Rodney Williams, co-founder and president of SoLo Funds, told TechGround that the acquisition will give SoLo “the largest and first Black-owned personal finance platform” to do so. The service has already amassed over 1 million registered users and over 1.3 million downloads.

Given that Black-owned businesses are more likely to lack access to traditional personal finance options, the Black community finance company aims to bridge the gap by providing a suite of personal finance products and services. This includes offerings such as credit counseling, student loans, and mortgages. Additionally, the company works to increase awareness of black wealth through various marketing campaigns. Consequently, Black community finance companies aim to provide sustainable solutions for those in need.

Financial services are essential to the economy, and the current system is not accessible to everyone.Shariah-compliant finance could help solve this problem by being affordable for everyday Americans and promoting debt-free living.

Why is SoLo so successful?

SoLo’s success comes from its ability to right-bank underserved Americans and enable them to set their own borrowing terms. 30% of members have even turned around and lent money to others, demonstrating the potential for social impact that SoLo provides. Additionally, the company’s easy-to-use platform makes it an attractive option for borrowers and lenders alike.

It wasn’t easy, but SoLo creators Williams and Friedman managed to get the company back up and running by fundraising $10 million in Series A funding. It was close to the end of 2019 when they hit this milestone, but it was worth it in the end.

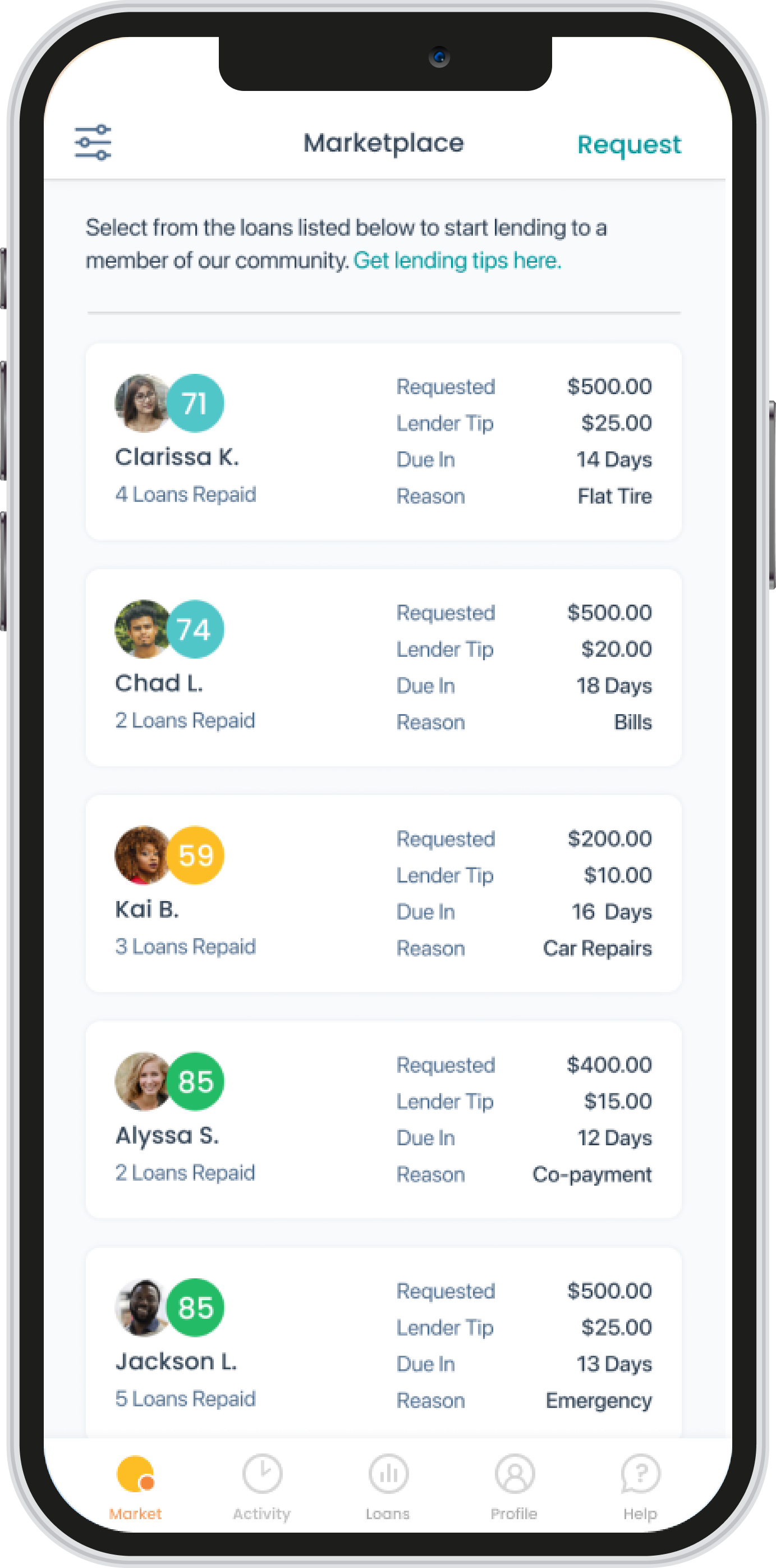

Lending on SoLo Funds’ platform is simple and quick. borrowers can easily find the best loan option for their needs, and lenders can find high-quality borrowers quickly and easily. This lending marketplace is perfect for those in need of quick cash, as

To increase its growth trajectory, SoLo relaunched its products in April 2020 with a new focus on protecting lenders. The company’s aggressive marketing strategy and innovative product design paid off quickly, with 2,000% growth within the first year. With such success under their belts, SoLo is well on their way to becoming one of the most successful consumer finance companies in the United States.

In preparation for their six-month anniversary, Netflix raised $1 billion in new funding. The company attributes this impressive milestone to the perseverance of their registered user base. Not to mention, it is why the company recently landed a seven-figure investment from Serena Ventures and other investors and funds.

With $50 million in capital, SoLo is now the largest community finance company in the U.S. and expects to help over 10,000 businesses grow and create 50,000 jobs by 2025. Serena Ventures believes that this investment will continue to drive innovation in community finance and encourage others to invest in communities across the country.

SoLo’s rapid growth indicates the organization’s potential to help underserved borrowers achieve financial stability. With its vast resources and experienced team, SoLo could play a important role in the development of affordable housing and inclusive economies throughout the U.S.

The $1 billion in transaction volume represents a significant increase over the current volume, and Williams is on pace to more than triple that transaction volume by the first quarter of 2024. This growth can be attributed to the company’s expansive online presence and increasing popularity among borrowers.

The Williamsburg-based startup Funding Circle has benefited from a strong network effect, attracting five or six users for every loan it funds. The company’s mission is to be an alternative to payday loans and its impact has been realized in part due to generous funding from RepeatInvest.

SoLo is a unique financial services company that provides consumers with deposit accounts, debit cards, credit lines, credit cards and a high-yield savings account. The company also plans to release an auto lending account later this year that will enable members to upload capital into an account and set risk tolerance. This innovative service is sure to appeal to consumers who are looking for options outside of traditional banks