The UAE is home to most of its customers, and people from Saudi Arabia and Kuwait form the bulk of its international customer base.

Entering Saudi ArabiaStake claims it has surpassed Dubai-based fractional property investment platforms like Smartcrowd, but it will be starting afresh in Saudi Arabia.

Property investment companies therefore set up special purpose vehicles through which they let investors buy real estate.

“Saudi Arabia has properties that are recently completed and under development that are worth billions.

We are going to use [our] experience to offer a similar unified product for investment in Saudi Arabia within the same app,” Mahmassani said.

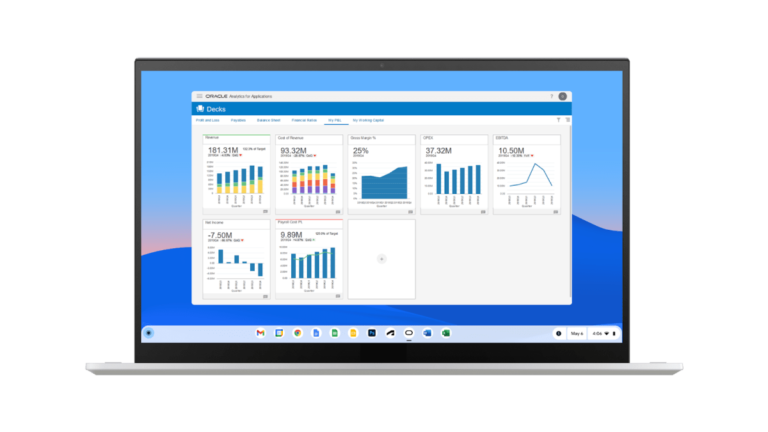

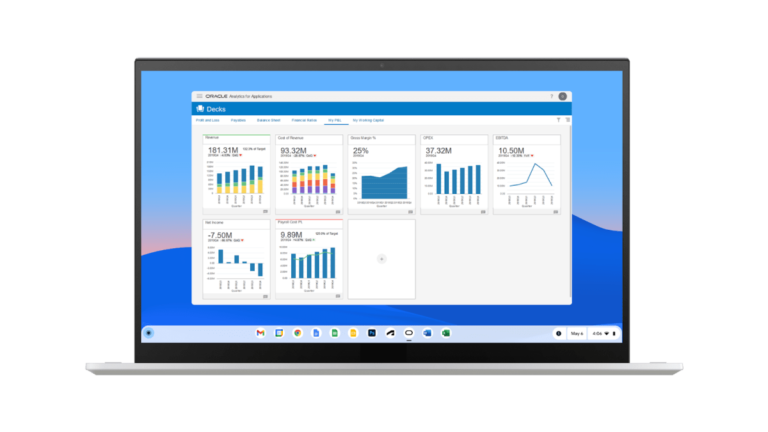

Google has acquired Cameyo, a company developing virtualization tools to run Windows apps on ChromeOS devices, for an undisclosed amount.

Cameyo CTO Eyal Dotan founded the startup in 2018, aiming to create a platform to virtualize Windows apps so that they could run on non-Windows machines and even within web browsers.

Last year, perhaps foreshadowing the acquisition, Google partnered with Cameyo to launch features including Windows app local file system integration and the ability to deliver virtual Windows apps as progressive web apps, or apps hosted in datacenters that run in browsers.

With Cameyo’s tech, organizations looking to move away from Windows — or work with both Windows and ChromeOS — have a potentially more appealing avenue, particularly as more and more apps move to the cloud and web-based technologies.

Indeed, Cameyo claims on its website that hundreds of organizations, including school districts and financial institutions, already rely on its software.

NASA’s decision to scrap its $11 billion, 15-year mission to Mars to bring back samples could create a startup feeding frenzy, TechCrunch reports.

Describing its plans as too slow, and too expensive, NASA is going back to the drawing board, with an eye on getting the space industry to help.

But space startups are not worried about it.

So, the NASA money might have a bunch of startup-sized buckets to drip into, and I am here for it.

To that end, if any startup that works with NASA on the Mars rock mission needs a human to send up there to check on the dials and such, I’m your guy.

