We welcome startup founders seeking innovative solutions to maintain wellness while achieving the optimal point of productivity for those crucial momentum moments throughout your startup journey.

Description: Join us the week of TechCrunch Early Stage 2024 at PTC’s headquarters for an exciting happy hour for founders!

Register HereHosted By: Women in Tech — Global MovementTime: April 25, 5:30 p.m. to 8 p.m.

Description: Join our Women Tech Meetup — an incredible gathering of women in technology, female founders, entrepreneurs, community builders, and other professionals!

Description: Join AlleyCorp, Anzu Partners, Argon VC, Aurelia Foundry, Converge Ventures, Cybernetix Ventures, First Star Ventures, Glasswing Ventures, Hyperplane Ventures, and SkyRiver Ventures after TechCrunch Early Stage, for a happy hour with deep tech founders, operators, and investors.

Crafting the perfect venture capital pitch is so simple that there’s an industry of consultants to help founders get their decks in order.

TechCrunch has a long-running series of Pitch Deck Teardowns to help founders, and you can find an infinite number of Twitter threads on the subject.

Enter Wing Venture Capital’s Sara Choi, who will give a talk at TechCrunch Early Stage 2024 this April and take audience questions on how to pitch.

After all, when venture capital is harder to raise than it has been in years, nailing the pitch is critical for today’s early-stage founders.

Early Stage 2024 is just around the corner, so book your pass here before March 29 and save $200.

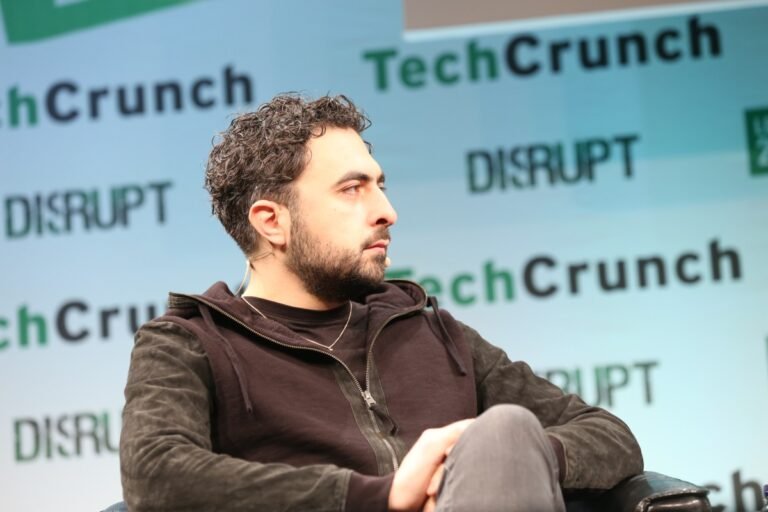

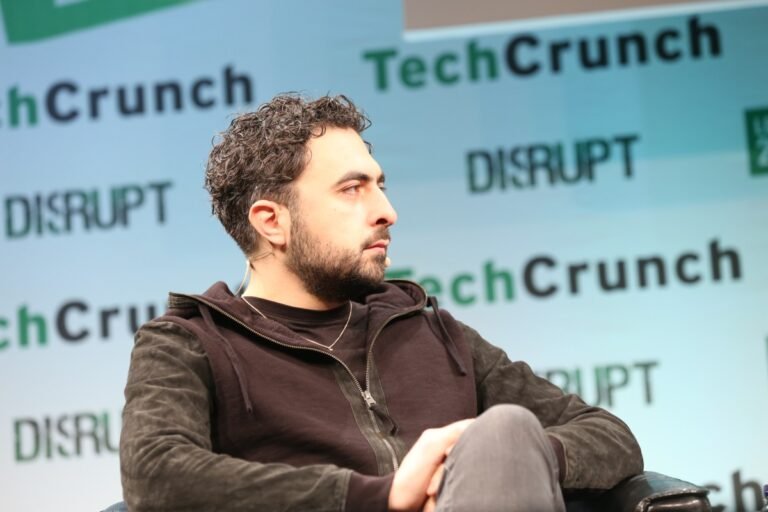

Suleyman — also a co-founder of DeepMind, which Google bought in 2014 to bolster its own AI efforts — will run Microsoft’s newly formed consumer AI unit, called Microsoft AI, whereas Simonyan is joining the company as a chief scientist in the same new group.

