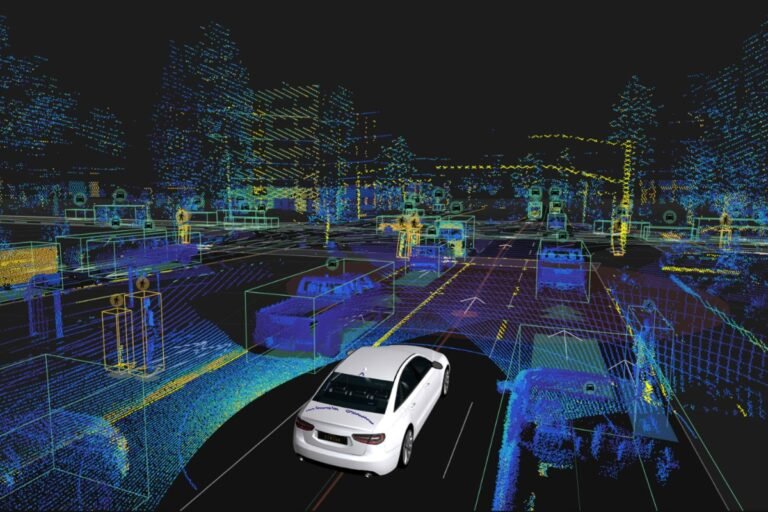

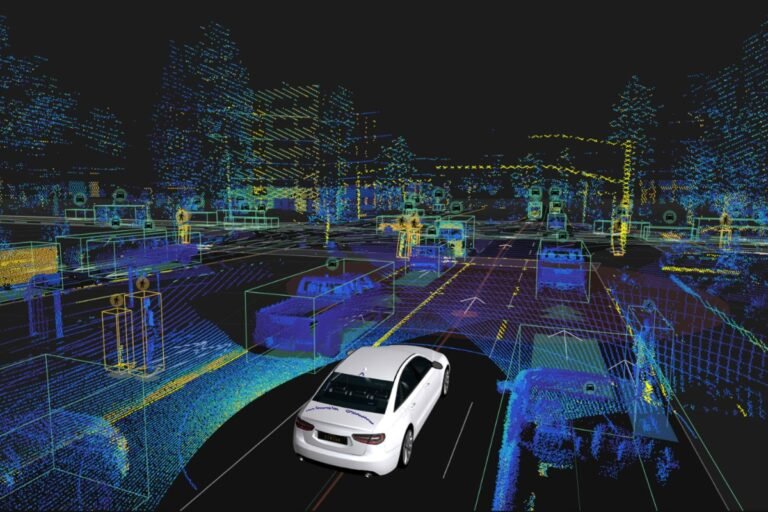

Autonomous vehicle software company Applied Intuition has raised $250 million in a round that values the startup at $6 billion, as it pushes to bring more artificial intelligence to the automotive, defense, construction and agriculture sectors.

The eye-popping funding round is the latest example of investor fervor for AI.

Lux Capital, Elad Gil, and Andreessen Horowitz all previously led funding rounds for Applied Intuition.

Founded in 2017, Applied Intuition creates software that automakers and others use to develop autonomous vehicle solutions.

“When they think like, ‘I have this software or AI problem,’ we generally want them to think about us,” Younis says.

With the second fund, Ada says it will invest between £250,000 and £1.5 million in pre-seed and seed stage startups, with a “significant amount” allocated for follow-ons.

So far, 12 investments have been made from the second fund.

Ada claims 30% of the investments from Fund I and Fund II were sourced this way.

Warner retorted: “There are 350+ fantastic female VC partners in Europe.

: “I think every leader of every VC fund needs to do whatever we can to attract the best talent in the industry.

Hello and welcome back to TechCrunch Space.

You also can send a note to the whole TechCrunch crew at tips@techcrunch.com.

This week in space historyI don’t mean to be impolite, but this week in space history we’re revisiting…URANUS.

That’s right: On March 13, 1781, a German-born, British astronomer named Sir William Herschel noticed a faint object through his telescope.

He initially thought it might be a comet, but later correctly identified it as our solar system’s seventh planet.

Hello and welcome back to TechCrunch Space.

You also can send a note to the whole TechCrunch crew at tips@techcrunch.com.

This week in space historyI don’t mean to be impolite, but this week in space history we’re revisiting…URANUS.

That’s right: On March 13, 1781, a German-born, British astronomer named Sir William Herschel noticed a faint object through his telescope.

He initially thought it might be a comet, but later correctly identified it as our solar system’s seventh planet.

Would-be Twitter/X rival Bluesky is looking to more directly invest in its developer community in order to foster growth.

The company last week announced “AT Protocol Grants,” a new program that will dole out small grants to developers building on its new social networking protocol.

Initially, Bluesky said it would release $10,000 in grants of $500 to $2,000 per project apiece, based on factors like cost, usage, and more.

The concept of decentralized social networking has been around longer than Bluesky, however, with many projects, including Mastodon, Misskey, Pixelfed, and others, backed by the ActivityPub protocol.

