“The predominant traveler today was born in an age where they are very comfortable with technology,” Harman Singh Narula, Canary Technologies co-founder and CEO, said.

Narula started Canary Technologies with longtime friend SJ Sawhney to provide that technology so hotels can offer better guest experiences, augmented by technology.

Today, the hotel guest management technology company’s platform digitizes the hotel guest journey from post-booking through checkout with tools that manage mobile check-in/checkout, registrations, upsells, guest messaging and digital tipping.

Canary now works with over 20,000 hoteliers globally at brands like Marriott International, Four Seasons, Choice Hotels, Wyndham Hotels & Resorts, Rosewood and Intercontinental Hotel Group.

Though he didn’t give a specific valuation, Narula did say the valuation has now more than doubled since the company’s $30 million Series B round in 2022.

Patlytics, an AI-powered patent analytics platform, wants to help enterprises, IP professionals, and law firms speed up their patent workflows from discovery, analytics, comparisons, and prosecution to litigation.

The outfit recently launched its product, which is SOC-2 certified, and already serves some top-tier law firms and a few in-house legal counsels at enterprises as customers.

Its target users include IP law firms and companies with several patents.

“Protecting intellectual property remains a major priority and business requirement for information technology, physical product, and biotechnology companies.

Notably, the round also attracted a host of angel backers, including partners at premier law firms, Datadog President Amit Agarwal, Fiscal Note founder Tim Hwang, and Tapas Media founder Chang Kim.

PayPal Ventures’ latest investment is in an Indonesian startup that provides personal insurance products covering a variety of risks, including accidents, phone screen damage, and ticket cancellations.

Qoala has secured $47 million in a new round co-led by PayPal Ventures and MassMutual Ventures, the five-year-old startup said Wednesday.

Qoala, headquartered in Jakarta, is an insurance broker that works with top local insurers and e-commerce firms to offer customers personalized and affordable products.

The startup sells these insurance both through its website and app as well as through offline engagements.

“It is commendable to see what Qoala has achieved in a short period of time,” said Alexandros Bottenbruch, Principal at PayPal Ventures in a statement.

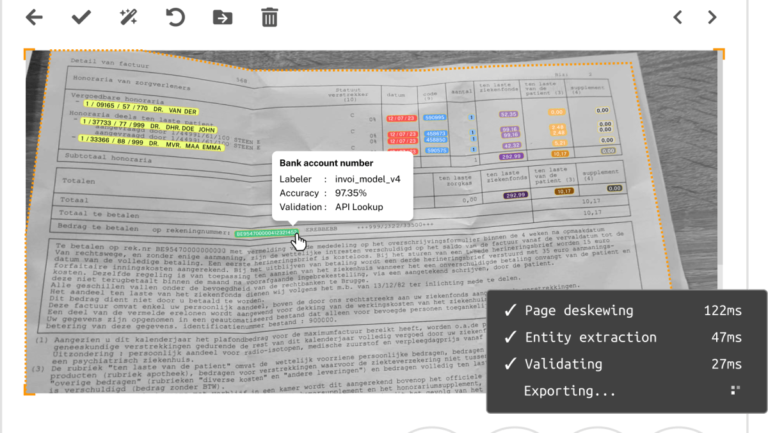

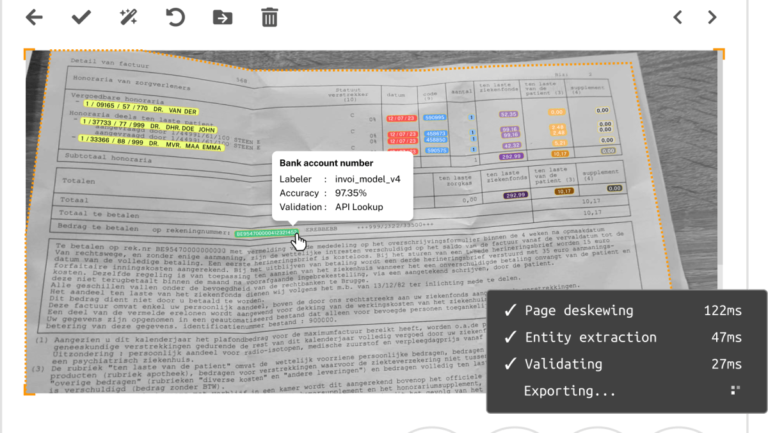

A fledgling Dutch startup wants to help companies extra data from large volumes of complex documents where accuracy and security is paramount — and it has just secured the backing of Google’s Gradient Ventures to do so.

How it worksCompanies can access Send AI’s cloud-based software via APIs which funnels data from documents sent over email.

Upon receipt, Send AI visually enhances the documents before sending to its language models for classification and extraction.

In terms of pricing, Send AI charges on a credit-based basic, whereby customers pay per processing-step.

Send AI attempts to address such concerns by deploying small, isolated open source transformer models for each customer.

Silicon Valley venture capital (VC) juggernaut Sequoia is backing a fledgling Danish startup to build a next-gen software composition analysis (SCA) tool, one that promises to help companies filter through the noise and identify vulnerabilities that are a genuine threat.

For context, most software contains at least some open source components, many of which are out-of-date and irregularly — if at all — maintained.

In turn, this is leading to an array of fresh regulation, designed to strong-arm businesses into running a tighter software supply chain.

The problem is, with millions of components permeating the software supply chain, it’s not always easy to know whether a given application is using a particular component.

And this is where Danish cybersecurity startup Coana is setting out to make a difference, using “code aware” SCA to help its users separate out irrelevant alerts and focus only on those that matter.

In 2020, the startup raised $27.5 million in its Series E funding round led by Alphabet’s CapitalG.

It competes with the likes of Capital Float, Lendingkart and Indifi, which all work toward offering credit to small enterprises in the South Asian nation.

One key reason for startups like Aye Finance and others to gain enough traction in India is the lack of credit for small businesses.

“Aye Finance is on a growth journey, and we are delighted to partner with BII, who have a deep understanding of the financial services sector in India.

“Our investment in Aye Finance underscores our commitment to back companies that have a strong development impact philosophy and promote financial inclusion for India’s underserved groups.

Zyod believes that its proposition of providing clothing sourcing and manufacturing services to fashion brands globally is unique and appealing, and that it can help improve the quality and consistency…

Shoppable videos are videos that can be purchased by viewers rather than uploaded automatically. This is a big change for YouTube, as until now it has been mainly a site…

Given the prevalence of mental health issues in Asia, it is no surprise that startups arefocused on digital platforms that provide easy access to information and support. Thoughtfull is one…

Rodney Williams, co-founder and president of SoLo Funds, told TechGround that the acquisition will give SoLo “the largest and first Black-owned personal finance platform” to do so. The service has…