Mustafa, whose official title at Microsoft is EVP and CEO of Microsoft AI, will report to chief executive Nadella.

“Several members of the Inflection team have chosen to join Mustafa and Karén at Microsoft,” Nadella wrote in a blog post.

In a blog post, Inflection AI said that it will shift its focus to the AI studio business, where it builds and tests customer generative AI models.

“This renewed emphasis on our API also comes with some important changes in the company,” wrote Inflection AI.

TigerEye CEO Tracy Young and her husband and CTO Ralph Gootee helped build their previous startup, PlanGrid, into a $100 million ARR business before selling it to Autodesk for $850 million in 2018.

Yet in spite of that success, they always felt they left business on the table because of an inability to forecast business changes accurately.

“TigerEye is a business simulation engine that helps companies predict their future,” Young told TechCrunch.

The couple was advising other startups at Y Combinator in 2021 when they decided it was time to build TigerEye.

The following year, they brought a bunch of the core members of the PlanGrid team back together and started working on the problem.

Yi and Shin started Ethos Fund two years ago to bridge opportunities and startup communities between Vietnam and the United States.

They are also investing smaller checks into third culture founders there who fall into categories, including returned Vietnamese diaspora, Vietnamese Americans and expats residing in Vietnam, and subsequently doubling-down with larger checks into validated startups.

“Ethos is called Ethos because we focus on the ethos of the founders,” Yi said.

One of the things Yi noticed about his startups was that they weren’t growing past a certain stage.

Now the pair wants to help startup founders figure those lessons out early.

Late-stage VCs may be preventing their startups from going public in 2024 Founders might have unintentionally given their VCs too much power to block an IPOWhile some investors are loudly bemoaning that the IPO window can’t stay shut forever, other VCs themselves are actually part of the problem.

It’s a common term for late-stage investors agreeing to pay higher prices for their stake to boost a startup’s valuation.

When late-stage startups raised at sky-high valuations in 2021 they may not have realized how much power they were giving their late-stage investors if the market cooled, which it did.

“People confuse up and to the right, with a god-given right,” Hinkle said.

He added that there is always a lot more friction between investors and startups about the decision to IPO than investors would like to admit.

Former web3 gaming founders raise $2.5M for their NFT marketplace to retain users even when there ‘isn’t money to be made’Even though NFT sales volume is still down 88% from 2022 all time-highs (and down 38% year-to-date), Pallet Exchange is building a new type of NFT marketplace focused on user retention.

“It’s cool if there’s a lot of financial innovations happening, but at the same time we saw there’s pain points from a user experience,” Li said.

It’s using social media tactics like in-app messaging that lets people interested in the same NFT collections engage with each other on its marketplace.

That’s when Seiyans, an Sei-based NFT collection fueled by meme culture, capitulated the new blockchain and marketplace into the talk of the crypto world.

Down the line, Pallet plans to look into working with big partners in the art marketplace and create a separate marketplace for those creators.

The wings of time are flying fast, and so is the countdown to the biggest savings on passes to TechCrunch Disrupt — taking place October 28–30 in San Francisco.

Here’s the thing: You have only four days left to save $1,000 on your pass.

How to save $1,000 on passes to TechCrunch Disrupt 2024You’ll save $1,000 on Attendee, Founder and Investor passes.

Across every stage at Disrupt, you’ll learn the latest insights and developments from tech’s leading founders, VCs and industry experts.

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2024?

With the second fund, Ada says it will invest between £250,000 and £1.5 million in pre-seed and seed stage startups, with a “significant amount” allocated for follow-ons.

So far, 12 investments have been made from the second fund.

Ada claims 30% of the investments from Fund I and Fund II were sourced this way.

Warner retorted: “There are 350+ fantastic female VC partners in Europe.

: “I think every leader of every VC fund needs to do whatever we can to attract the best talent in the industry.

The Artemis Fund, which invests in underrepresented founders, closed on its second fund with $36 million in capital commitments.

“We really wanted to make sure that our LPs aligned with our long-term goal of backing diverse founders,” Murakhovskaya told TechCrunch.

VC investment itself continues to be fairly stagnant in these areas, according to my colleague Dominic-Madori Davis, who crunched the numbers on venture capital funding to these demographics earlier this month.

Female founders and co-founders secured more capital overall in 2023 than they did in 2020, according to new Pitchbook research.

For Fund II, Artemis intends to continue leading and co-leading investments and will target around 20 new companies.