Validating consumer demand is a crucial step for any startup, and TechCrunch Early Stage is offering a golden opportunity to learn how to do it right.

In this workshop, Gladstone will guide founders on how to leverage their expertise to understand and solve consumer problems effectively.

With hands-on advice and practical strategies, attendees can expect to gain insights into testing solutions, refining product development processes, and ultimately validating consumer demand.

With a BA from Brandeis University and an MBA from the Tuck School of Business at Dartmouth, Gladstone’s expertise is grounded in both academic rigor and real-world experience.

For founders eager to validate their ideas and drive meaningful consumer engagement, this workshop is a must-attend event at TechCrunch Early Stage.

When Josh Silverman started shopping around the idea for his methane-eating microbe startup, Windfall Bio, eight years ago, the market just wasn’t ready.

Menlo Park–based Windfall Bio raised a $28 million Series A round to expand its commercialization efforts.

The round was led by Prelude Ventures with participation from Amazon’s Climate Pledge Fund, Incite Ventures and Positive Ventures, among others, as well as existing investors, including Mayfield.

Windfall works with industries that produce large levels of methane, such as agriculture, oil and gas, and landfills.

The startup supplies methane-eating microbes that absorb methane emissions, turning them into fertilizer.

The global demand for wood could grow by 54% between 2010 and 2050, according to a study by the World Resources Institute.

While some building materials like steel get consistently recycled back into the supply chain, wood does not.

Cambium looks to build the supply chain that keeps wood from being wasted by connecting those with already-been-used wood to the businesses and folks that need it.

“We’re building a better value chain where you can use local material, you can use salvaged material, and all of that is connected through our technology,” Christensen said.

And we do that in a really efficient and cost competitive way.”Demand for more sustainable wood has been growing in recent years, Christensen said, but before Cambium there wasn’t a good system to find the recycled wood.

Founder Daudi Barnes started the company in 2019 to augment the work of his previous company, Advanced Mobile Propulsion Test.

The Colorado-based startup already operates one test stand, called Sunshine, which AMPT stood up in 2010.

“The market is just really, really expanding really fast right now,” Animas project manager Graham Dudley explained.

So they’ve had four plus years of design and development that they have to reboot on, and that’s really, really expensive and hard for your schedule prediction.

Its a competitive edge in the space propulsion market, which has become increasingly crowded as the cost to launch spacecraft to orbit has dropped.

The deal is interesting on a number of fronts including the round’s structure and how Skyflow has been impacted by growth of AI.

The new capital comes after Skyflow expanded its data privacy business to support new AI technologies last year.

(In its latest news dump, Skyflow said that it expanded its support of China and that market’s particular data rules.)

This Skyflow round slots neatly into several trends we’ve observed recently.

The explosive growth in AI is creating healthy businesses for LLM infrastructure and support companies.

A new report highlights the demand for startups building open source tools and technologies for the snowballing AI revolution, with the adjacent data infrastructure vertical also heating up.

A broader look at the “top 50 trending” open source startups last year reveals that more than half (26) are related to AI and data infrastructure.

This ethos often translates into commercial open source startups which might not have a traditional center of gravity anchored by a brick-and-mortar HQ.

For comparative purposes, there are other indexes and lists out there that give a steer on the “whats hot” in the open source landscape.

So the ROSS Index has emerged as a useful complementary tool for figuring out which open source “startups” specifically are worth keeping tabs on.

Astera Labs started its life as a public company trading at $52.56 per share, up 46% when the bell rang.

Astera Labs makes connectivity hardware for cloud computing data centers.

Astera Labs’ IPO price valued it at around $5.5 billion, a figure that swells to around $8.9 billion at its current trading price.

The strong performance of Astera in its first hours as a public company could also ameliorate some investor activity that is holding back, or even preventing some public offerings altogether.

If VCs know that the startup could pop on the public market like Astera Labs, maybe they will think about the timeline differently.

The digital currency hit a new all-time high for the first time since November 2021 when it passed $69,000 on Tuesday morning, as demand surged in recent weeks following the spot bitcoin ETF approvals in the U.S. and the pending bitcoin halving in late April.

Bitcoin halving, which is usually referred to as “the halvening,” is a periodic decline in bitcoin mining rates, which means the number of bitcoin miners can potentially get for each block mined is cut in half.

This process is meant to control the supply of bitcoin over time and once the number of bitcoin in circulation hits 21 million, its total supply, the process will end.

The price jump increase is also being driven by the 11 spot bitcoin ETFs the U.S. Securities and Exchange Commission approved in January.

