As an extension round, the valuation is also remaining flat, at $2.6 billion.

(Prior to that, the company raised a $100 million round in 2021 at a $1.2 billion valuation.)

“I didn’t feel the need to increase the valuation from the last round,” CEO and founder Dean Sysman, answered when asked about the decision.

Axonius is one of a group of specialist firms building platforms to help manage this.

“We’ve been a longstanding partner of Axonius, and we like to double down into our best performing companies.

It’s been a long road for spot bitcoin ETF filers – and today the U.S. Securities and Exchange Commission finally approved all 11 standing applications from issuers.

“We always knew the investor sentiment would get there, regulators would get there and the financial advisor community would get there.”Grayscale, a digital asset investment firm that was one of the 11 firms to file for a bitcoin spot ETF, is best known for its Grayscale Bitcoin Trust (GBTC), which has now been converted, or “uplisted,” into its new bitcoin spot ETF product.

The 10 other issuers are BlackRock’s iShares Bitcoin Trust, ARK 21Shares Bitcoin ETF, Bitwise Bitcoin ETP Trust, WisdomTree Bitcoin Fund, Fidelity Wise Origin Bitcoin Trust, VanEck Bitcoin Trust, Invesco Galaxy Bitcoin ETF, Valkyrie Bitcoin Fund, Hashdex Bitcoin ETF and Franklin Bitcoin ETF.

While futures ETFs marked a big milestone in 2021, Sonnenshein believes the most critical one that brought these bitcoin spot ETF approvals was the D.C.

Circuit Court of Appeals’ ruling in favor of Grayscale against the U.S. Securities and Exchange Commision in the case of a bitcoin spot ETF in the Summer of 2023.

It’s been over a decade since the first application for a spot bitcoin ETF was filed.

After a number of denials over the years, the U.S. Securities and Exchange Commission has approved all 11 applications from spot bitcoin ETF issuers, marking a potential watershed moment for the crypto industry and potentially opening the floodgates by making it easier for institutional investors and consumers alike to invest in the biggest digital asset.

The issuers are BlackRock’s iShares Bitcoin Trust, Grayscale Bitcoin Trust, ARK 21Shares Bitcoin ETF, Bitwise Bitcoin ETP Trust, WisdomTree Bitcoin Fund, Fidelity Wise Origin Bitcoin Trust, VanEck Bitcoin Trust, Invesco Galaxy Bitcoin ETF, Valkyrie Bitcoin Fund, Hashdex Bitcoin ETF and Franklin Bitcoin ETF.

In 2021, BITO, the first bitcoin-linked futures ETF in the U.S., launched and immediately saw a lot of demand during its first year.

It eventually grew to become one of the largest and most traded crypto ETFs., according to ProShares data.

Digital asset risk infrastructure-focused Andalusia Labs, formerly known as RiskHarbor, has raised $48 million in a Series A round at a valuation “north of $1 billion,” the company exclusively shared with TechCrunch.

Alongside the fresh capital raise, Andalusia Labs opened its global headquarters in Abu Dhabi.

The $48 million will also be used to grow its product development and expand the team, said Raouf Ben-Har, co-founder of Andalusia Labs.

All aim to provide digital asset support to institutions, developers and consumers through their respective niches.

“Developers, developers, developers,” said co-founder Drew Patel.

Yang is currently working on a new project called Sealth, which utilizes a system of smart contracts and blockchain technology to provide financial stability to businesses and individuals. The goal…

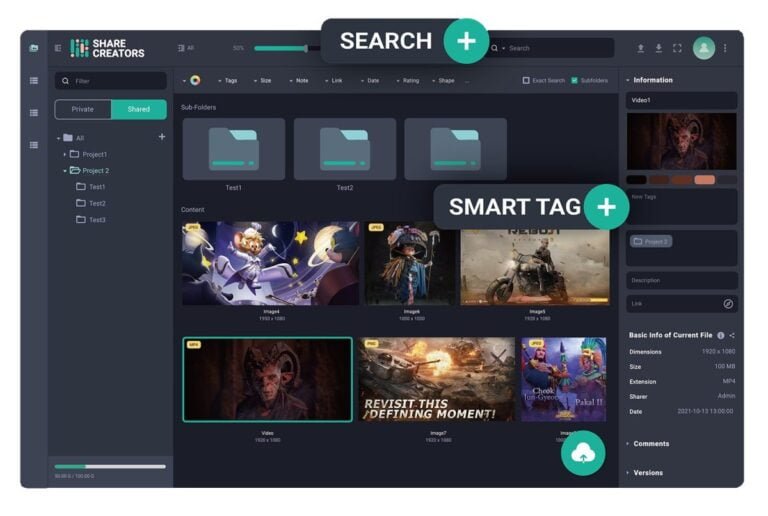

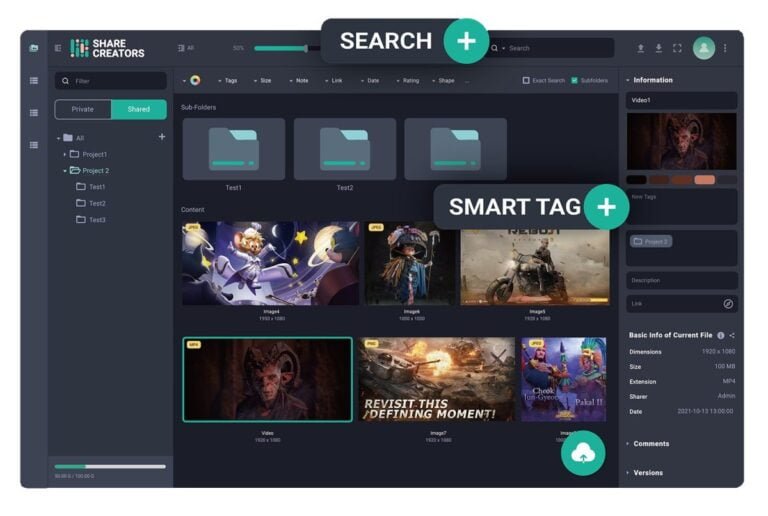

Share Creators’ platform helps game developers work with large media assets as remote work becomes increasingly common in the industry. With Share Creators, game developers can manage and store large…