“Big tech companies have ‘mis-set’ expectations when it comes to AI,” Heltewig told TechCrunch.

According to one survey, over half of businesses have already invested in AI capabilities to support their customer service operations.

Per market research firm Markets and Markets, revenue in the market for call center AI alone is set to climb from $1.6 billion in 2022 to $4.1 billion by year-end 2027.

And it’s scalable; Cognigy manages AI agents that can handle up to tens of thousands of customer conversations at once.

Image Credits: Cognigy“Cognigy provides a platform to build, operate and analyze AI agents for customer experiences in the contact center,” Heltewig said.

Data transformation and optimization — tasks that many, if not most, large enterprises deal with — aren’t easy.

The result was Coalesce, a San Francisco-based company building a suite of data transformation services, apps and tools.

“The data transformation layer has long been the largest bottleneck in analytics,” Petrossian, Coalesce’s CEO, told TechCrunch.

Coalesce’s response is a platform that standardizes data while automating the more repetitive, mundane data transformation processes.

That sort of vendor lock-in could be an anathema to expansion, especially given that Coalesce isn’t the only data transformation tool vendor in town.

This week, we’re looking at Robinhood’s new Gold Card, challenges in the BaaS space and how a tiny startup caught Stripe’s eye.

BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees.

The startup is not the only VC-backed BaaS company to have resorted to layoffs to preserve cash over the past year.

MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

It has more primary customers than ChaseInside a CEO’s bold claims about her hot fintech startup, which TC previously covered here.

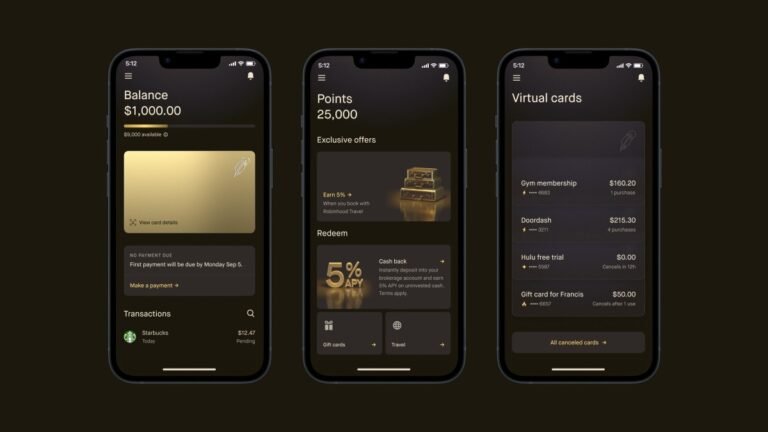

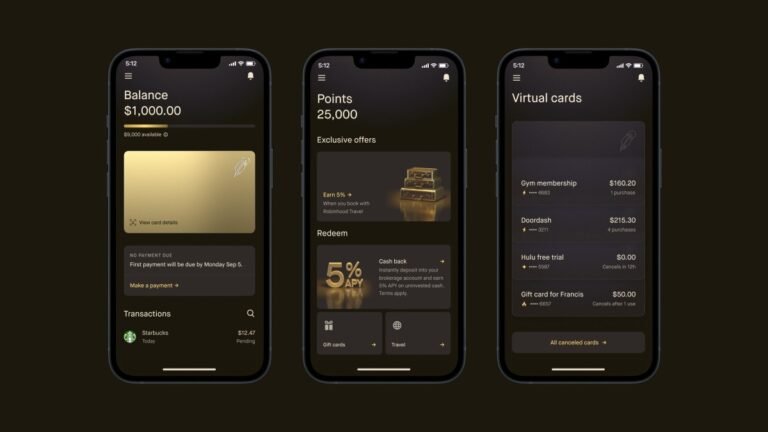

Robinhood’s new credit card goes after Apple Card with ability to invest cash-back perksEight months after acquiring credit card startup X1 for $95 million, Robinhood announced today the launch of its new Gold Card, with a list of features that could even give Apple Card users envy.

Apple, for instance, offers 3% cash back on all purchases made at Apple, and on purchases made at select merchants when using the Apple Card with Apple Pay.

In general, purchases made on Apple Card with Apple Pay earn users 2% back.

It’s why we started Robinhood…” Robinhood co-founder and CEO Vlad Tenev said in a written statement.

“Today’s announcements…bring us one step closer to the goal of giving everyone better access to the financial system.”Robinhood Gold Card, explained:What are the requirements to apply for a Robinhood Gold Card?

Eight months after acquiring credit card startup X1 for $95 million, Robinhood announced today the launch of its new Gold Card, with a list of features that could even give Apple Card users envy.

However, it will only be available for Robinhood Gold members, which costs $5 a month, or $50 annually.

Apple, for instance, offers 3% cash back on all purchases made at Apple, and on purchases made at select merchants when using the Apple Card with Apple Pay.

The new credit card is part of Robinhood’s evolving business model and offerings over the years.

Gold Membership, a requirement to get the Gold Card, increases the eligible match to up to 3% match.

With only 4 days left, the clock is ticking on your chance to snag the early-bird savings for TechCrunch Early Stage 2024.

Don’t miss out — secure your ticket now and save $200 before the 11:59pm PT deadline on Friday, March 29.

Explore the pros and cons of convertible notes, simple agreements for future equity (SAFE), and series seed financing rounds, and equip yourself with the knowledge to navigate these alternatives with confidence.

Don’t let this opportunity slip away — secure your early-bird ticket to TechCrunch Early Stage 2024 today and position yourself for startup success.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

EV startup Fisker is pausing production of its electric Ocean SUV for six weeks as it scrambles for a cash infusion.

