Torpago, a commercial credit card and spend management provider, is no different, but with one caveat — banks are who it builds technology for, particularly community banks.

“We started as a competitor with Brex and Ramp, as well as American Express and Capital One,” Jackson told TechCrunch.

The Torpago Powered By tools and infrastructure enable means that those banks’ to customers don’t have to leave the bank’s brand domain to get sophisticated fintech features.

Banks have all the customers, and they have all the card volume, but “they have the absolute worst credit card tools and technology,” he said.

Since making the shift to banks as customers, that was whittled down to 300 companies while it goes after bank customers.

Global Screening Services (GSS), a London-based regulatory compliance platform that helps financial institutions meet their global sanctions obligations, has raised $47 million in a round of funding.

The raise comes amid a spike in economic sanctions, with the U.S. issuing trade-restrictions and asset-blocking against states including Russia, China, Iran and more.

The company actually raised a similar amount of funding last year from big-name backers including Japan’s Mitsubishi UFJ Financial Group (MUFG), one of the world’s largest banks.

Banks often find themselves at the forefront of sanctions enforcement, given their role in controlling the flow of money around the globe.

GSS sells a sanctions-screening platform to help banks and other financial institutions comply with regulations.

Appzone is one of the standout local fintech software providers for banks and fintechs, providing better pricing and flexibility.

As such, it rebranded to Zone, a licensed blockchain-enabled payment infrastructure company–and carved out its original banking-as-a-service business into a separate standalone company, Qore.

Today, Zone, its blockchain network that enables payments and acceptance of digital currencies, is announcing that it has raised $8.5 million in a seed round.

Therefore, the fintech is developing an interoperable payment infrastructure using blockchain technology — known for its ability to scale infinitely — to connect banks and fintech companies, facilitating transaction flow without intermediaries.

“We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.

Lago, developer of an open-source billing platform, has picked up the funding across two rounds of funding it’s revealing to coincide with its official launch.

The Lago doing business today as a billing platform got its start in a very classical startup way: it had no idea that it would be a billing platform.

There are even a number of providers already pursuing an open-source approach, including FossBilling, ChargeBee, Kill Bill, AppDirect’s jBilling and the imaginatively named “Open Source Billing.” (Why beat around the bush?)

So it’s an it’s still an unsolved problem.” In Lago’s view, offering open source tools is that best solution to meet a variety of needs and ideas.

For some of those users, the open source ethos also lines up with what they are hoping to espouse themselves as businesses.

Bfree, a tech-enabled debt collection startup based in Nigeria, was founded to automate and introduce ethical debt recovery processes after its founders witnessed the use and adverse effects of aggressive retrieval techniques, such as incessant calling and debt-shaming, by predatory digital lenders.

It also launched a loan collection management SaaS dubbed Workflow, which targets companies with in-house collection teams or those that are not keen to outsource.

Bfree to create secondary market for loansIts current loan portfolio stands at over $400 million, out of which it has managed to collect 12.5%.

He added that they also have an analytics solution for banks to help them gain insights into secondary debt markets.

“We foresee the growing prominence of credit management and are confident that Bfree will spearhead the creation of a secondary market on the continent for distressed assets.

In a role reversal, Xalts, a Singapore fintech startup founded 18 months ago, has acquired Contour Network, a digital trade platform set up by eight major banks including HSBC, Standard Chartered and BNP.

Backed by Accel and Citi Ventures, Xalts enables financial institutions to build and manage blockchain-based apps.

The startup plans to turn Contour into a rail connecting banks, corporations and other institutions, and integrate it with Xalts’ platform.

Kaur says this will enable Xalts’ clients to not only build apps, but also connect with each other in a secure and compliant way.

It will focus first on enabling banks and logistics companies to offer embedded trade and supply chain apps on a single platform to their customers.

The company provides community and regional banks with end-to-end deposit management capabilities, including a deposit network so bank customers can grow, retain and manage their deposit base by sourcing deposits, sweeping funds and providing additional security to depositors.

In fact, ModernFi, founded in 2022 by Paolo Bertolotti and Adam DeVita, raised $4.5 million in a seed round a month prior to the SVB news.

Canapi Ventures led the round and was joined by Andreessen Horowitz, Remarkable Ventures and a group of banks including Huntington National Bank, First Horizon and Regions.

