When they first met in 2007, the now brothers-in-law bonded over their passion for venture capital, eventually leading them to invest together from their personal capital.

By 2020, Anderson and Fogelsong decided to take their investing relationship to the next level by launching their first fund with external capital.

That fund, which the firm considers its second vehicle, closed at $91.5 million, well above its initial target of $60 million.

So,they named their firm “Friends & Family Capital” to capture that spirit, their own family connection, and Fogelsong’s roots in a prominent Silicon Valley VC family.

Like its previous fund, Friends & Family’s third fund will be used to invest in “classic B2B enterprise software” companies and hardware businesses with recurring revenue components.

TechCrunch Disrupt 2024 in San Francisco is the must-attend event for startup founders aiming to make their mark in the tech world.

Founder benefits: Each founder of the startup can access all Founder Pass benefits.

Here’s what participation offers:Global showcase : Be among the top 200 startups selected from around the globe, spanning multiple industries.

Whether you’re looking to network, learn, or showcase your startup, Disrupt offers the ideal platform to propel your business forward.

Secure your place at TechCrunch Disrupt 2024 and take the next big step in your entrepreneurial journey.

Today they are the co-founders of Cherub, a marketplace that pairs angel investors with entrepreneurs.

Johnson likens Los Angeles-based Cherub to Raya, an online membership-based community for dating, in that it matches founders and angel investors based on their preferences.

Or if an entrepreneur’s minimum investment is $25,000 but an angel investor is only investing $10,000 per deal, they can see that and not reach out to connect.

Of those deals, 40% were new angel investors, meaning they were accredited investors that had never written checks before.

Angel investor Allen Orr told TechCrunch that he had used other platforms such as AngelList in the past.

Mentee Robotics hasn’t been in stealth, exactly.

The Israeli firm caught a small wave of press at the tail end of 2022, following Tesla’s initial humanoid robotics announcement.

Even so, the firm caught some headlines because its co-founder and chair, Amnon Shashua, founded Mobileye and the well-funded AI firm, AI21 Labs.

On Wednesday, however, the company offered up a glimpse of Menteebot, its own stab at the rapidly growing humanoid category.

In fact, this is one of those spots where the precise definition of what constitutes a humanoid system gets blurred.

Investors and founders can meet their match with Cherub, the ‘Raya of angel investing’Jaclyn Johnson and Angeline Vuong were on a hike deliberating how hard it can be for people to get started in angel investing when they realized they had stumbled upon a startup idea.

Today they are the co-founders of Cherub, a marketplace that pairs angel investors with entrepreneurs.

Johnson likens Los Angeles-based Cherub to Raya, an online membership-based community for dating, in that it matches founders and angel investors based on their preferences.

Of those deals, 40% were new angel investors, meaning they were accredited investors that had never written checks before.

Angel investor Allen Orr told TechCrunch that he had used other platforms such as AngelList in the past.

If so, ensuring your cap table and data room are pristine could be the difference between a smooth, swift raise and a drawn-out, costly process.

At TechCrunch Early Stage 2024, join Fidelity Private Shares’ session, “Preparing to Raise: Cap Table Best Practices to Help You Close Fast” to gain invaluable insights from industry experts.

Whether you’re a first-time founder or a seasoned entrepreneur, mastering cap table management is essential for a successful fundraising journey.

Meet the speakersKristen Craft, vice president and business partner manager at Fidelity Private Shares, brings a wealth of experience from both sides of the startup equation.

At Fidelity, she spearheads initiatives to support founders and investors with equity management tools, fundraising strategy, and go-to-market best practices.

For the firm that calls itself “the first check in deep tech,” the last check for SOSV’s latest $306 million fund took a bit longer than founder Sean O’Sullivan would have liked.

“We’re concentrating and double doubling down on deep tech,” O’Sullivan said.

We’re doing a fewer number of companies, more like 80 deep tech companies per year.

O’Sullivan said that SOSV intends to invest about 70% of the funds in climate tech companies, 25% in health tech, and the remaining 5% will be reserved for opportunistic investments.

“We have a special place to serve because we do deep tech, because we do get into the biology, we do get into the chemistry, the physics and the electronics.

