Cricket match streaming has been the prime driver of new users for streaming platforms in India.

By securing numerous cricket rights, Disney and Reliance have left rival services with limited content options to attract fans.

“The 2023-27 IPL broadcasting now sit under the JV – Viacom 18 has digital streaming rights (won for US$2.9bn) while Star has TV broadcasting rights for US$2.8bn.

Combined with about 8% of the TV market that Viacom18 assumes in India, the merged operations — which will feature some 120 TV channels — will command about 49% of the broadcasting market.

In a statement Wednesday, Disney and Reliance said they will reach 750 million users in India with the merged entity.

Ethiopian startup eQub is the winner of the fintech pitch-off at 4YFN 2024, Mobile World Congress’ startup event.

The startup’s name is an Amharic word referring to a local form of peer-to-peer credit, Michael said.

An Equb is a group of people who join forces to save money, which is then distributed on a rotating basis.

Starting with an app, it targets users among the growing number of Ethiopians who have bank accounts and mobile phones, but limited access to credit.

Making an Equb digital is an improvement in itself: For eQub members with bank accounts, they can add money without having to go to an ATM.

And tech companies in the West have rallied around the sector, increasingly working with Ukrainian tech firms on a range of initiatives.

This week Google launched its second ‘Google for Startups Ukraine Support Fund’ with a budget of $10M to support Ukrainian startups during 2024 and 2025.

Selected Ukrainian startups will receive up to $200,000 in equity-free funding, as well as Google mentorship, product support, and $300,000 in Google Cloud credits.

Meanwhile, Estonian accelerator Startup Wise Guys launched Growth Ukraine, a programme for startups in Ukraine.

And the EU-funded project ‘Seeds of Bravery’ programme has five programmes to support Ukrainian tech startups with grants ranging from €10,000 to €50,000.

We can’t compete against our global peers with that engine throttled by last-generation digital infrastructure and policy.

They are already slowing investment in 5G network deployments and signaling their disinterest in 6G investment.

If we create more game-changing wireless applications — from advanced manufacturing, to smart cities, to autonomous transport, to remote sensing — we create demand that pulls digital infrastructure forward.

But we can’t compete against our global peers with that engine throttled by last-generation digital infrastructure and policy.

We must acknowledge new realities and play to our strengths to reverse digital infrastructure deterioration.

