Byju’s, once valued at $22 billion, is willing to cut its valuation to below $2 billion as it hunts for new funding, a person familiar with the matter told TechCrunch.

Byju’s willingness to cut the valuation is a stunning reversal of fortune for the startup, once the poster child of the Indian startup ecosystem.

Byju’s has been chasing for new funding for nearly a year.

The new funding deliberation follows BlackRock cutting the value of its holding in Byju’s, slashing the implied valuation of the Indian startup to about $1 billion, according to disclosures made by the asset manager.

Byju’s was preparing to go public in early 2022 through a SPAC deal that would have valued the company at up to $40 billion.

Threads’ roadmap for integrations with the fediverse, aka the network of decentralized apps that includes Twitter/X rival Mastodon and others, has been revealed.

In the meeting, which Coates characterized as a “good faith” effort by the Instagram team, the roadmap for Threads’ fediverse integration was laid out, starting with a December launch of a feature within the Threads app that would allow their posts to become visible to Mastodon clients.

Meta did, in fact, start testing ActivityPub integration in December, allowing Threads posts to appear on Mastodon.

In addition, this rule would potentially come into play when a user banned from Meta’s platform moved their content to another Mastodon server.

Other questions remained unresolved at this time — like whether Threads would surface third-party Mastodon content in its algorithmic feed, whether it would ultimately allow for algorithmic choice, whether Mastodon content would be made to appear visually differentiated from Threads’ content in some way, and more.

But because of the country’s naturally dry and biodiverse climate, it’s particularly vulnerable to extreme weather events that have been exacerbated by climate change.

Australia has experienced its fair share of a climate catastrophes, which has only fueled its climate tech startups into action.

The hype for climate tech in Australia is real, as long as it can be sustained.

Local VCs are most excited about the sector this year, with climate and cleantech dominating in funding and deal count in Q3 2023.

In 2022, climate tech in Australia raised $553 million in capital, compared to $338 million in 2021, according to a report from Climate Salad, a community of Australian climate tech stakeholders.

India’s Ola Electric seeks to raise $661.8 million in an initial public offering, the Bengaluru-headquartered startup said in draft papers filed with the country’s market regulator on Friday.

The paperwork for the initial public offering follows Ola Electric raising $384 million from Temasek and Indian government-backed lender State Bank of India in a debt-heavy funding round in late October.

Led by Aggarwal, Ola Electric emerged out of the ride-hailing giant Ola in 2019.

He is also the Chairman and Managing Director of ANI Technologies Private Limited and has recently founded a new startup, Krutrim SI Designs Private Limited.

His involvement with ANI Technologies Private Limited and Krutrim SI Designs Private Limited may detract from the time that he is able to dedicate to our Company,” the prospectus added.

ShareChat is in final stages of deliberations to secure about $50 million in new funding that trims the startup’s valuation to below $1.5 billion, according to two sources familiar with the matter.

The terms of the talks, which are still ongoing so they may slightly change, currently value ShareChat below $1.5 billion, the sources said, a steep drop from the $4.9 billion valuation at which ShareChat raised funding early last year.

(In late 2020 and early 2021, X explored buying ShareChat in a $2 billion deal, TechCrunch exclusively reported earlier.)

Prosus recently marked down the valuation of Byju’s to below $3 billion, down from $22 billion in early 2022.

Byju’s has raised more than $5 billion in equity and via debt over the years.

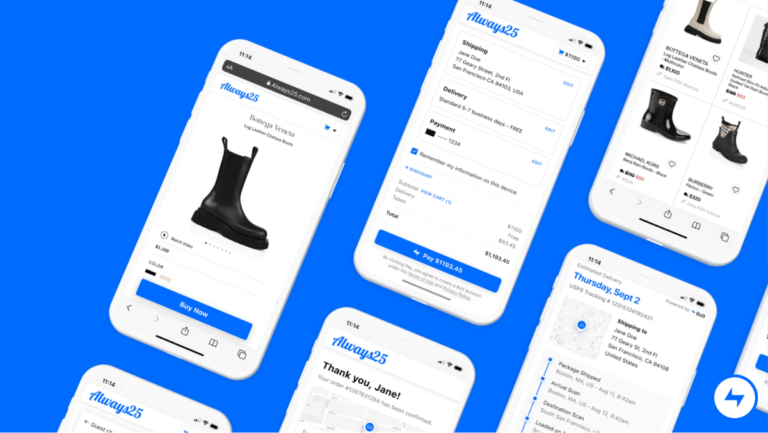

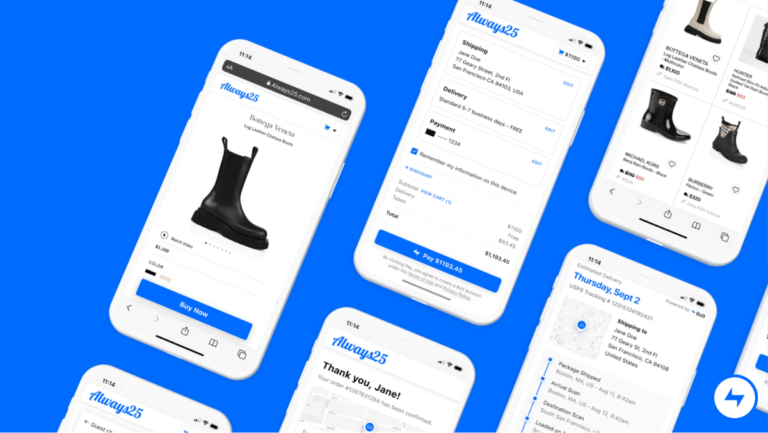

E-commerce and fintech company Bolt, which was at one time the subject of a federal probe, confirmed it laid off 29% of its staff, according to a company spokesperson.

This latest round of layoffs, which the spokesperson said happened last week, follow a handful of other layoffs made by the company since 2022.

It’s not clear how many employees the company had at the time of the layoffs or which roles were impacted.

The company, which provides software to retailers to speed up checkout, raised around $1 billion in total venture-backed funding and at one time was valued at $11 billion.

The company announced partnerships with retailers, including Saks OFF 5TH, Shinola, Filson, Lafayette 148 and Toys”R”Us, in November.