Bluesky says the projects receiving the grants can be useful to either developers or end users and will be paid out via public GitHub Sponsorships.

Why does every startup want to help you get paid?

Then I wrote about Remofirst, a startup out to take on the likes of Deel and Rippling, too, securing $25 million in Series A funding.

Also, Tage wrote about how UAE-based RemotePass announced it had raised $5.5 million in Series A funding led by Istanbul-based 212 VC.

Paris-based business banking startup Qonto is using an undisclosed portion of its cash reserve to acquire Regate, an accounting and financial automation platform.

Argyle raises $30M to expand automated income, employment verificationSynctera raises $18.6M in Series A-1 funding (TC covered Synctera’s Series A here.)

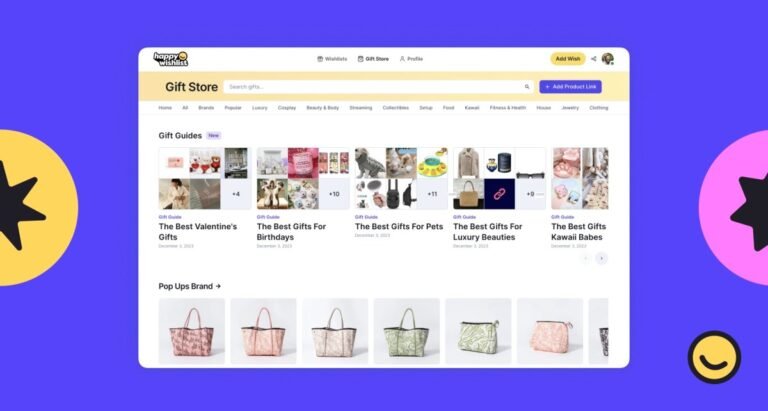

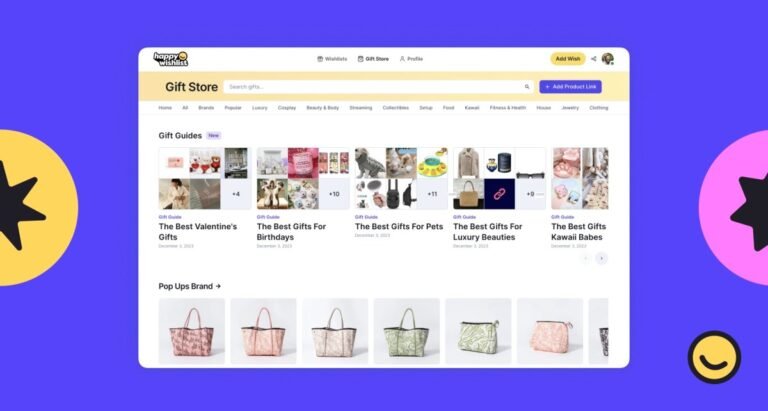

Throne, which lets fans gift items to creators from their wishlist, is launching a new gifting portal for family and friends called Happy Wishlist.

The co-founders started exploring the idea of Throne when some of their creator friends talked about issues like creating a P.O.

Fans can gift creators items from that list.

While the company was about to raise Series A, it decided to turn towards profitability and returned the investor money by December 2023.

Essentially, Throne is diversifying its revenue sources already — instead of raising money, it wants to make money.

The Artemis Fund, which invests in underrepresented founders, closed on its second fund with $36 million in capital commitments.

“We really wanted to make sure that our LPs aligned with our long-term goal of backing diverse founders,” Murakhovskaya told TechCrunch.

VC investment itself continues to be fairly stagnant in these areas, according to my colleague Dominic-Madori Davis, who crunched the numbers on venture capital funding to these demographics earlier this month.

Female founders and co-founders secured more capital overall in 2023 than they did in 2020, according to new Pitchbook research.

For Fund II, Artemis intends to continue leading and co-leading investments and will target around 20 new companies.

Baron Capital, an investor in Indian food delivery startup Swiggy, has increased the value of its stake in the Indian firm, implying a valuation of $12.16 billion, surpassing the $10.7 billion post-money valuation at which Swiggy secured funding in early 2022.

The valuation uptick at the end of December is a noteworthy development for Swiggy and, more broadly, the Indian startup ecosystem.

This is particularly significant given that Swiggy’s valuation had previously been marked down to a low of $5.5 billion.

Swiggy commands roughly 45% market share in the Indian food delivery sector and is “well positioned to benefit from structural growth in online food delivery in India,” Baron Capital wrote in a separate filing.

Swiggy, which is also a key player in the instant-grocery delivery space in India, is increasingly broadening its offerings.

And it is using an undisclosed portion of its cash reserve to acquire Regate, an accounting and financial automation platform.

Qonto originally started with online business accounts with debit cards specifically tailored for small and medium businesses.

After a while, Regate will be integrated in Qonto directly to improve several accounting automation features of Qonto, such as invoicing, accounts payables, accounts receivables, etc.

Qonto finds itself in a different position from Payfit, another French unicorn (or former unicorn) that provides a software-as-a-service tool focused on payroll.

As many fintech startups are struggling to raise a new funding round, Qonto could become a consolidator in the space.