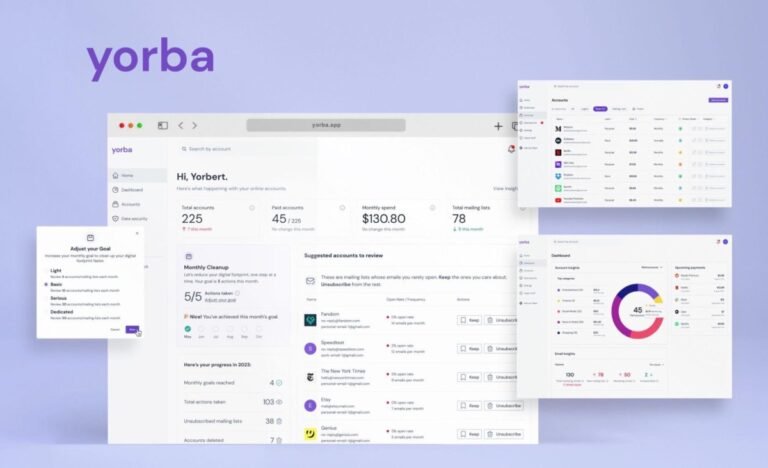

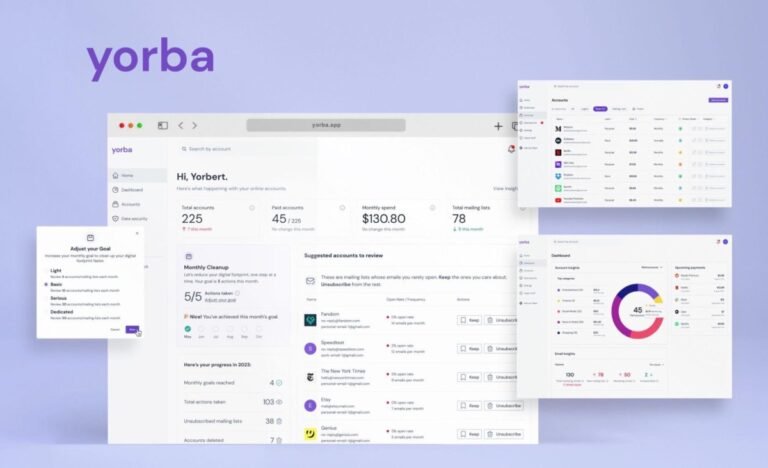

Spend enough time online, and you’ll collect a digital paper trail of accounts, logins, subscriptions, mailing lists, and passwords wrapped up in data breaches.

From its web-based dashboard, you can organize, monitor, and manage your online accounts, unsubscribe from mailing lists, cancel subscriptions, review privacy policies, and more.

The end result is something like a Mint for your entire online life, so to speak.

Instead, it works by connecting with your online accounts, like your Gmail, and soon other online services and cloud storage providers.

Some of the functionality Yorba offers may not be unique.

FairMoney, a digital bank based in Lagos and headquartered in Paris, is in discussions to acquire Umba, a credit-led digital bank providing payroll and financial services to customers in Nigeria and Kenya, in a $20 million all-stock deal, sources tell TechCrunch.

Umba, founded by Tiernan Kennedy and Barry O’Mahony in San Francisco in 2018, was launched as a credit-led digital bank targeting emerging markets.

To date, the digital bank has secured around $20 million in funding, per PitchBook data.

FairMoney could likely be more interested in Umba’s microfinance license, obtained in 2022 through acquiring a majority shareholding in Daraja Microfinance Bank.

For FairMoney, acquiring Umba could streamline entry into Kenya, bypassing the lengthy licensing process that took Umba three years.

In a role reversal, Xalts, a Singapore fintech startup founded 18 months ago, has acquired Contour Network, a digital trade platform set up by eight major banks including HSBC, Standard Chartered and BNP.

Backed by Accel and Citi Ventures, Xalts enables financial institutions to build and manage blockchain-based apps.

The startup plans to turn Contour into a rail connecting banks, corporations and other institutions, and integrate it with Xalts’ platform.

Kaur says this will enable Xalts’ clients to not only build apps, but also connect with each other in a secure and compliant way.

It will focus first on enabling banks and logistics companies to offer embedded trade and supply chain apps on a single platform to their customers.

The European Union is formally investigating TikTok’s compliance with the bloc’s Digital Services Act (DSA), the Commission has announced.

Although the EU’s concerns over TikTok’s approach to content governance and safety predate the DSA coming into force on larger platforms.

Commenting in a statement, Margrethe Vestager, EVP for digital, said:The safety and well-being of online users in Europe is crucial.

The EU may also accept commitments offered by a platform under investigation if they are aimed at fixing the issues identified.

In TikTok’s case the platform informed the bloc last year that it had 135.9M monthly active users in the EU.

I founded Mindtickle, a sales readiness platform, in 2011 to address this issue and help companies prepare their sales teams to tackle any challenge.

Digital sales rooms offer a new way to achieve just that.

Winning sales organizations have now started using digital sales rooms (DSRs) to introduce buyer enablement to the sales enablement ecosystem to create a more interactive and engaging experience for buyers.

Combining DSRs with sales enablement toolsBuyers are scrutinizing purchases more and sellers are under pressure to provide value in every buyer interaction.

Digital sales rooms are online microsites where sellers can customize and share contracts, mutual action plans, sales content, and more with buyers.

Four years after leaving iOS, Fortnite is coming back — but only European players will be dropping in this time.

The endless beef between Epic Games and Apple over the company’s App Store fees took its most recent surprise turn on Thursday when the iPhone maker announced changes coming to iOS in the EU.

The plan to offer Fortnite for iOS dovetails with Epic’s news that it will launch a version of the Epic Games Store on the platform in the EU.

Beyond developing Fortnite and the Unreal Engine, Epic also runs the Epic Game Store, a digital storefront for PC games that’s also available on Macs.

That vision is increasingly coming into focus on Fortnite, which has evolved from being a few third-person shooter game modes into a full-fledged Roblox-like portal for digital games.