UK-based legaltech company Lawhive, which offers an AI-based in-house ‘lawyer’ through a software-as-a-service platform targeted at small law firms, has raised £9.5 million ($11.9M) in a seed round to expand the reach of AI-driven services for ‘main street’ law firms.

To date, most legaltech startups that are deploying AI have concentrated on the big, juicy market of ‘Big Law’ — meaning large, either country-wide or global, law firms that are keenly pushing AI into their workflows.

These include Harvey (US-based; raised $106M); Robin AI (UK-based; raised $43.4M); Spellbook (Canada-based; raised $32.4M).

Lawhive targets its platform at small law firms or solo lawyers running their own shop.

That’s a very small number of big law firms in the US in the UK.

It last raised a $50M Series C funding round in 2021.

TransferGo claims the new investment doubles its valuation to around $600M, from the $200M-$300M Dealroom valued it at back in September 2021.

We achieved sustainability of the business and became profitable and we still have proceeds from the last funding round.

We don’t need external capital to grow.”However, he saw the opportunity to raise funding from Asia to expand there.

“We are still taking customers from incumbents: 75% come from cash, banks, and Western Union — that’s still the gorilla in the room.”He puts TransferGo’s growth down to focusing on the consumer experience.

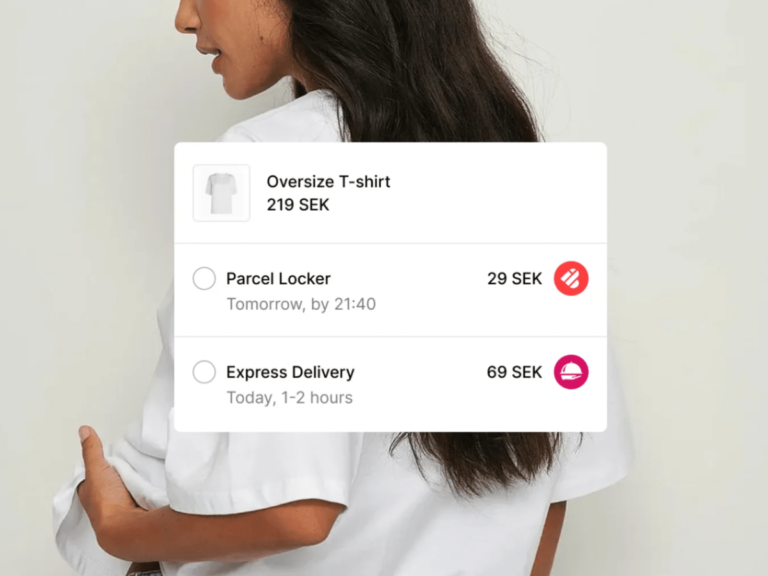

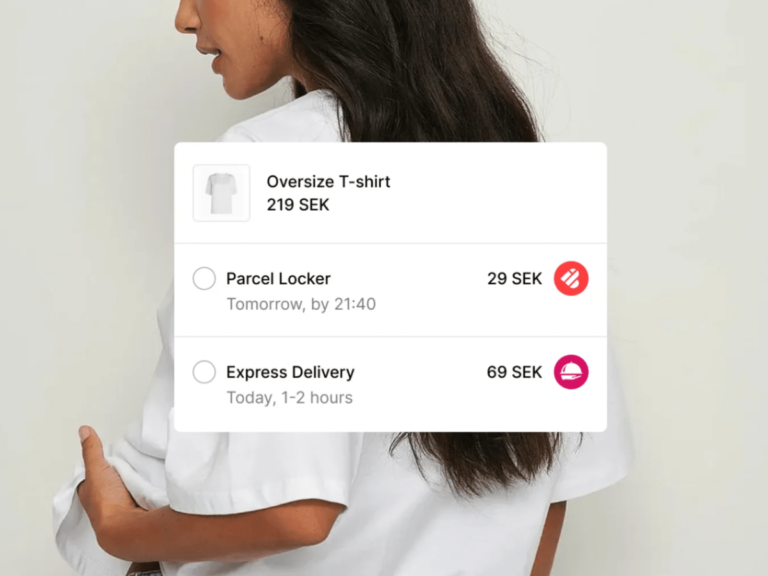

Among the many stress points in e-commerce machine, delivery has long been seen as one of the more painful ones.

“Delivery is the biggest unsolved puzzle is delivery part,” Piotr Zaleski, Ingrid’s co-founder and CEO said in an interview.

And in case you are at all curious: Ingrid the business was not named to ensure coverage in TechCrunch by me, Ingrid.

Ingrid has identified a very obvious problem that most certainly can use fixing, but it also faces a few challenges.

“The only way is to build a hell of a platform that retailers want to use to take a volume position,” Zaleski said.

