And it is using an undisclosed portion of its cash reserve to acquire Regate, an accounting and financial automation platform.

Qonto originally started with online business accounts with debit cards specifically tailored for small and medium businesses.

After a while, Regate will be integrated in Qonto directly to improve several accounting automation features of Qonto, such as invoicing, accounts payables, accounts receivables, etc.

Qonto finds itself in a different position from Payfit, another French unicorn (or former unicorn) that provides a software-as-a-service tool focused on payroll.

As many fintech startups are struggling to raise a new funding round, Qonto could become a consolidator in the space.

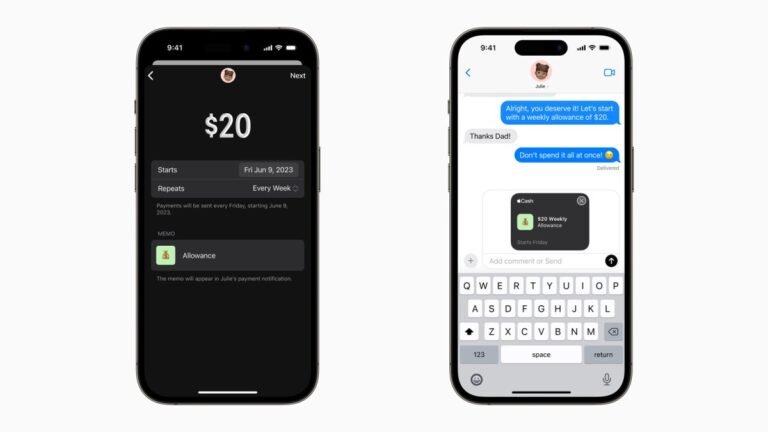

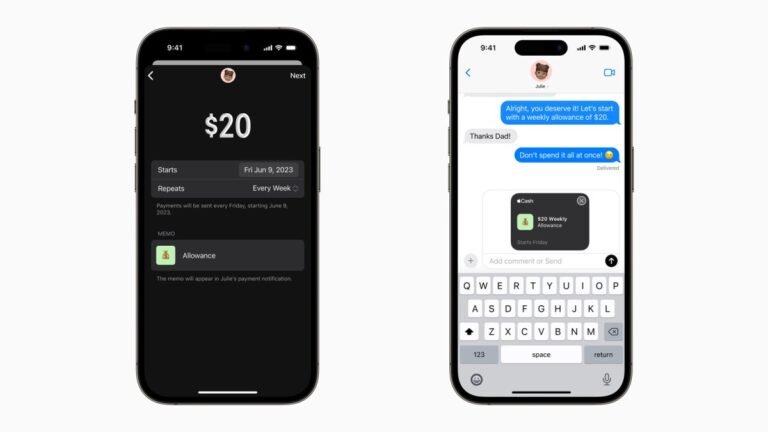

But the company has also released a new API called FinanceKit that lets developers fetch transactions and balance information from Apple Card, Apple Cash, and Savings with Apple.

The most requested credit card integration is now live on Copilot Money 💳 Starting today, Copilot can keep track of your Apple Card, Apple Cash, and Savings accounts.

It released the Apple Card in 2019.

Earlier this year, it said that Apple Card users earned $1 billion in daily cash rewards in 2023.

In April 2023, Apple launched a savings account with a 4.15% APY in partnership with Goldman Sachs.

A couple of years ago, payments orchestration was a foreign term to many large companies Juan Pablo Ortega would speak to.

Today, Yuno has facilitated transactions in over 40 countries worldwide and is working with enterprise clients like McDonald’s, Rappi, Avianca and inDrive.

The global payments orchestration market is forecasted to reach nearly $7 billion in value by 2032.

Many of Yuno’s competitors focus on solving payment orchestration for small and medium businesses, and not many were building the infrastructure for large enterprises, Ortega says.

That new round of capital gives Yuno a valuation of $150 million, Ortega said.

As cybercriminals continue to reap the financial rewards of their attacks, talk of a federal ban on ransom payments is getting louder.

Since then, just as talk of a potential ransom payment ban has gotten louder, so has the ransomware activity.

Is a ban on ransom payments the solution?

For a ban on ransom payments to be successful, international and universal regulation would need to be implemented — which, given varying international standards around ransom payments, would be almost impossible to enforce.

Given the brazen nature of these attackers, it’s unlikely that they would be deterred by a ban on ransom payments.

In 2022, Walmart acquired earned wage access provider Even to offer early pay access to its employees.

Other big U.S. companies, including Amazon, McDonald’s and Uber, also offer employees early wage access programs.

Like other earned wage access providers, Wagely charges a nominal flat membership fee to employees withdrawing their salaries early.

“This is something that no other competitor is even close to because other earned wage access companies are focusing on different things,” he said.

One of the areas where global earned wage access providers have shifted their focus nowadays is lending — in some cases, to lend money to employers.

The big storyLast week, I wrote about two startups — Sunset and SimpleClosure — that help other startups shut down raising capital.

It was a deep dive into how and why this business has become one that is so sought after by investors.

I also covered Stripe’s tender offer that resulted in a 30% higher bump in valuation — to $65 billion — for the payments giant.

She emphasized, though, that the company had not made any cuts as a consequence of launching this AI assistant.

Embat, a Spanish fintech which does what they call “real-time treasury management,” closed a financing round of $16 million Series A led by Creandum.

Venture capital funding has never been robust for women or Black and brown founders.

Read about funding for Black foundersFunding to Black founders has been on a steady decline since 2021, implying that investors have either lost interest or focus on backing Black founders.

This is a big deal because after the murder of George Floyd, the venture and startup ecosystem made promises to better support Black founders.

Since 2022, TechCrunch has been speaking with experts to find out what is needed to help boost funding to Black founders.

To help gather data, last year, Crunchbase announced it would officially start tracking the amount of venture capital dollars allocated to LGBTQ+ founders.

Nvidia’s chief rivals in the AI chip space — AMD, Arm and Intel — have been investing aggressively in startups, too, looking to make up ground in markets inclusive of the especially frothy generative AI segment.

IntelOf Nvidia’s competitors, Intel far and away has the biggest startup investment operation thanks to Intel Capital, its long-running VC.

Curiously, AI startups — despite their strategic importance to the chip industry these days — make up a relatively small portion of Intel’s venture portfolio.

According to Crunchbase, Intel’s holdings in software, IT and enterprise SaaS companies far outnumber its AI startup holdings by deal volume.

AMDLike Intel and Arm, AMD invests in startups both directly and through a VC org, AMD Ventures.

It did so, however, with the ambitious goal of creating a walking bipedal robot in a year’s time.

Humanoid robots are having a moment.

The goal of the deal is to “develop next generation AI models for humanoid robots,” according to Figure.

“We are excited to collaborate with Figure and work towards accelerating AI breakthroughs,” says Microsoft Corporate VP, Jon Tinter.

Mechatronics are easier to judge in a short video than AI and autonomy, and from that perspective, the Figure 01 robot appears quite dexterous.

Payments infrastructure giant Stripe said today it has inked deals with investors to provide liquidity to current and former employees through a tender offer at a $65 billion valuation.

Notably, the valuation represents a 30% increase compared to what Stripe was valued at last March when it raised $6.5 billion in Series I funding at a $50 billion valuation.

But it is also still lower than the $95 billion valuation achieved in March of 2021.

A Stripe IPO has been long anticipated and was widely expected to happen in 2024.

But with this deal, it appears that an initial public offering may not take place until next year.