What is worth $11 billion and wants to go to Mars to collect rocks?

NASA’s mission to Mars to collect rocks that was expected to cost $11 billion and take ages.

So, the U.S. space agency is throwing the doors open to get more input, and that means that startups are looking at an opportunity that is truly out of this world.

To close, the massive, gobsmackingly big $7.2 billion worth of new funds from a16z.

For the full interview transcript, for those who prefer reading over listening, read on, or check out our full archive of episodes over at Simplecast.

Read MoreAndreessen Horowitz’s Fresh $7.2B Investment for the Future

NeuBird founders Goutham Rao and Vinod Jayaraman came from PortWorx, a cloud native storage solution they eventually sold to PureStorage in 2019 for $370 million.

When they went looking for their next startup challenge last year, they saw an opportunity to combine their cloud native knowledge, especially around IT operations, with the burgeoning area of generative AI.

Rao, the CEO, says that while the cloud native community has done a good job at solving a lot of difficult problems, it has created increasing levels of complexity along the way.

“We’ve done an incredible job as a community over the past 10 plus years building cloud native architectures with service oriented designs.

At the same time, large language models were beginning to mature, so the founders decided to put them to work on the problem.

Read MoreCreating cutting-edge AI technology for intricate cloud-native systems: Introducing NeuBird

Inversion Space is aptly named.

Inversion has developed a pathfinder vehicle, called Ray, that’s a technical precursor to a larger platform that will debut in 2026.

Impressively, the company has designed and built almost all of the Ray vehicle in-house, from the propulsion system to the structure to the parachutes.

“The purpose of our Ray vehicle is to develop technology for our next-gen vehicle.

As such, we’ve built basically the entire vehicle in-house,” Fiaschetti said.

Read MoreOctober Launch to Determine Success of Inversion Space’s Space Delivery Technology

The capital, which brings total funding raised by the startup to $6.2 million, will enable it to serve more brands.

For diverse brands in particular, there are a lot of economic hurdles that these groups face, which makes it even harder for them to access capital.

Its other offering is a labor marketplace for brands not in a position to hire full-time teams but require talent occasionally.

Its community of brands recommends the talent or manufacturer, who are listed on the marketplace after several stages of vetting.

Brands gain access to the labor marketplace, capital and other resources, upon signing up (at a cost) on the startup’s main product, the B2B marketplace and SaaS product.

Read More“B2B Market Emerges as The Folklore Secures $3.4M Seed to Expand Brand Reach in Global Retail”

It was while sourcing manufacturing equipment for Tesla factories that Will Drewery drew inspiration for Diagon, a startup that helps manufacturers procure equipment.

Companies in fields like automotive and aerospace can identify qualified suppliers from Diagon’s network of equipment suppliers, system integrators and service providers.

East Coast originsThe journey to Diagon for Drewery, who spent most of his career as an equipment buyer, started in Pittsburgh.

“This is why I felt the market needs a Diagon,” Drewery said.

“Now we are developing tools that help customers find suppliers better or help them interpret and summarize quotes better,” Drewery said.

Read MoreLeveraging Diagon’s Expertise in Tesla’s Supply Chain to Boost Small Businesses

Now, we’re headed to Washington, D.C., for another night of top-notch interviews and unparalleled networking, all at the cozy Woolly Mammoth Theatre on Tuesday, June 11.

Lina Khan – Chair, Federal Trade CommissionAs Chair of the Federal Trade Commission, Lina Khan brings a wealth of experience and expertise to the table.

With a background in business reporting and antitrust research, Khan has dedicated her career to addressing consolidation across various markets.

Steve Case – Chairman & CEO, RevolutionSteve Case is known for his pioneering efforts, such as founding AOL, and integrating the internet into everyday life.

Secure Your Spot:Tickets for StrictlyVC Washington, D.C., are priced at $159, offering exceptional value for an evening packed with exclusive content and networking opportunities.

Read MoreWashington, D.C. Gains Top Names like Lina Khan and Steve Case to StrictlyVC

Yet a binary choice (aka “consent or pay”) is exactly what Meta is currently forcing on users in the region.

The European Data Protection Board (EDPB) has been meeting this week to discuss adopting an opinion on so-called “consent or pay”, following a request made back in February by a trio of concerned data protection authorities.

A spokeswoman for the EDPB confirmed to TechCrunch that it adopted an opinion on “consent or pay” on Wednesday morning, saying it will be published later today.

However the choice Meta gives EU users is a binary one: Either consent to its use of personal data for targeted advertisng or pay a monthly fee to access ad-free versions of its social networks.

But on the core issue of whether Meta’s mechanism complies with the EU’s long-standing data protection framework the Board’s opinion is key.

