Polestar secured a $950 million loan from a dozen banks, critical funds needed to keep its EV plans moving forward following Volvo’s decision to pull back its financial support of the electric automaker.

Polestar, which has cut 10% of jobs since mid-2023, said it plans to make another 15% cut this year.

Polestar currently produces the Polestar 2, Polestar 3, which recently started production in China, and the Polestar 4.

The company said it has successfully completed test production runs for the Polestar 3 at its factory in South Carolina.

The $950 million loan follows Volvo Cars’ decision last month to reduce its 48% holding in Polestar and let parent company Geely take over financial responsibility.

Crypto fund Asymmetric Financial is creating its Bitcoin DeFi Venture Fund I to focus on investing in the blockchain’s nascent space with a target raise of $21 million.

The fund will be spearheaded by general partner Dan Held, former director of growth at Kraken and long-time Bitcoiner.

Many Bitcoin-focused VCs ignore DeFi because it’s speculative, and broader crypto VCs see it as a “dead boomer rock,” he added.

Much of this activity has centered on the Ethereum blockchain, but Held believes Bitcoin’s blockchain has tons of future potential as an ecosystem.

“It will be a Bitcoin DeFi renaissance.”“Bitcoin is worth more than every other crypto asset combined,” Held added.

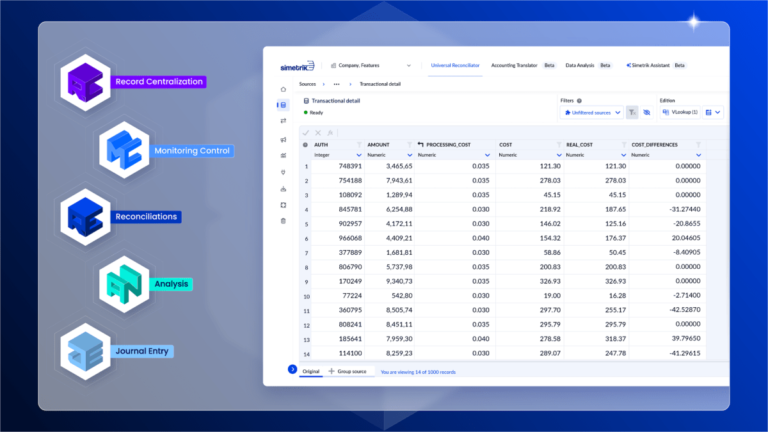

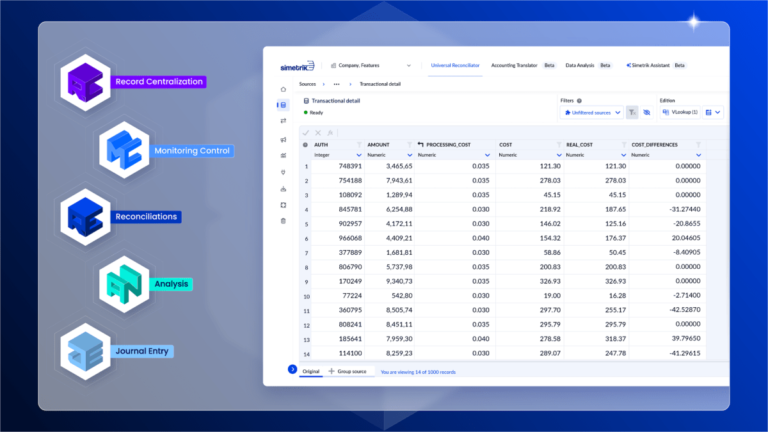

Where it is differentiating itself is through its Simetrik Building Blocks, or SBBs, which are scalable and adaptable concepts based on no-code development and generative AI technologies.

In the past two years, the company grew to have clients in more than 35 countries, up from 10, and is monitoring over 200 million records every day.

Previously that was 70 million records daily.

The use of the new funds will go into further developing the Simetrik Building Blocks, enhancing AI capabilities and continuing to expand Simetrik’s international reach.

They need a new approach, and that is where our building blocks have a strong product market piece.”

In a role reversal, Xalts, a Singapore fintech startup founded 18 months ago, has acquired Contour Network, a digital trade platform set up by eight major banks including HSBC, Standard Chartered and BNP.

Backed by Accel and Citi Ventures, Xalts enables financial institutions to build and manage blockchain-based apps.

The startup plans to turn Contour into a rail connecting banks, corporations and other institutions, and integrate it with Xalts’ platform.

Kaur says this will enable Xalts’ clients to not only build apps, but also connect with each other in a secure and compliant way.

It will focus first on enabling banks and logistics companies to offer embedded trade and supply chain apps on a single platform to their customers.

This week, we’re looking at a new finance-based dating app, Robinhood’s earnings results and the startup in which PayPal Ventures made its first investment.

Launched by financial platform Neon Money Club, Score is a dating app for people with good to excellent credit, and it seeks to help raise awareness about the importance of finances in relationships.

Dollars and centsFinom, a European challenger bank aimed at SMEs and freelancers, has raised €50 million ($54 million) in a Series B equity round of funding.

Rasa, an enterprise-focused conversational generative AI platform with financial services companies as clients, raised $30 million in a Series C round co-led by StepStone Capital and PayPal Ventures.

