Fisker is issuing the first recall for its all-electric Ocean SUV because of problems with the warning lights, according to new information published by the National Highway Traffic Safety Administration.

The recall technically only applies to all 6,864 Ocean SUVs in the US, as other regions have their own safety regimes.

The recall comes after months of problems with the Ocean SUV, and at a time when Fisker is on the brink of bankruptcy.

This recall is not related to any of the four active investigations NHTSA has launched into the Ocean.

With those, the agency is probing inadvertent automatic emergency braking, sudden braking loss, vehicle rollaway and doors that won’t open.

Read MoreFirst Ocean recall issued for problematic Fisker SUV

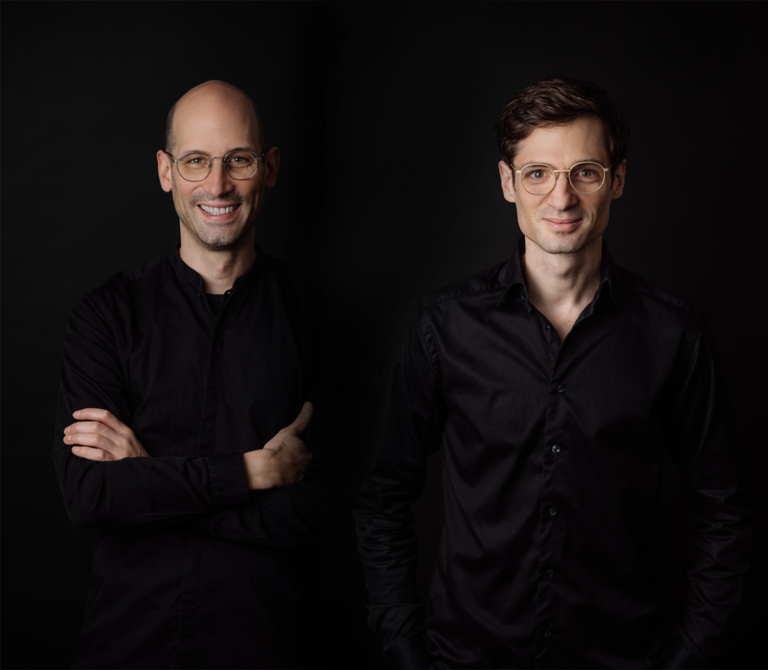

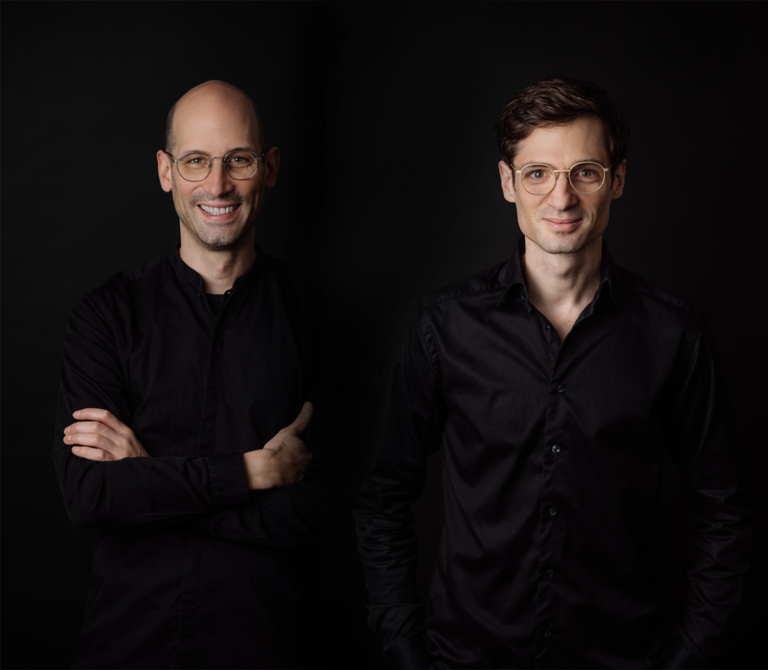

When they first met in 2007, the now brothers-in-law bonded over their passion for venture capital, eventually leading them to invest together from their personal capital.

By 2020, Anderson and Fogelsong decided to take their investing relationship to the next level by launching their first fund with external capital.

That fund, which the firm considers its second vehicle, closed at $91.5 million, well above its initial target of $60 million.

So,they named their firm “Friends & Family Capital” to capture that spirit, their own family connection, and Fogelsong’s roots in a prominent Silicon Valley VC family.

Like its previous fund, Friends & Family’s third fund will be used to invest in “classic B2B enterprise software” companies and hardware businesses with recurring revenue components.

Read MoreIntroducing the Third $118M Fund of Friends & Family Capital, Established by Former Palantir CFO and Son of IVP’s Founder

But other bumps can be attributed to the quirks of the industry itself: It’s a labor intensive business that’s resistant to automation and heavily fragmented.

It is crazier than many other services industries,” Lee Kesheshian, founder and CEO of Civic Renewables, told TechCrunch.

To try to address the quality and consistency problem, Civic Renewables is buying small installers and rolling them up.

“Now let’s go and put those systems in place under this umbrella.”Each company that Civic Renewables buys will retain its branding but append the umbrella organization’s name.