The company said in a Monday morning regulatory filing that it had just $121 million in cash and cash equivalents as of March 15th, $32 million of which is restricted or not immediately accessible.

Fisker finished 2023 having shipped roughly 5,000 of the 10,000 cars that its contract manufacturing partner, Magna Steyr, produced.

Automotive manufacturing is incredibly expensive, even for a company like Fisker which is outsourcing much of the work to suppliers like Magna.

In the near-term, Fisker said Monday it is trying to raise $150 million through the sale of convertible notes.

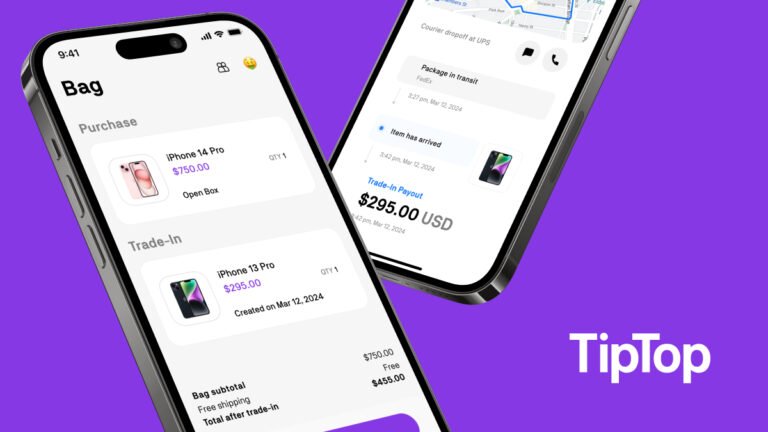

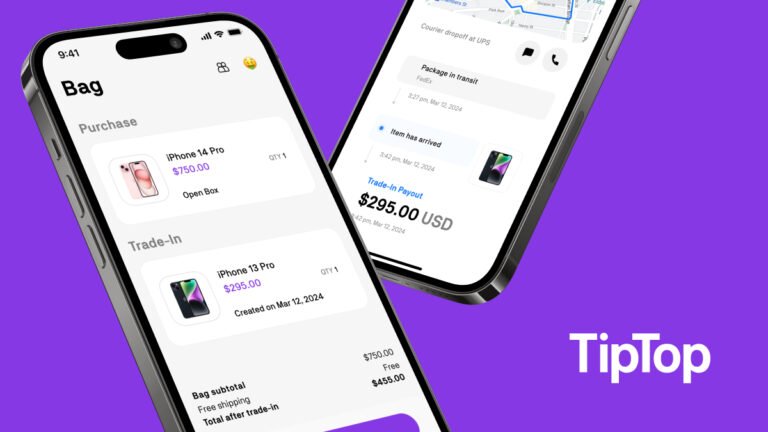

TipTop, the new app from Postmates’ founder and CEO, now lets you buy devices with trade-ins and cashTipTop, the startup that offers instant cash for electronics, is launching TipTop Shop: a way for users to purchase and trade in devices.

TipTop Shop builds on the success of TipTop Cash, which was released late last year.

It lets people get instant payouts for electronic devices like smartphones, iPads, cameras, game systems and more.

People can buy new, open-box and refurbished devices through cash and trade-ins.

Unlike on platforms like eBay and Facebook Marketplace, consumers aren’t buying products on TipTop from other consumers, as the devices are owned by the startup itself.

And it is using an undisclosed portion of its cash reserve to acquire Regate, an accounting and financial automation platform.

Qonto originally started with online business accounts with debit cards specifically tailored for small and medium businesses.

After a while, Regate will be integrated in Qonto directly to improve several accounting automation features of Qonto, such as invoicing, accounts payables, accounts receivables, etc.

Qonto finds itself in a different position from Payfit, another French unicorn (or former unicorn) that provides a software-as-a-service tool focused on payroll.

As many fintech startups are struggling to raise a new funding round, Qonto could become a consolidator in the space.

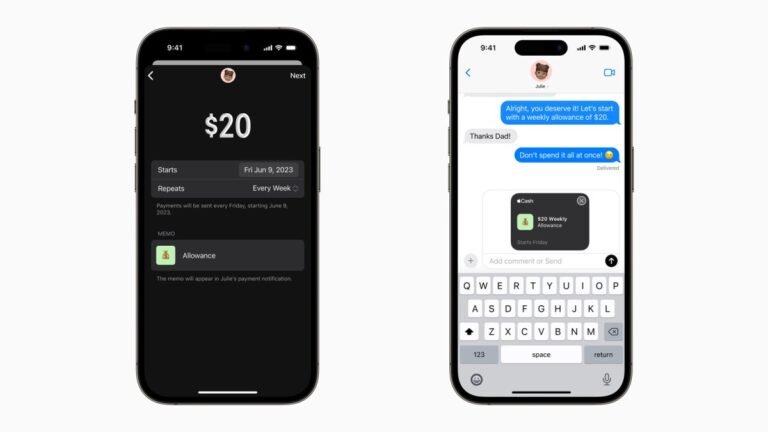

But the company has also released a new API called FinanceKit that lets developers fetch transactions and balance information from Apple Card, Apple Cash, and Savings with Apple.

The most requested credit card integration is now live on Copilot Money 💳 Starting today, Copilot can keep track of your Apple Card, Apple Cash, and Savings accounts.

It released the Apple Card in 2019.

Earlier this year, it said that Apple Card users earned $1 billion in daily cash rewards in 2023.

In April 2023, Apple launched a savings account with a 4.15% APY in partnership with Goldman Sachs.