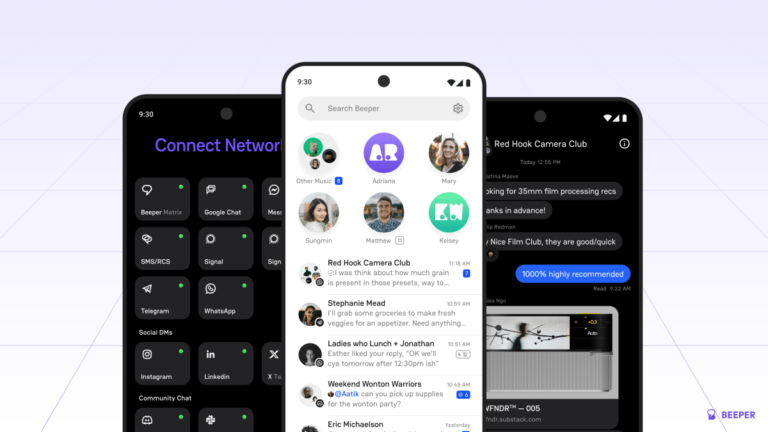

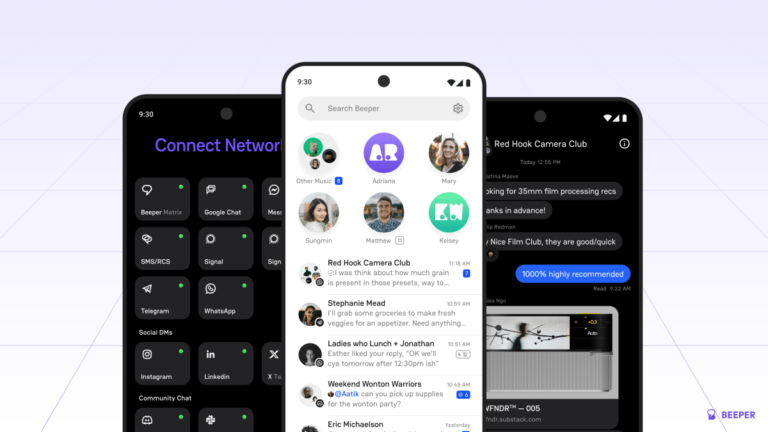

WordPress.com owner Automattic is acquiring Beeper, the company behind the iMessage-on-Android solution that was referenced by the Department of Justice in its antitrust lawsuit against Apple.

One of the reasons why there are no other people building this type of app is it costs a surprisingly large amount of money to build a damn good chat app,” Migicovsky noted.

As for Beeper’s products, the company has now briefed the DOJ on what happened when Apple blocked its newer app, Beeper Mini, which aimed to bring iMessage to Android.

Beeper on Android launches to allThe company is instead releasing an updated version of its core app, Beeper, on Android.

In this rewritten version of Beeper, the company is starting to roll out fully end-to-end encrypted messages across Signal.

Turkey has gained a well-earned reputation as a veritable cauldron of mobile games startups, leading to the rise of VCs dedicated to the sector.

The latest to join this coterie is Laton Ventures, a new gaming-focused VC that has raised a $35 million fund.

Indeed, between 2018 and 2022 Turkish gaming start-ups raised more than $1 billion in funding.

There are now at least 25 VC funds that invest in video games startups based out of Turkey.

“We’re positioning as a bridge between the Turkish gaming ecosystem, which is booming, and the international gaming ecosystem.

Byju’s is holding an extraordinary general meeting Friday, where it will attempt to pass the resolution over the rights issue.

The rights issue values Byju’s under $250 million, a stunning drop from the $22 billion valuation it carried in early 2022.

Prosus Ventures, Peak XV Partners and Chan Zuckerberg Initiative are among the investors who didn’t participate in Byju’s recent $200 million rights issue.

The investors have instead sought, using legal means, to remove Raveendran and his family from the startup and to invalidate the rights issue.

The investors quit the startup’s board whereas the global auditing giant Deloitte dropped the account of Byju’s over these concerns last year.