Cash App announced it will now offer “up to” a 4.5% APY (annual percentage yield) for its Cash App Savings customers, with a few caveats.

Fintech company Kashable is the latest to also grab some venture capital attention for its approach to offering credit and financial wellness products as an employer-sponsored voluntary benefit.

In total, the company raised $45 million in equity capital and over $175 million in debt capital.

Financial wellness is one of the areas many of the startups get into.

“When we first started our journey in 2013, financial wellness was just an emerging concept,” Kumar told TechCrunch.

In addition, Kashable offers financial education resources, including credit monitoring, individual financial coaching and budgeting tools.

Briq, a startup that uses AI to automate finances in construction, brings in $8M extension at a $150M valuationAt a time where many startups are struggling to raise funding, or are raising – but at lower valuations, it’s notable when companies raise at flat or higher valuations.

The startup last announced a fundraise in June of 2021 – a $30 million Series B financing led by Tiger Global Management.

Customers include Briq Choate Construction, Catamount Construction, Fessler and Bowman, and Elder Construction, among others.

Briq deploys that across two products: Briq AutoPilot and Briq CoPilot.

“Usually when we think about robots in construction, we think about machines on a jobsite.

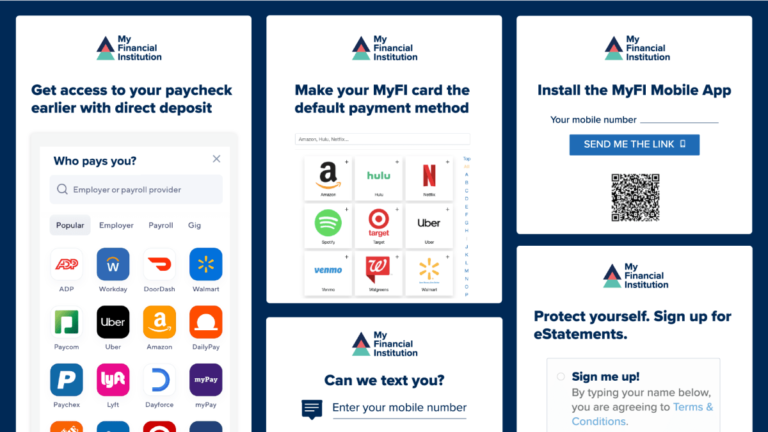

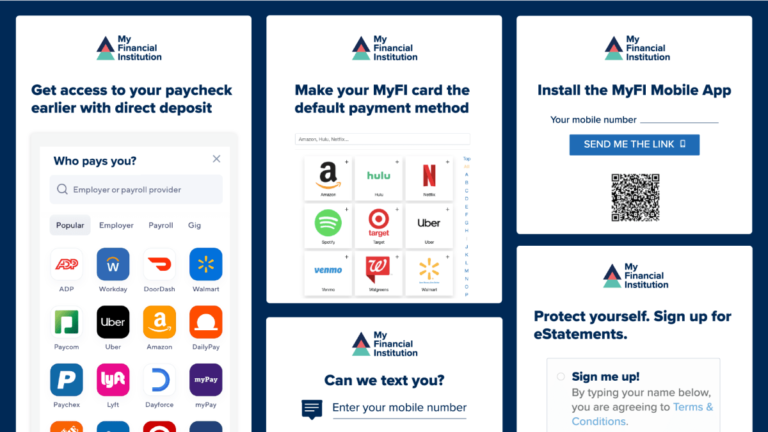

Digital Onboarding, a SaaS company specializing in helping financial institutions strengthen relationships with customers, secured $58 million in growth capital from Volition Capital to continue developing its digital engagement platform.

They changed the name to Digital Onboarding and began selling its engagement platform to banks and credit unions in January of 2018.

Communications from financial institutions, which are under strict regulations, is often paper-based, especially when opening a new account.

This often leads to between 25% and 40% of new checking accounts closed within the first year, said Brown, CEO of Digital Onboarding, citing a statistic from the 2023 Future of Finance Report.

Digital Onboarding is working with more than 140 financial institution customers.

This week Devin, Kirsten and I have been running around in Las Vegas for CES to figure out what’s going on in the world of tech.

Siri in particular could do with getting its act together, before it’s completely left in the dust by its competitors.

Biggest news from CESSamsung’s Ballie, the spherical home robot first seen at CES 2020, has rolled back into the spotlight at CES 2024 with some trend-forward AI enhancements.

Kyle reports how AI tools can easily manipulate ID images, creating deepfakes convincing enough to pass KYC tests.

Plus, Alexa’s got a new AI model making it more opinionated and emotional.

Treasure Financial has laid off 14 employees, the fintech startup confirmed to TechCrunch today.

Sam Strasser, founder and CEO of Treasure Financial, told TechCrunch that “a need to streamline our operations and align our workforce with our current strategic goals and financial realities” drove the decision.

“Market conditions and organizational challenges aside, financial stewardship necessitated this unfortunate but necessary action,” he added.

San Francisco-based Treasure Financial offers cash management software for businesses and is a registered investment advisor (RIA).

Just last July, the startup raised $7.5 million in a funding round led by Ventura Capital, a previous investor in the firm.