Two of the country’s prominent fabless AI chip startups, Rebellions and Sapeon, have agreed to merge, the companies said on Wednesday.

The merger is a strategic move by Rebellions and Sapeon aimed at leading the fabless AI chip market in South Korea to take on global rivals like Nvidia.

Indeed, the deal comes at a pivotal moment in the global chip industry.

Meanwhile, KT in 2023 incorporated Atom, Rebellions’ datacenter-focused AI chip, into its cloud-based NPU infrastructure.

Last November, the company launched a 7-nanometer AI chip, X330 NPU, for autonomous vehicles, and earlier this year, it said it would develop an on-device AI chip targeting the edge computing market.

That’s according to Jonathan Sanders, CEO and co-founder of fledgling Danish startup Light, which exits stealth Wednesday with $13 million in a seed round of funding led by European VC giant Atomico.

The Copenhagen-based startup is reimagining general ledger software from the ground up, replete with AI to cleanse transactional data, while also enabling finance teams to ask plain-English questions and receive straightforward answers from their data.

Enterprise resource planning (ERP) software is king, packing support for CRM (customer relationship management), HR (human resources), project management, and perhaps the most crucial component of all, the general ledger.

And it’s this element of the ERP that Light is focused on dragging into the modern digital era, where AI increasingly rules the roost.

“Our mission is to be the first automated ledger for global companies,” Sanders told TechCrunch.

While funding for Italian startups has been growing, the country still ranks eighth in Europe by VC investment, according to Dealroom.

Newly created Italian Founders Fund (IFF) hopes to help with the catching up, both in quantity and in quality.

It will use this geographical flexibility to also back Italian founders operating abroad, as well as foreign startups interested in entering the Italian market.

It will also help that some of its LPs are GPs of foreign funds, and that it plans to back Italian founders with global ambitions.

Global Italian startups include Bending Spoons, the owner of popular apps and services like Evernote and Meetup, which is valued at $2.55 billion.

Stock-trading platform Robinhood is diving deeper into the cryptocurrency realm with the acquisition of crypto exchange Bitstamp.

With Bitstamp under its wing, Robinhood says that it will be better positioned to target retail and institutional crypto investors across Europe, Asia, and the U.S., with Bitstamp currently holding more than 50 licenses and registrations to operate in these markets.

“The acquisition of Bitstamp is a major step in growing our crypto business,” Robinhood’s crypto general manager Johann Kerbrat said in a statement.

“The Bitstamp team has established one of the strongest reputations across retail and institutional crypto investors.

Through this strategic combination, we are better positioned to expand our footprint outside of the U.S. and welcome institutional customers to Robinhood.”

The capital, which brings total funding raised by the startup to $6.2 million, will enable it to serve more brands.

For diverse brands in particular, there are a lot of economic hurdles that these groups face, which makes it even harder for them to access capital.

Its other offering is a labor marketplace for brands not in a position to hire full-time teams but require talent occasionally.

Its community of brands recommends the talent or manufacturer, who are listed on the marketplace after several stages of vetting.

Brands gain access to the labor marketplace, capital and other resources, upon signing up (at a cost) on the startup’s main product, the B2B marketplace and SaaS product.

