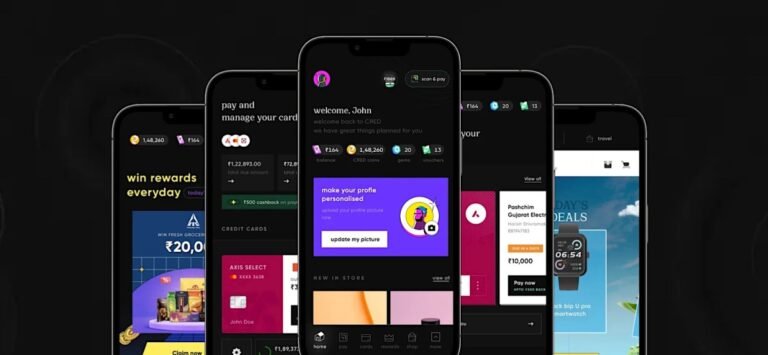

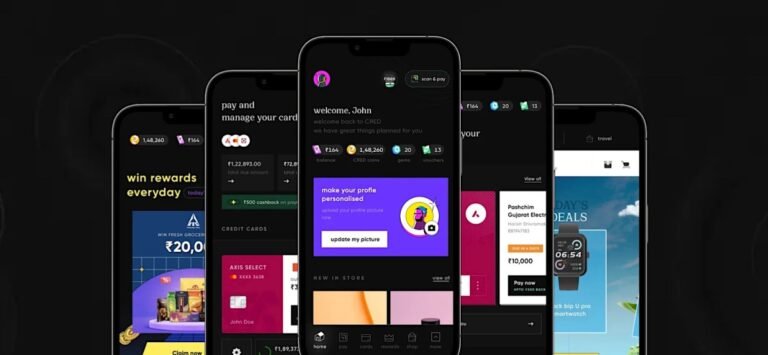

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could help it better serve its customers and launch new products and experiment with ideas faster.

The RBI has granted in-principle approval for payment aggregator licenses to several companies, including Reliance Payment and Pine Labs, over the past year.

Typically, the central bank takes nine months to a year to issue full approval following the in-principle approval.

Without a license, fintech startups must rely on third-party payment processors to handle transactions, and these players may not prioritize such mandates.

Obtaining a license allows fintech companies to process payments directly, reduce costs, gain greater control over payment flow, and onboard merchants directly.

India is walking back on a recent AI advisory after receiving criticism from many local and global entrepreneurs and investors.

The Ministry of Electronics and IT shared an updated AI advisory with industry stakeholders on Friday that no longer asked them to take the government approval before launching or deploying an AI model to users in the South Asian market.

Under the revised guidelines, firms are instead advised to label under-tested and unreliable AI models to inform users of their potential fallibility or unreliability.

The revision follows India’s IT ministry receiving severe criticism earlier this month from many high-profile individuals.

Less than a year ago, the ministry had declined to regulate AI growth, identifying the sector as vital to India’s strategic interests.

India has waded into global AI debate by issuing an advisory that requires tech firms to get government permission before launching new models.

India’s Ministry of Electronics and IT issued the advisory to firms on Friday.

It seeks compliance with “immediate effect” and asks tech firms to submit “Action Taken-cum-Status Report” to the ministry within 15 days.

The new advisory, which also asks tech firms to “appropriately” label the “possible and inherent fallibility or unreliability” of the output their AI models generate, marks a reversal from India’s previous hands-off approach to AI regulation.

Less than a year ago, the ministry had declined to regulate AI growth, instead identifying the sector as vital to India’s strategic interests.

Waymo received approval Friday afternoon from the California Public Utilities Commission to operate a commercial robotaxi service in Los Angeles, the San Francisco Peninsula and on San Francisco freeways.

Importantly, it opens up new territory for Waymo in one of the country’s largest cities and unlocks a route to the San Francisco Airport.

Waymo has operated a commercial service 24 hours a day, seven days a week throughout the city of San Francisco since receiving approval from the commission in August.