The total market cap across the spot bitcoin ETF products is $53.74 billion, according to Blockworks data.

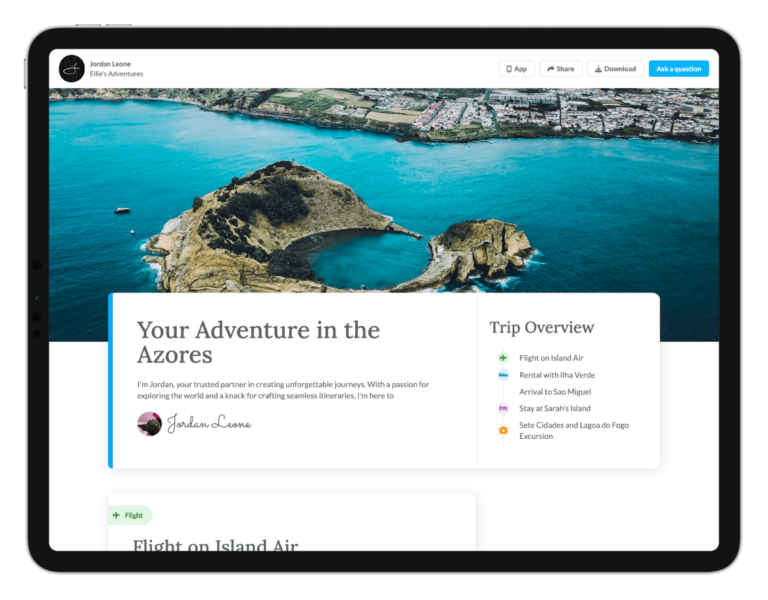

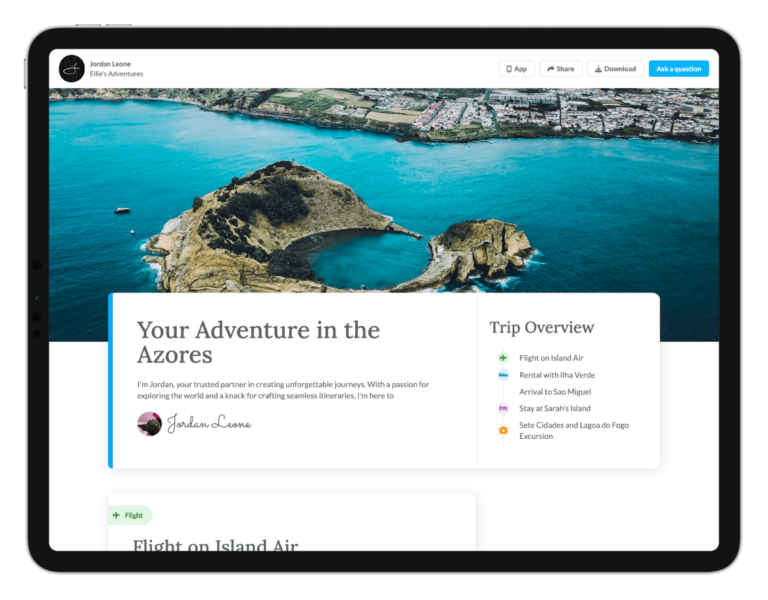

For co-founder and CEO Dayo Esho, the idea for TravelJoy emerged from his experiences growing up in the travel industry, supporting his mom’s travel agency business.

The co-founders began working TravelJoy in 2018, while participating in NFX’s accelerator.

The company also recently added integrations with travel insurance provider Faye and Viator, a marketplace for travel experiences.

The idea is to centralize the travel entrepreneur’s workflow, with CRM, messaging, invoicing, payments, proposals, itineraries, and group trip management in one digital solution.

Despite the pandemic’s massive and immediate impact on global travel, TravelJoy surprisingly didn’t shut down.

Ford is cutting prices of its all-electric 2023 Mustang Mach-E by has much as $8,100 as the automaker attempts to rid itself of inventory and compete with Tesla and its increasingly cheaper EVs.

Total market share of new EV sales has grown, reaching nearly 8% in U.S. in 2023.

Ford confirmed with TechCrunch the price cuts, which are only for model year 2023 Mustang Mach-E vehicles and range between $3,100 and $8,100.

“The Mustang Mach-E is America’s No.2 EV SUV in 2023 and Ford is America’s No.2 EV brand,” Ford spokesperson Marty Günsberg wrote in an emailed statement.

Tesla shipped a record number of electric vehicles in the fourth quarter, which helped it reach 1.81 million deliveries in 2023.