MDaaS Global, a Nigerian health tech company that operates a network of tech-enabled diagnostic centers across the country, has secured $3 million in pre-Series A funding.

The seven-year-old health tech also plans to expand its healthcare network to cover all Nigerian states through a combination of company-owned and affiliate clinics.

Improving access to diagnostics and preventive care, a domain where MDaaS has garnered recognition, is essential in tackling this healthcare challenge.

On the other hand, MDaaS’ care network involves collaboration with over 1,300 referring clinicians across more than 1,000 organizations, including hospitals, pharmacies, health tech startups, corporate partners and 34 HMOs.

Since its inception, MDaaS has provided care to over 275,000 patients, leveraging its integrated care network and BeaconOS capabilities.

Waymo’s application to expand its robotaxi service in Los Angeles and San Mateo counties has been suspended for 120 days by the California Public Utilities Commission’s Consumer Protection and Enforcement Division.

The decision doesn’t change Waymo’s ability to commercially operate driverless vehicles in San Francisco.

However, it does put an abrupt halt to the company’s aspirations to expand where it can operate — at least until June 2024.

The CPED said on its website that the application has been suspended for further staff review.

San Mateo County Board of Supervisors Vice President David J. Canepa issued a statement following the ruling.

AppDirect, a San Francisco- and Montreal-based platform for buying, selling and managing tech through a network of IT advisors, has raised $100 million from CDPQ to expand its financing program for small- and medium-sized tech businesses.

“Our Invest program is purpose-built to empower our technology advisors,” Emanuel Bertolin, AppDirect’s chief revenue officer, said in a statement.

“To keep up with today’s ever-changing market, technology merchants need fast access to capital to accelerate their growth.”AppDirect’s Capital Invest program is a loan program, providing capital for tech businesses in the form of upfront payments.

Today, AppDirect offers a set of tools that let businesses monetize — or buy — tech products across a range of different channels and devices.

We also provide the opportunity for our advisor community to procure technology for their customers directly from the AppDirect catalog.”AppDirect launched the Capital Invest program in 2021.

Governance, risk management and compliance — GRC for short — remains one of the most active startup areas in terms of VC investments.

GRC helps organizations better manage risk while staying in compliance with regulations — and there’s an increasing number of regulations to worry about.

“Anecdotes is redefining compliance and risk management by transforming it from a labor-intensive task with skyrocketing associated costs into data-oriented processes.”Anecdotes’ platform automatically collects GRC-related “artifacts” (i.e.

Anecdotes’ competitors include VComply, a risk and compliance management startup that’s raised over $10 million in venture capital so far, and Cypago, which aims to automate compliance and governance for companies.

Kuznitsov asserts that Anecdotes is well-positioned, though, with around 100 customers including Snowflake, Coinbase SoFi, Grafana and Payscale.

The plan is for “centers of excellence” to be set up to support the development of dedicated AI algorithms that can run on the EU’s supercomputers, they added.

AI startups are more likely to be accustomed to using dedicated compute hardware provided by US hyperscalers to train their models than tapping the processing power offered by supercomputers as a training resource.

Using its supercomputing resources to fire up AI startups specifically has emerged as a more recent strategic priority after the EU president’s announcement of the compute access for AI model training program this fall.

It’s still early days for the EU’s ‘supercompute for AI’ program so it’s unclear whether there’s much model training upside to report off of dedicated access as yet.

But the early presence of Mistral in the EU’s supercomputing access program may suggest an alignment in the thinking.

ImpriMed, a California-based precision medicine startup, builds AI-powered dog cancer treatment technology that helps veterinarians identify the most suitable drugs for individual canine and feline blood cancers.

The startup, which centers on improving treatment outcomes of dogs and cats with cancer first, now aims to expand its precision medicine technology for human oncology applications.

“Also, the proven know-how acquired from developing AI algorithms in veterinary oncology streamlines the building of new predictive models in human oncology.

For human precision oncology, its AI software for multiple myeloma, a rare blood cancer, is in the process of approval, aiming to commercialize in 2025, Lim told TechCrunch.

ImpriMed’s unique strength is “the ability to develop and incorporate AI models into the personalized medicine service workflow,” according to Lim.

Lolli, a bitcoin and cashback rewards application, has raised an $8 million Series B round, TechCrunch has exclusively learned.

Its rewards program awards its users with bitcoin or cashback when they shop online or in person at restaurants and stores.

The app gives up to 30% back on purchases, with an average of 7% back in bitcoin or cashback rewards.

Since its inception, Lolli has given over $10 million in bitcoin rewards, in addition to cashback rewards, Adelman said.

The company plans to use the momentum in the markets to “drive more revenue to partners and bring more major companies into offering bitcoin rewards,” Adelman said.