In 2023, VNV Global, a Swedish investment firm, revealed in its annual report a significant decrease of 48% in the value of its investment in Wasoko, an African B2B e-commerce startup. VNV Global specializes in backing startups in the mobility, health, and marketplace industries. This markdown was based on VNV’s 4.2% stake in Wasoko, which is currently valued at $10.9 million.

Interestingly, this is not the first time that VNV Global has slashed Wasoko’s value. In the fourth quarter of 2022, the investment firm valued the startup at a staggering $501 million. However, just a few months later, the eight-year-old company announced a merger with its Egyptian counterpart, MaxAB, which caused VNV Global to reassess and decrease its valuation.

VNV Global explained that its fair value estimate for Wasoko was determined by a valuation model based on the trading multiples of public peers, as opposed to historical funding rounds.

“Wasoko is proud to have VNV Global as one of our major investors,” said a representative from the Tiger-backed company, responding to the markdown. “VNV has not reduced its shareholding in Wasoko whatsoever and continues to remain active and supportive of the company, including through our landmark merger with MaxAB. Wasoko is not involved in VNV’s internal reporting but sees VNV’s continued holdings of Wasoko as a clear signal of expected long-term value growth.”

VNV Global, which also has investments in Blablacar and Gett, announced its intentions to hold on to its stake in Wasoko after the merger with MaxAB. “With VNV’s permanent capital structure, we are typically very long-term investors, and we believe the combined company has the potential to become a significantly valuable business in the coming years,” explained VNV Global’s spokesperson in an email to TechCrunch.

Wasoko, founded by Daniel Yu in 2014, holds the title of one of Africa’s largest B2B grocery marketplaces. The Nairobi-based startup has secured agreements with major suppliers such as P&G and Unilever, offering competitive prices and bypassing intermediaries. By 2022, Wasoko had expanded to six additional African markets, reporting an annualized gross merchandise value (GMV) of $300 million.

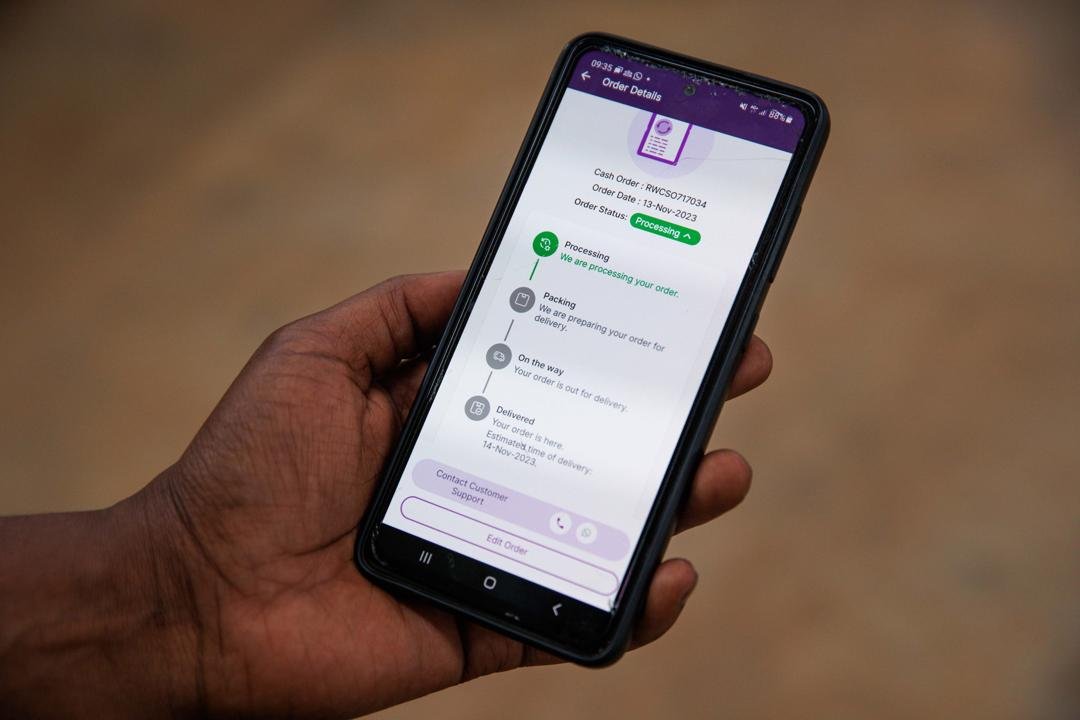

By 2023, Wasoko’s customer base had grown to over 200,000 small retailers who use the company’s app to order groceries and household items on-demand for their stores.

According to a study by Mastercard, B2C e-commerce only accounts for less than 1% of retail in Africa, in comparison to the U.S. where it was 15.6% of all retail sales in the last quarter. However, in Africa, physical retailers rely heavily on e-commerce channels to source goods. Over the last decade, there has been a significant increase in funding and interest in B2B startups. But with the COVID-19 pandemic, the business models of B2B e-commerce startups have come under pressure, with issues such as challenging unit economics and high costs making it challenging to turn a profit. In developing markets, funding has also been scarce, leading to shorter runways for startups. Just like their counterparts in other parts of the world, African startups have had to resort to layoffs, cost-cutting measures, and in some cases, closure.

Wasoko has also faced its share of challenges. To focus on profitability, they had to pivot from aggressive expansion, leading them to make strategic cuts and implement cost-saving measures. In preparation for their merger with MaxAB, Wasoko closed hubs in Senegal and Ivory Coast and let go of staff in Kenya. The company also temporarily halted operations in Uganda and Zambia, both markets in which Wasoko had expanded in 2023, according to local media outlet TechCabal.

Despite these setbacks, Wasoko continued to provide financial services to its merchants and remained operational in its three largest GMV markets: Kenya, Rwanda, and Tanzania. The company expects to finalize its merger with MaxAB by the end of this month.

MaxAB, which offers a food and grocery B2B e-commerce platform in Egypt and Morocco, came close to financial peril last year, despite raising over $100 million from investors such as Silverlake and British International Investment. The terms of the merger between MaxAB and Wasoko are still unclear, but both companies are confident that together, they can pave the way for a successful and profitable B2B e-commerce industry in Africa.