCrunch that it gained 5 million registered users last year, bringing its userbase up to 35 million.

Teachers’ Venture Growth, the late-stage venture and growth investment arm of Ontario Teachers’ Pension Plan, is investing $80 million in Perfios, an Indian fintech that provides real-time credit underwriting solutions to banks and other financial institutions.

The new investment values Perfios at a valuation of over $1 billion.

Bengaluru-based Perfios provides real-time data aggregation and analysis tools to financial institutions, enabling them to streamline their customer journeys and make more informed decisions.

Perfios said it delivers 8.2 billion data points to banks and other financial institutions every year to facilitate faster decisioning, and processes 1.7 billion transactions a year with an AUM of $36 billion.

Ontario Teachers’ Pension Plan, one of Canada’s largest pension funds, has ramped up its interest in India in recent years.

TikTok is expanding its Effect Creator Rewards monetization program to more regions and lowering its payout threshold, the company announced today.

The program, which launched in May 2023, rewards creators for the effects they make through TikTok’s AR development platform, Effect House.

TikTok is also updating the program’s payout model, as creators will now only receive rewards for effects used in public videos.

Effect Creator Rewards is now available in a total of 53 regions.

Previously, creators needed an effect to have been used in 200,000 qualified videos within 90 days for the effect to start collecting rewards.

The “State of Subscription Apps” report offers a bird’s-eye view into the subscription app universe, as RevenueCat has nearly 30,000 apps using its platform’s tools to manage their monetization.

Outside of Apple and Google, that makes RevenueCat the largest collection of subscription app developers on one platform.

For instance, 59% of the apps that reach $1,000 will go on to reach $2,500 and 60% of the apps that reach $2,500 will make it to $5,000.

The report highlights other aspects of the race to subscription app monetization, as well, including that North America-based apps have 4x the monetization of the global average.

The larger report gets into more specifics that will be useful to subscription app developers, including details about subscription packages, pricing, trial strategies, conversion, refund rates, retention, growth, and more.

Founded by former Silicon Valley engineers, UK-based Griffin Bank bills itself as an API-driven ‘Banking as a Service’ platform.

But Griffin isn’t likely to offer banking accounts directly to consumers, but to other businesses needing to offer embedded financial solutions such as savings accounts, safeguarding accounts and accounts for holding client money.

Last year in North America, Treasury Prime secured a $40 million Series C, Synctera $15 million and Omnio raised $9.8 million.

So they’re leveraging an existing financial relationship to bundle additional financial services in an embedded way.

All of that needs to sit in specially marked bank accounts.” Griffin’s aim, he says is to pick up as much of that business as possible.

Why does every startup want to help you get paid?

Then I wrote about Remofirst, a startup out to take on the likes of Deel and Rippling, too, securing $25 million in Series A funding.

Also, Tage wrote about how UAE-based RemotePass announced it had raised $5.5 million in Series A funding led by Istanbul-based 212 VC.

Paris-based business banking startup Qonto is using an undisclosed portion of its cash reserve to acquire Regate, an accounting and financial automation platform.

Argyle raises $30M to expand automated income, employment verificationSynctera raises $18.6M in Series A-1 funding (TC covered Synctera’s Series A here.)

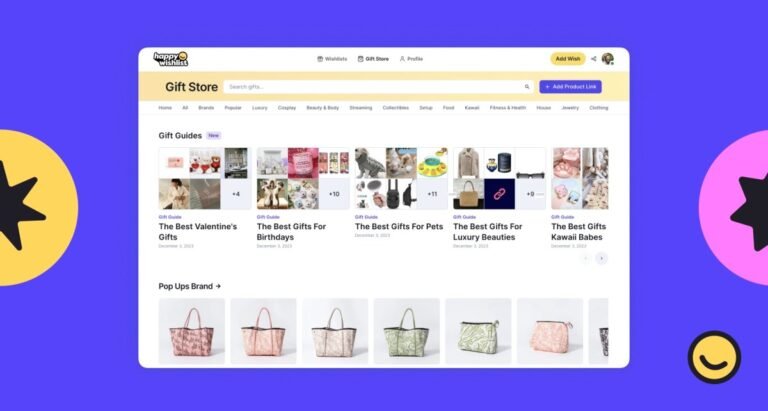

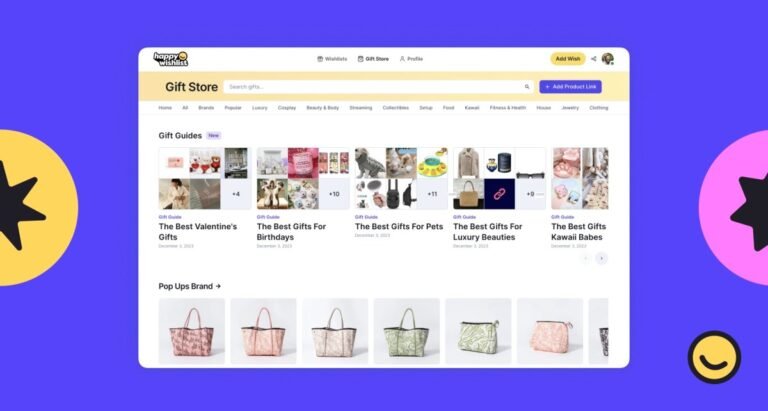

Throne, which lets fans gift items to creators from their wishlist, is launching a new gifting portal for family and friends called Happy Wishlist.

The co-founders started exploring the idea of Throne when some of their creator friends talked about issues like creating a P.O.

Fans can gift creators items from that list.

While the company was about to raise Series A, it decided to turn towards profitability and returned the investor money by December 2023.

Essentially, Throne is diversifying its revenue sources already — instead of raising money, it wants to make money.

Zora co-founder Jacob Horne and Goens see crypto and AI as two complementary technologies that can benefit from one another.

“Crypto wants information to be on-chain so that it can be valued and add value to the system,” Goens said.

“And then AI wants information to be on-chain so that it can be freely accessed and utilized by the system.

“We need systems that can help bring all of these things on-chain and that’s what we’re trying to do at Zora,” Goens said.

This means these AI creators have the ability to capture value from their models’ outputs when people mint them and the payouts are split in half automatically.