Read MoreEuropean Privacy Group Takes Stance on Meta’s Controversial ‘Consent or Pay’ Strategy

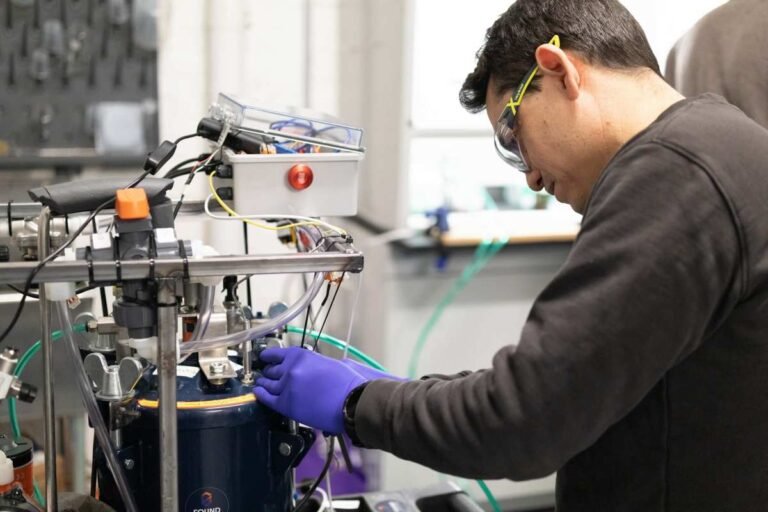

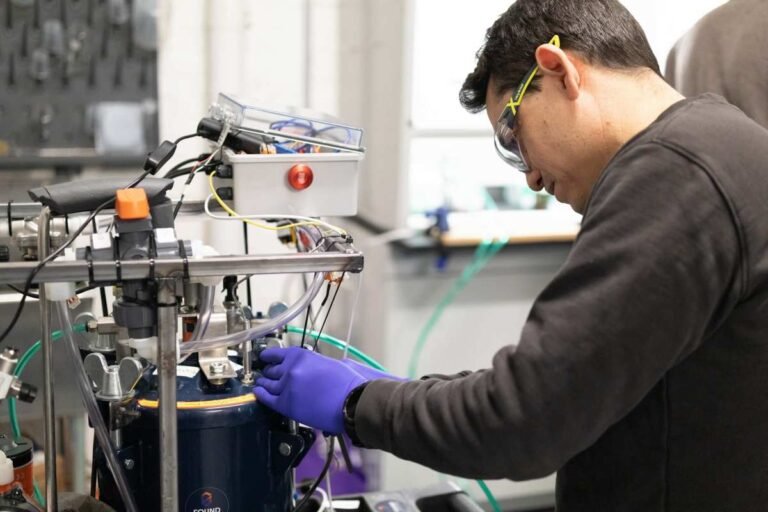

The aluminum used to make the spacecraft held more than 10 times the energy of any cutting-edge battery.

To release the energy embodied in refined aluminum, Godart had to figure out how to get past the metal’s defenses, so to speak.

“One of the hardest elements of heavy industry to decarbonize is the heat,” Godart said.

Aluminum is slightly heavier than diesel or bunker fuel, but its energy density could be game changing for those industries.

One could imagine future ships powered by aluminum dropping their waste powder off at a smelter to be refueled for a return voyage.

Read MoreFrom Robotics Consuming Themselves to Revamping Heavy Industry: The Transformation of Found Energy

Business banking startup Mercury, founded in 2020, is now launching a consumer banking product.

“We already have a few hundred thousand users of our business banking product, and a lot of people have expressed that they want a personal banking product,” he told TechCrunch in an interview.

The person also said the fintech partner banking market as a whole has been the target of more regulatory scrutiny.

Crossing overBut success in B2B banking doesn’t automatically queue up Mercury to handle consumer banking.

Sign up for TechCrunch Fintech here.

Read MoreMercury, a Fintech Startup Facing Regulatory Scrutiny, Launches into the World of Consumer Banking

Inside LemFi’s play to be fintech to the Global South diaspora First, the Nigerian startup focused on migrants from Africa.

These events spotlight the company’s growing influence in Africa’s remittance market, fuelled by a $33 million Series A funding round and the launch of services in the U.S. corridor, both announced last August.

LemFi later expanded to serve other African diaspora communities in the country before entering the U.K. market in 2021 by acquiring RightCard for $2.5 million.

Additionally, Daiyaan Alam, formerly leading partnerships at Delivery Hero subsidiary Foodpanda in Pakistan, is spearheading LemFi’s expansion efforts into Pakistan and South Asia.

They join Allen Qu, former COO at Chinese-backed African fintech OPay, who leads the fintech’s growth among the Chinese diaspora.

Read MoreExploring LemFi’s Fintech Vision for the Diaspora of the Global South