Despite having 47 IPOs, 28 M&As and 58 FDA-approved drugs under its belt, the 13-year-old multi-stage healthcare and life sciences firm took two years to raise its sixth fund.

On Wednesday, Foresite announced that it closed its sixth fund with $900 million.

Last summer, Foresite co-led a $115 million Series F into CG Oncology, a drug discovery company that had a successful IPO listing in January.

Foresite intends to back about 20 companies from its sixth fund, writing checks from a couple of million up to $75 million.

“Over a decade ago, we named the firm Foresite because we thought we had an idea of where healthcare was headed,” Tananbaum said.

Cloud-based education software vendor PowerSchool is being taken private by investment firm Bain Capital in a $5.6 billion deal.

The announcement comes amid a swathe of take-private deals led by private equity firms seeking a bargain on under-performing enterprise software firms.

Founded in 1997, PowerSchool is a web-based platform that helps educational institutions manage areas of their operations such as enrollment, grades, attendance, and communication with parents and students.

The company went public on the New York Stock Exchange (NYSE) in 2021, after previously been acquired by private equity firms Onex and Vista.

UK-based legaltech company Lawhive, which offers an AI-based in-house ‘lawyer’ through a software-as-a-service platform targeted at small law firms, has raised £9.5 million ($11.9M) in a seed round to expand the reach of AI-driven services for ‘main street’ law firms.

To date, most legaltech startups that are deploying AI have concentrated on the big, juicy market of ‘Big Law’ — meaning large, either country-wide or global, law firms that are keenly pushing AI into their workflows.

These include Harvey (US-based; raised $106M); Robin AI (UK-based; raised $43.4M); Spellbook (Canada-based; raised $32.4M).

Lawhive targets its platform at small law firms or solo lawyers running their own shop.

That’s a very small number of big law firms in the US in the UK.

Cendana, Kline Hill have a fresh $105M to buy stakes in seed VC funds from LPs looking to sellIf you ask investors to name the biggest challenge for venture capital today, you’ll likely get a near-unanimous answer: lack of liquidity.

Cash-hungry venture investors, whether VCs themselves or their limited partners are increasingly looking to sell their illiquid positions to secondary buyers.

“We simply passed the hat around to our existing LPS at Kline Hill and Cendana,” said Kim.

It then passes these opportunities to Kline Hill, which values, underwrites and negotiates the transaction price.

Traditional secondary investors, such as Lexington Partners and Blackstone, recently raised their largest secondary funds ever.

Patlytics, an AI-powered patent analytics platform, wants to help enterprises, IP professionals, and law firms speed up their patent workflows from discovery, analytics, comparisons, and prosecution to litigation.

The outfit recently launched its product, which is SOC-2 certified, and already serves some top-tier law firms and a few in-house legal counsels at enterprises as customers.

Its target users include IP law firms and companies with several patents.

“Protecting intellectual property remains a major priority and business requirement for information technology, physical product, and biotechnology companies.

Notably, the round also attracted a host of angel backers, including partners at premier law firms, Datadog President Amit Agarwal, Fiscal Note founder Tim Hwang, and Tapas Media founder Chang Kim.

All VC firms have also grown increasingly focused on making early-stage investments in India in recent years and finding the next Flipkart at the seed stage.

Accel has been trying to find the right fit for its early-stage accelerator program for nearly half a decade now.

SkoobSkoob is a generative AI platform which is revolutionizing the way readers interact with books.

More than 800 startups applied to be in Atoms 3.0, and about 300-400 applicants were AI startups.

Swaroop said nearly two-thirds of all pitches focused on AI startups that sought to solve HR and marketing problems.

In the summer after his freshman year at Worcester Polytechnic Institute, an engineering school in Worcester, Massachusetts, Cyvl.ai co-founder and CEO Daniel Pelaez needed a job.

And during my time there, I quickly saw firsthand they had no data on anything,” Pelaez told TechCrunch.

He saw an opportunity that would eventually become Cyvl.ai, a firm that helps municipalities and civil engineering firms bring a digital layer to tracking the conditions of transportation infrastructure.