Waymo is also allowed to give people free driverless rides in parts of Los Angeles.

Until today’s approval, it was not able to charge for rides in Los Angeles.

Fast-forward to Wednesday and the SEC approved the first spot bitcoin ETF applications for 11 issuers (TC+).

I spoke with two executives from Grayscale and Valkyrie about what’s in store for their spot bitcoin ETFs.

Anyways, that’s enough housekeeping and spot bitcoin ETF news for today.

And now, Grayscale’s bitcoin spot ETF was approved.

We dive into what a spot bitcoin ETF approval means for GBTC and market demand.

Talks of bitcoin spot ETF approval circulate as India blocks exchange sites and crypto is seeing more optimismWelcome back to Chain Reaction.

The crypto space has been off to a strong start for 2024 as reporters and ETF analysts have reported that a bitcoin spot ETF approval in the U.S. could be coming as soon.

This week in web3The latest podFor this week’s news episode, Jacquelyn dove back into the latest developments on spot bitcoin ETF applications in the U.S. as anticipation builds.

As it stands, there are 14 asset management firms, including BlackRock, Fidelity, Grayscale and VanEck, hoping to individually win approval from the U.S. Securities and Exchange Commission for their spot bitcoin ETFs.

We also discussed what a spot bitcoin ETF could mean for investors, institutions and miners, as well as bitcoin’s price.

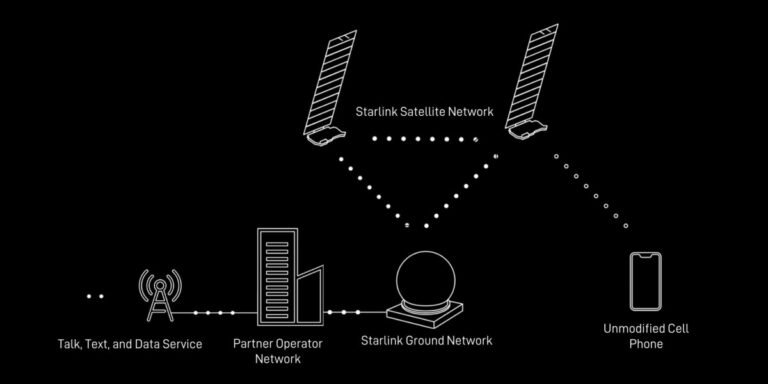

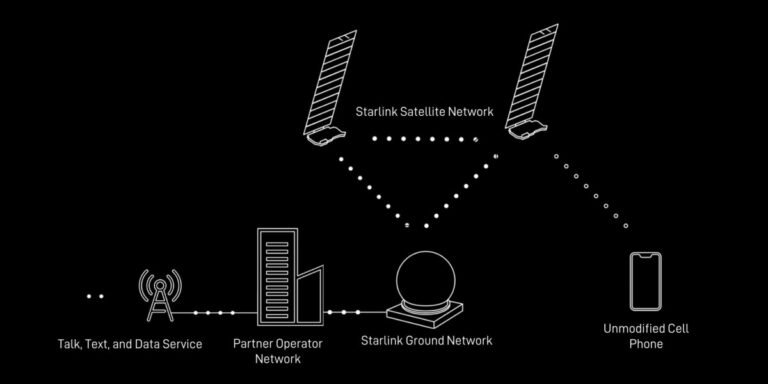

SpaceX launched its first batch of Starlink satellites that will be able to connect directly to cell phones ahead of planned testing later this year.

The company launched six Starlink satellites with this capability with a batch of 15 other Starlink birds aboard a Falcon 9 rocket late last night.

SpaceX obtained approval from U.S. regulators last month to test the satellites in partnership with T-Mobile.

SpaceX has a number of other partnerships with native telecom companies in countries including Australia, Canada and Japan.

SpaceX said the tests would eventually involve 840 satellites transmitting 4G connectivity to around 2,000 unmodified smartphones.

Didi’s return comes just 18 months after it was shut down in China over regulatory concerns. The company has been eager to re-enter the Chinese market, and its entrance is…