“On this whole notion of deposit growth, retention management became first, second and third priority for a lot of institutions.

Bertolotti plans to grow in engineering, new product development, compliance and regulatory adherence and in business development.

Fintech company Kashable is the latest to also grab some venture capital attention for its approach to offering credit and financial wellness products as an employer-sponsored voluntary benefit.

In total, the company raised $45 million in equity capital and over $175 million in debt capital.

Financial wellness is one of the areas many of the startups get into.

“When we first started our journey in 2013, financial wellness was just an emerging concept,” Kumar told TechCrunch.

In addition, Kashable offers financial education resources, including credit monitoring, individual financial coaching and budgeting tools.

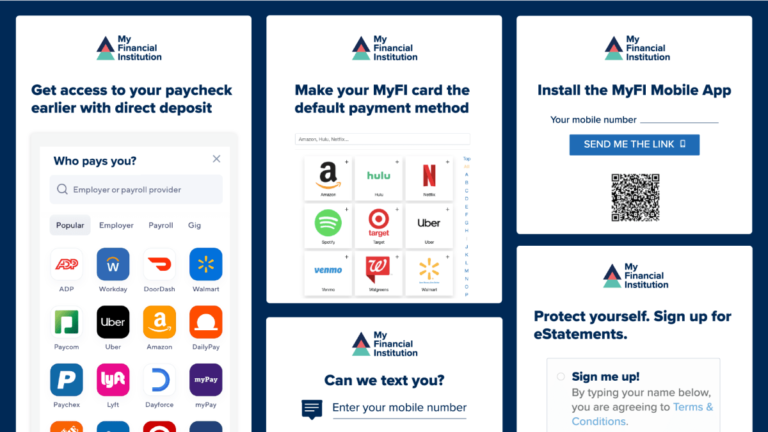

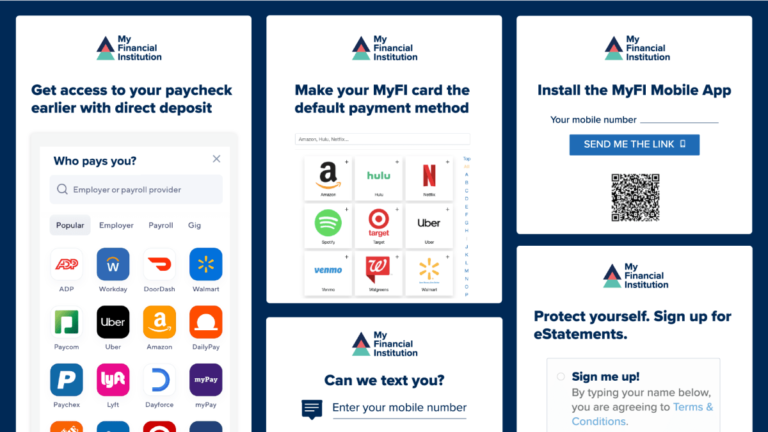

Digital Onboarding, a SaaS company specializing in helping financial institutions strengthen relationships with customers, secured $58 million in growth capital from Volition Capital to continue developing its digital engagement platform.

They changed the name to Digital Onboarding and began selling its engagement platform to banks and credit unions in January of 2018.

Communications from financial institutions, which are under strict regulations, is often paper-based, especially when opening a new account.

This often leads to between 25% and 40% of new checking accounts closed within the first year, said Brown, CEO of Digital Onboarding, citing a statistic from the 2023 Future of Finance Report.

Digital Onboarding is working with more than 140 financial institution customers.

“Pier is building ‘Stripe for credit,’ which is a way for companies to automate their own credit products.”Here’s how it works: Developers add Pier’s APIs with a few lines of codes, saving months of labor and millions of dollars, Zhang said.

Pier’s technology then manages the credit lifecycle from end-to-end, including origination, underwriting, compliance and servicing.

Other companies have also claimed to be “Stripe for credit,” for example, Setpoint, a startup that developed software for faster loan transactions.

Even Stripe itself created new credit products for businesses about six months ago.

Other solutions out there address specific components of the lifecycle, like underwriting or Know Your Customer, while Pier provides a more comprehensive offering.