“Our core vision and why we started the company in the first place is to help the entire world build and maintain better transportation infrastructure,” he said.

The $6 million investment was led by Companyon Ventures with participation from Argon Ventures, AeroX Ventures and Alumni Ventures.

New Summit Investments is raising a new $100 million impact fund, according to documents filed with the SEC.

This is the firm’s fifth fund and marks a sizable jump from the $40 million its previous fund, which closed back in 2022.

New Summit has supported marginalized fund managers by launching initiatives like its partnership with investment firm Gratitude Railroad to source and underwrite underrepresented fund managers.

New Summit Investments’ was founded in 2016 as an impact investment firm focusing on climate, health, and economic opportunities.

New Summit Investments’ first fund closed for $20 million in 2016, followed by $36 million in 2018, according to Pitchbook.

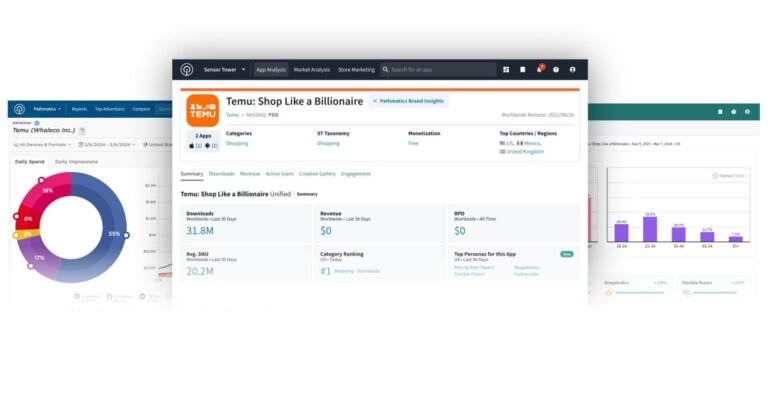

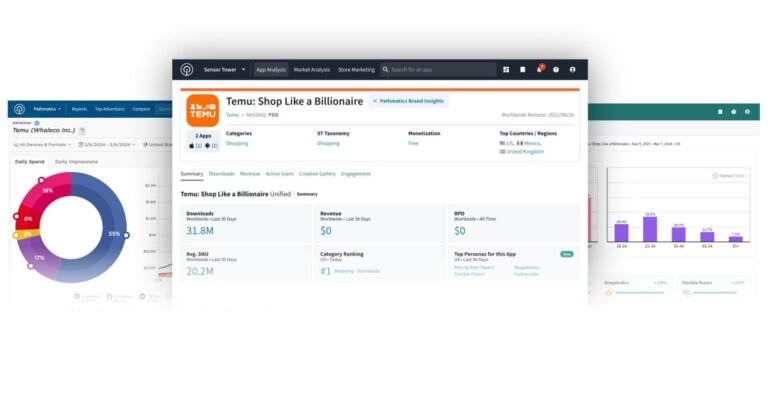

Sensor Tower, a leading app analytics firm, is acquiring rival Data.ai in a move that consolidates the mobile intelligence industry, creating a powerhouse that could dominate the sector and provide aggressively competitive insights into the app economy.

Sensor Tower didn’t disclose the financial terms of the deal but said Bain Capital and Riverwood Capital are providing credit-based financing.

Data.ai had secured over three times the amount of funding compared to Sensor Tower, according to Crunchbase.

Data.ai had raised over $157 million over various rounds, whereas Sensor Tower had raised just $46 million.

Sensor Tower issued an apology in 2020 and said the company had taken the route it did to stay competitive.

Indian firms whose apps were delisted by Google last week have begrudgingly started to comply with Play Store billing rules to get their apps back on the store.

A lot of protesting developers have opted for a consumption-only model for now, while others have opted for the Google Play billing.

And what about alternate app stores like the recently launched Indus app store from PhonePe?” Janakiraman told the publication.

Google also noted that the company has given developers three years to comply with Play Store rules.

Firms seeking regulatory actionThe firms that are protesting against Google’s move are looking for regulatory intervention.