Because solar has been around for a while, the business plan underpinning Civic Renewables could show a path for at least part of the climate tech market.

Read More“Revitalizing Communities: Uniting Residential Solar Installers for Enhanced Quality and Expansion”

Two of the country’s prominent fabless AI chip startups, Rebellions and Sapeon, have agreed to merge, the companies said on Wednesday.

The merger is a strategic move by Rebellions and Sapeon aimed at leading the fabless AI chip market in South Korea to take on global rivals like Nvidia.

Indeed, the deal comes at a pivotal moment in the global chip industry.

Meanwhile, KT in 2023 incorporated Atom, Rebellions’ datacenter-focused AI chip, into its cloud-based NPU infrastructure.

Last November, the company launched a 7-nanometer AI chip, X330 NPU, for autonomous vehicles, and earlier this year, it said it would develop an on-device AI chip targeting the edge computing market.

Read More“Global AI Hardware Industry: Rebellion and Sapeon Merge as Competition Intensifies for Fabless AI Chip Manufacturers”

Gorilla, a Belgian company that serves the energy sector with real-time data and analytics for pricing and forecasting, has raised €23 million ($25 million) in a Series B round led by U.S. venture capital firm Headline.

Founded in 2018, Antwerp-based Gorilla works with energy providers across Europe, the U.S. and Australia, including British Gas’ parent Centrica, Shell Energy, and Atlanta, Georgia-based Gas South.

Throw into the mix geopolitical factors such as the Russia-Ukraine conflict, ever-evolving regulations, increasingly distributed energy sources across fossil and renewables, and the increasing use of connected technology, and we now have fertile ground for data-focused energy startups to flourish.

“No one knows what the energy sector will look like 10 years from now,” Gorilla’s co-founder and CEO, Ruben Van den Bossche, said in a statement.

Other participants in the round include the startup’s existing investors Beringea and Belgian private equity firm, PMV.

Read More“Energy Crunch: Belgian Startup Gorilla Scores $25M in Funding with Cutting-Edge Data Solutions”

But a lot of those features were already available to some extent on Apple devices through third-party apps.

So, just like the past few years, we will examine the ideas that Apple “Sherlocked” in this year’s updates.

But what do we mean that Apple “sherlocked” something?

Feature: Voice transcriptionSherlocked apps: Otter, AudioPen, Voicenotes.comApart from call transcription, Apple will also offer voice transcription in apps like Notes with the upcoming updates.

That said, some of these Sherlocked apps might survive by offering customized or enterprise solutions, but some small-scale indie apps will eventually lose users to Apple.

Read More“WWDC 2024: Apple’s Rob, Or Borrowed? A Look at the Apps that Got Sherlocked”

That’s according to Jonathan Sanders, CEO and co-founder of fledgling Danish startup Light, which exits stealth Wednesday with $13 million in a seed round of funding led by European VC giant Atomico.

The Copenhagen-based startup is reimagining general ledger software from the ground up, replete with AI to cleanse transactional data, while also enabling finance teams to ask plain-English questions and receive straightforward answers from their data.

Enterprise resource planning (ERP) software is king, packing support for CRM (customer relationship management), HR (human resources), project management, and perhaps the most crucial component of all, the general ledger.

And it’s this element of the ERP that Light is focused on dragging into the modern digital era, where AI increasingly rules the roost.

“Our mission is to be the first automated ledger for global companies,” Sanders told TechCrunch.

Read MoreIlluminating the Way: Danish Startup Emerges from Stealth with $13M in Seed Financing to Revolutionize AI Integration in Financial Records

Tech sovereignty has become a looming priority for a number of nations these days, and now a startup working in semiconductors has received a major boost in aid of that effort for Germany and Europe.

The sum is one of the largest to date raised by a European startup working in semiconductors.

Black is a spin-out from the University of Aachen co-founded by brothers Daniel and Sebastian Schall (respectively the CEO and CFO).

The funding, a Series A, is important not just for its size but also because of the intention behind it.

Porsche Ventures and Project A Ventures are co-leads, with participation from Scania Growth, Capnamic, Tech Vision Fonds, and NRW.BANK.

Read More“Black Semiconductor from Germany Secures $273M in Funding for Revolutionary Graphene Chip Technology”

Fresh off the success of its first mission, satellite manufacturer Apex has closed $95 million in new capital to scale its operations.

The Los Angeles-based startup successfully launched and commissioned its first spacecraft, a model called Aries, in March.

The company is on track to manufacture five Aries this year alone, Apex CEO and co-founder Ian Cinnamon told TechCrunch.

Apex was founded on the thesis that the one of the main bottlenecks facing the growth of the space industry was satellite bus manufacturing.

The company is approaching fifty people and that number is likely to double by the end of this year.

Read MoreApex Ventures Secures $95M Investment for Satellite Bus Division

“So many folks in D.C. don’t actually know what it is,” he remarked.

When Graham put out a call for startup applications, a dozen startups got into YC’s debut class.

Lowe didn’t confirm where that was a strategy on Tan’s part, but he praised Tan for his warmness and his dedication.

After educating the D.C. market, YC aims to leverage its influence, particularly in areas like competition policy.

And if we don’t do that, then it’s pretty easy to see how this plays out,” Lowe said.

Read More“Unfamiliar to DC’s political elite, Y Combinator sets its sights on changing their awareness”