“I couldn’t get a credit card because my parents couldn’t co-sign,” Kobe recalls, “and I didn’t want to put down a large security deposit.

Scott points out that New York-based Fizz set out to offer college students a different entry ramp into building credit.

And if you ask any of them, they’ll tell you that they’re credit card averse, but they’re not necessarily credit averse,” he told TechCrunch.

”Fizz is one of several fintechs aiming to serve the expansive Gen Z market.

For instance, Frich, a financial education and social community for Gen Z, just raised $2.8 million in seed funding.

Torpago, a commercial credit card and spend management provider, is no different, but with one caveat — banks are who it builds technology for, particularly community banks.

“We started as a competitor with Brex and Ramp, as well as American Express and Capital One,” Jackson told TechCrunch.

The Torpago Powered By tools and infrastructure enable means that those banks’ to customers don’t have to leave the bank’s brand domain to get sophisticated fintech features.

Banks have all the customers, and they have all the card volume, but “they have the absolute worst credit card tools and technology,” he said.

Since making the shift to banks as customers, that was whittled down to 300 companies while it goes after bank customers.

The transactions include a trading card commercial agreement that aims to provide trading enthusiasts a seamless buying, selling, grading, and storage experience.

As part of the partnership, eBay and PSA plan to introduce a “customer-centric product experience” over the coming months.

Additionally, eBay acquired Collectors’ auction house Goldin, a significant move that will greatly benefit collectors.

eBay is also selling the eBay vault to Collectors, creating a new offering that merges the existing vault services.

Launched in 2022, the eBay vault allows collectors to store trading cards that are valued at more than $750 in a secure, temperature-controlled vault.

This week, we’re looking at Robinhood’s new Gold Card, challenges in the BaaS space and how a tiny startup caught Stripe’s eye.

BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees.

The startup is not the only VC-backed BaaS company to have resorted to layoffs to preserve cash over the past year.

MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

It has more primary customers than ChaseInside a CEO’s bold claims about her hot fintech startup, which TC previously covered here.

And Manish wrote about the resignation of Stability AI founder and CEO Emad Mostaque late last week.

AI-powered itineraries: In an upgrade to its Search Generative Experience, Google has added the ability for users to ask Google Search to plan a travel itinerary.

Using AI, Search will draw on ideas from websites around the web along with reviews, photos and other details.