The lowly lamppost might be a better option: they’re everywhere, and they have all the wiring needed to make curbside charging seamless.

One startup from New York City, Voltpost, has been working on a product that retrofits existing street lampposts to enable EV charging.

On Thursday, it introduced its lamppost charger after a year of design and development.

Voltpost’s charger docks at hand-level on the lamppost shroud, and the retractable cable has an anchor eight-feet up to keep it off the ground.

As is the case with just about every EV charger network, there’s an app to oversee charging sessions, including payments.

Sprinto, a security compliance and risk platform, has raised a $20 million Series B round to build more automation into its compliance management platform and widen its customer base to include the wide gamut of companies that operate digitally but aren’t tech-first.

Sprinto is working to automate this aspect of security compliance management, which involves vendor risk management, vulnerability assessment, access control, evidence collection and other filing tasks.

Sprinto uses a mix of AI, GPTs and its own internal large language model to offer efficiencies in compliance management.

The market for automated compliance management solutions already has players such as Vanta and Drata, which Sprinto considers its key competitors.

However, Redekar said Sprinto primarily focuses on automating the entire compliance management process and helping businesses build trust.

Borderless Capital, an investment firm that specializes in web3, announced Tuesday that it is acquiring CTF Capital, a quantitative trading and asset management firm headquartered in Miami, with technology and operation teams in Latin America.

With this acquisition, Borderless Capital will add AI-infused quant trading expertise to its own business.

After combining with CTF Capital, Borderless will have over $500 million in assets under management (AUM).

All the existing funds managed by CTF Capital will be merged into Borderless’s Multi-Strategy Fund V LP., launched last year with $100 million under management today.

“Borderless already has significant exposure through several portfolio companies from this geography [Latin America].

DoorDash is expanding its partnership with Alphabet’s Wing to bring its drone delivery pilot to the U.S., the company announced on Thursday.

DoorDash first launched its drone delivery pilot program in Australia in 2022, where it is now operating drone deliveries with over 60 merchants.

Once they select the drone option, their order will be prepared and delivered via a Wing drone within 30 minutes.

Most of Wendy’s items will qualify for drone delivery, but certain items be not be eligible if they exceed volume and weight restrictions.

If the order contains more than what one drone can carry, DoorDash will deploy up to three drones to deliver the order.

Zscaler, a cloud security company with headquarters in San Jose, California, has acquired cybersecurity startup Avalor 26 months after its founding, reportedly for $310 million in cash and equity.

But what sets Avalor apart is the ability to handle data from virtually any source in any format, and its unique set of vulnerability risk management and prioritization tools.

Prior to the Zscaler acquisition, Avalor managed to secure $30 million from investors including TCV, Salesforce Ventures, Jibe Ventures and Cyberstarts.

And Raz sees Zscaler taking the business — and its ~80-person team spread across the U.S. and Israel — further.

As Crunchbase’s Chris Metinko noted earlier today, Zscaler’s acquisition — along with others in the cybersecurity space — could help spark activity in a slow-to-stagnant cyber M&A market.

Slack’s new CEO looks to bring stability after a turbulent period Three chief executives in one year will do thatIt’s not often you see an established company burn through three CEOs in less than a year.

But through circumstances beyond its control, that’s what has happened at Slack, the company Salesforce acquired in 2020 for $28 billion.

Jones herself had replaced company co-founder Stewart Butterfield when he announced that he was leaving at the end of 2022.

“And then you think about Salesforce having this incredible set of customer data, some of the world’s most valued data.

Even though Harris brings a long history of building Salesforce, Slack is losing a person who has a deep understanding of Slack’s technical underpinnings.

The Harness offering also has two other components, serving as a marketplace for discovery of advisors and services and consumer financial insight tools.

In order to fill that need, Harness partnered with experienced tax advisors who in most cases already had a significant roster of clients.

So when those advisors partnered with Harness, many of those clients became clients of Harness as well.

Put simply, the new platform “powers the collaboration between tax advisors and their clients,” the company said.

About 75% of Harness’ clients come through advisors that join the platform.