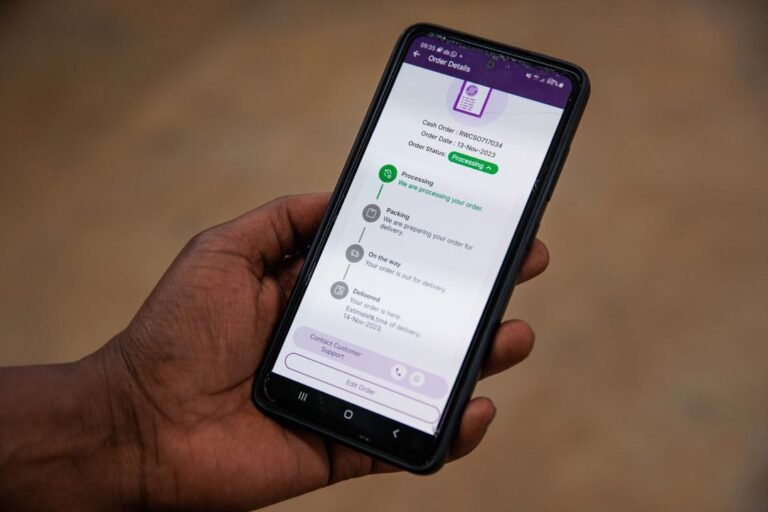

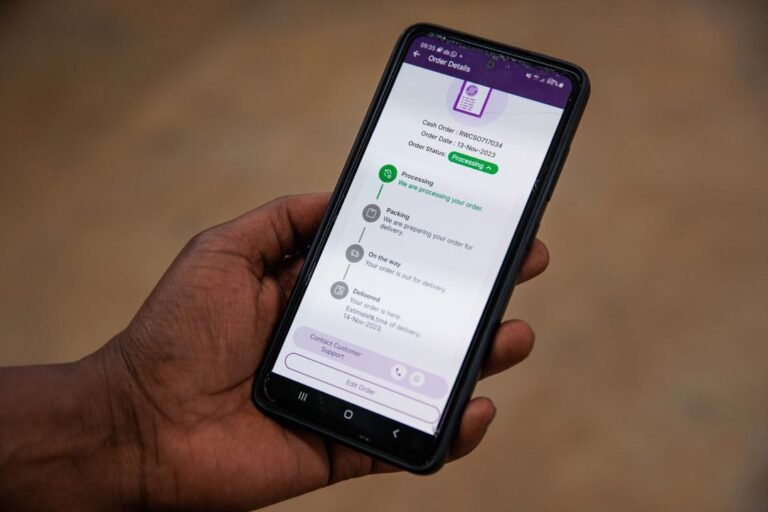

Inside LemFi’s play to be fintech to the Global South diaspora First, the Nigerian startup focused on migrants from Africa.

These events spotlight the company’s growing influence in Africa’s remittance market, fuelled by a $33 million Series A funding round and the launch of services in the U.S. corridor, both announced last August.

LemFi later expanded to serve other African diaspora communities in the country before entering the U.K. market in 2021 by acquiring RightCard for $2.5 million.

Additionally, Daiyaan Alam, formerly leading partnerships at Delivery Hero subsidiary Foodpanda in Pakistan, is spearheading LemFi’s expansion efforts into Pakistan and South Asia.

They join Allen Qu, former COO at Chinese-backed African fintech OPay, who leads the fintech’s growth among the Chinese diaspora.

Tesla is laying off thousands of employees as it tries to simultaneously cut costs and boost productivity, according to an internal email sent to staff by CEO Elon Musk, Electrek and Bloomberg News reported.

The electric automaker is cutting “more than 10%” of its global headcount, Musk said in the email.

Tesla finished 2023 with over 140,000 employees, meaning the cuts could impact more than 14,000 people.

The company has warned investors that sales growth could be “notably lower” in 2024 than its stated goal of 50% growth each year.

This will enable us to be lean, innovative and hungry for the next growth phase cycle,” Musk wrote.

The United States Department of Commerce Monday proposed investing as much as $6.6 billion to fund a third Taiwan Semiconductor Manufacturing Company Limited (TSMC) fab in Arizona.

The move represents a broader push to bring more manufacturing to the U.S., but unspoken in the fanfare around today’s announcement is the potential escalation of tensions with China.

TSMC Arizona — the subsidiary behind the proposed construction — has stated that it will build the facility before the end of the decade.

The United States and allies would be at a massive disadvantage should China seize control of Taiwan and its manufacturing capabilities.

For all the money the United States government continues to invest, Intel is simply playing catch-up to TSMC’s multiyear technological head start.

VNV Global attributes its fair value estimate to a valuation model based on trading multiples of public peers rather than historical funding rounds.

Funding and interest in B2B startups took off in the last decade and saw a bump in the wake of COVID-19.

African startups, including B2B e-commerce platforms like Wasoko, have followed the same playbook as their counterparts further afield: layoffs; cost cuts; and closures are not uncommon.

In the lead-up to its merger with MaxAB, Wasoko shuttered hubs in Senegal and Ivory Coast and laid off staff in Kenya.

It operates a food and grocery B2B e-commerce platform in Egypt and Morocco, expanding to the latter following its acquisition of YC-backed WaystoCap in 2021.

Global Screening Services (GSS), a London-based regulatory compliance platform that helps financial institutions meet their global sanctions obligations, has raised $47 million in a round of funding.

The raise comes amid a spike in economic sanctions, with the U.S. issuing trade-restrictions and asset-blocking against states including Russia, China, Iran and more.

The company actually raised a similar amount of funding last year from big-name backers including Japan’s Mitsubishi UFJ Financial Group (MUFG), one of the world’s largest banks.

Banks often find themselves at the forefront of sanctions enforcement, given their role in controlling the flow of money around the globe.

GSS sells a sanctions-screening platform to help banks and other financial institutions comply with regulations.