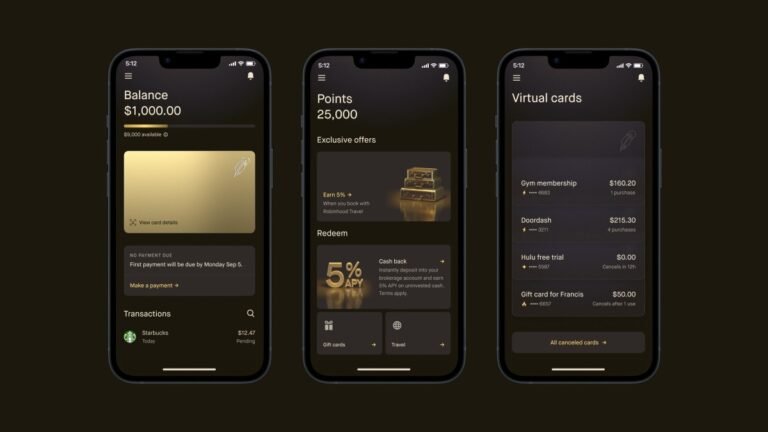

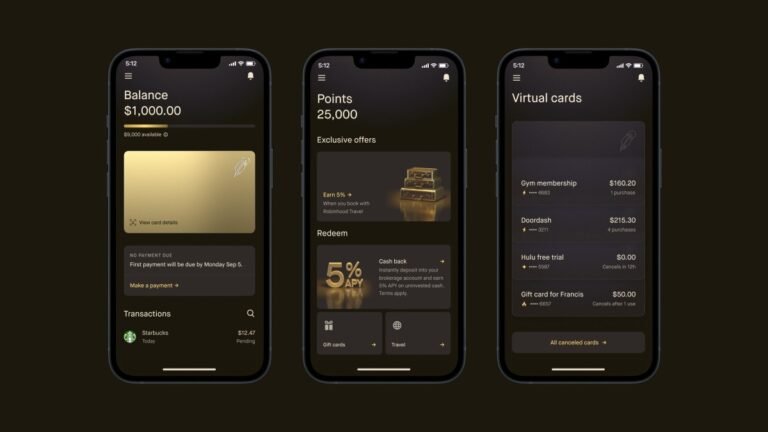

Robinhood’s new card: Nine months after acquiring credit card startup X1 for $95 million, Robinhood on Wednesday announced the launch of its new Gold Card, powered by X1’s technology, with a list of features that could make Apple Card users envious.

Bonus roundSpotify tests online learning: In its ongoing efforts to get its 600 million+ users to spend more time and money on its platform, Spotify is spinning up a new line of content: e-learning.

Welcome to Startups Weekly — your weekly recap of everything you can’t miss from the world of startups.

For the low, low price of being a Robinhood Gold member (because who doesn’t want to pay $5 a month for the privilege of spending more money?

Robinhood unveiled its Gold Card, a credit card so packed with features it might just make Apple Card users pause for a hot second.

For the low, low price of being a Robinhood Gold member (because who doesn’t want to pay $5 a month for the privilege of spending more money?

Trend of the week: Transportation troubleThe New York Stock Exchange has given EV startup Fisker the boot, citing its “abnormally low” stock prices.

Robinhood’s new credit card was revealed Tuesday, and though it’s only available for Robinhood Gold members, the Gold Card does have a feature that’s spurring headlines: the ability to invest cash back bonuses into investments.

But what gives with tech companies getting into the consumer credit game?

You could argue that Robinhood’s choice to offer a card is just an extension of its already-expanding portfolio of financial products.

But Apple also has a card, recall.

And the tech giant is getting deeper into the realm of personal finance as time goes along.

Robinhood’s new credit card goes after Apple Card with ability to invest cash-back perksEight months after acquiring credit card startup X1 for $95 million, Robinhood announced today the launch of its new Gold Card, with a list of features that could even give Apple Card users envy.

Apple, for instance, offers 3% cash back on all purchases made at Apple, and on purchases made at select merchants when using the Apple Card with Apple Pay.

In general, purchases made on Apple Card with Apple Pay earn users 2% back.

It’s why we started Robinhood…” Robinhood co-founder and CEO Vlad Tenev said in a written statement.

“Today’s announcements…bring us one step closer to the goal of giving everyone better access to the financial system.”Robinhood Gold Card, explained:What are the requirements to apply for a Robinhood Gold Card?

Eight months after acquiring credit card startup X1 for $95 million, Robinhood announced today the launch of its new Gold Card, with a list of features that could even give Apple Card users envy.

However, it will only be available for Robinhood Gold members, which costs $5 a month, or $50 annually.

Apple, for instance, offers 3% cash back on all purchases made at Apple, and on purchases made at select merchants when using the Apple Card with Apple Pay.

The new credit card is part of Robinhood’s evolving business model and offerings over the years.

Gold Membership, a requirement to get the Gold Card, increases the eligible match to up to 3% match.

PayPal launches Tap to Pay on iPhone for businesses using Venmo and Zettle in the USPayPal announced today that it’s launching “Tap to Pay” for merchants with an iPhone through the Venmo and Zettle apps in the U.S. PayPal, which owns both Venmo and Zettle, says the feature will allow businesses to accept contactless card and digital wallet payments directly on their iPhones with no additional cost or hardware.

In addition to being able to accept payments from cards or digital wallets like Apple Pay or Google Pay, Tap to Pay allows merchants to add taxes, accept tips, send receipts and issue refunds without any additional hardware.

Funds from sales are quickly put into a business’s Venmo or PayPal Zettle account, the company says.

With Tap to Pay on iPhone, Venmo business profile users will be able to reach for customers by accepting payments from buyers even if they don’t have a Venmo account.

A year later, Strip enabled businesses to carry out Tap to Pay transactions on NFC-equipped Android devices, as well.