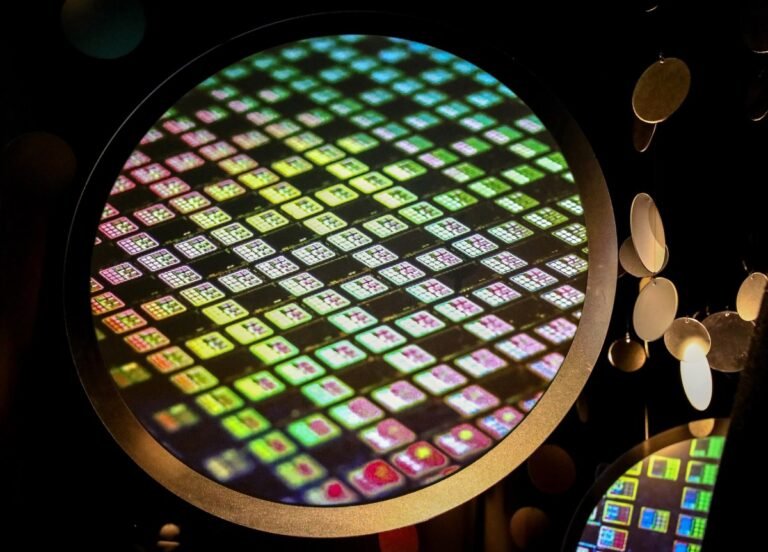

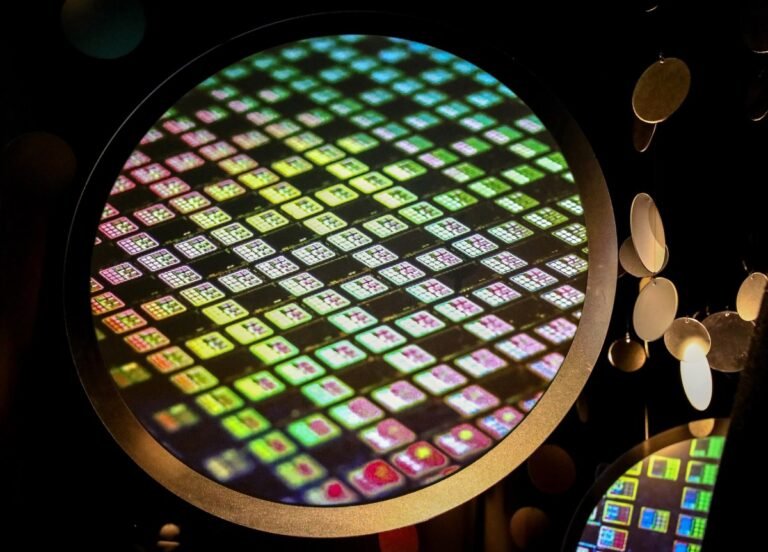

This grant, pegged for the company’s U.S. subsidiary, TSMC Arizona, is the latest step by the U.S. to strengthen its domestic supply of semiconductors as it seeks to reshore manufacturing of chips amid escalating geopolitical tensions between the U.S. and China.

The Act is primarily aimed at attracting manufacturing stateside, and also prohibits recipients of the funding from increasing their semiconductor manufacturing footprint in China.

With the new investment, Taiwan-based TSMC, which is the world’s largest producer of semiconductors, is broadening its plans for its fabrication plants in Arizona.

Intel could receive approximately $20 billion in grants and loans from the CHIPS and Science Act for its semiconductor manufacturing.

Meanwhile, Samsung, which announced a $17 billion additional investment in Taylor, Texas, is expected to receive more than $6 billion in grants for its chip facility in Texas.

If Reddit prices too high out the gate, it loses out on potential buyer interest and could trade down from its IPO valuation instead of building momentum.

Reddit’s most recent primary round in 2021 raised $410 million at a $10 billion valuation from investors, including Fidelity, Quiet Capital and Montauk Ventures, among others.

The market has obviously changed since then, and going out at that $10 billion valuation wouldn’t be smart.

What happens nextThe $5 billion valuation that Reddit may pursue is not risk-free.

Reddit offering shares to its top users is likely a ploy to avoid the stock entering meme-trading territory, Martin said.

With governments tightening the screws on Big Tech companies trying to buy smaller firms, a key exit avenue could be closed to startups in the near term.

That fact makes Reddit feeling out its own IPO valuation all the more important.

What could help tech companies avoid another 2023 (a year that had precious few public debuts) is a massive, winning public offering.

Too high, and the stock could lose ground from its IPO price.

But private tech companies want good IPO news that sticks, and public market investors won’t gain confidence if Reddit clears a bar that it set too low.