Indian quick-commerce startup Zepto has surpassed the annualised sales milestone of $1 billion within just 29 months of its inception, Goldman Sachs wrote in a note Thursday, citing the Zepto management.

Zepto, which became a unicorn last year, counts YC Continuity, StepStone Group, Glade Brook Capital and Lachy Groom among its backers.

“Overall EBITDA margin for Zepto is at negative single-digit percentage and the company is on track to break even at the EBITDA level within the next quarter.

The company expects steady state contribution margin of 12%, with steady state EBITDA margin of 7%,” the report added.

Zepto believes it can expand into 40-50 cities over time,” the report added.

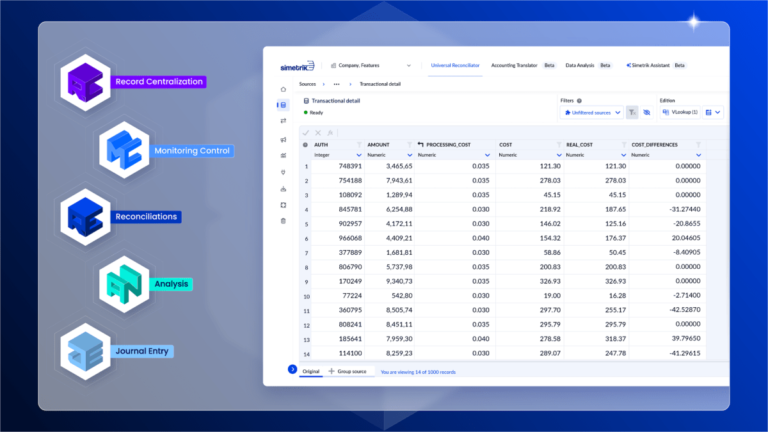

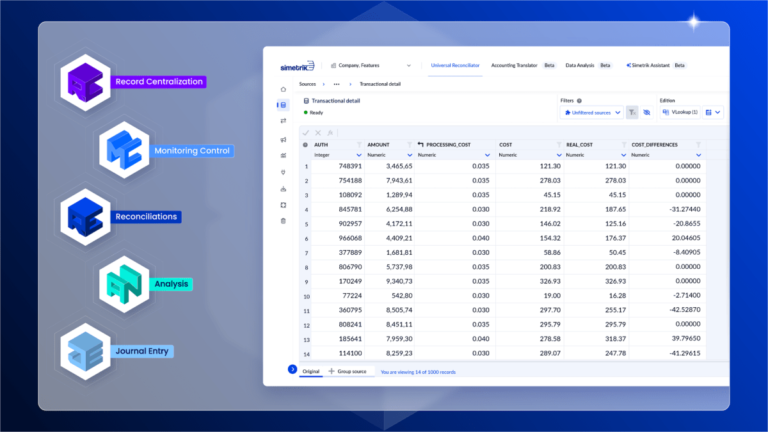

Where it is differentiating itself is through its Simetrik Building Blocks, or SBBs, which are scalable and adaptable concepts based on no-code development and generative AI technologies.

In the past two years, the company grew to have clients in more than 35 countries, up from 10, and is monitoring over 200 million records every day.

Previously that was 70 million records daily.

The use of the new funds will go into further developing the Simetrik Building Blocks, enhancing AI capabilities and continuing to expand Simetrik’s international reach.

They need a new approach, and that is where our building blocks have a strong product market piece.”

Krafton has more in store for its battle royale shooting game PUBG, its biggest mobile title, according to Goldman Sachs.

The South Korean firm is plotting “incremental updates” to its strategy to sustain and expand PUBG, Goldman Sachs said in a note Wednesday seen by TechCrunch.

Major graphics upgrade is also in the works, Goldman Sachs said, adding that Krafton plans to use Unreal Engine 5 for a PUBG 2.0 revamp.

The current version of PUBG uses a customized version of Unreal Engine 4.

Epic Game’s latest iteration of the ubiquitous Unreal Engine offers developers significant advancements in achieving heightened realism and immersion at reduced performance costs.

ZestMoney, the Goldman Sachs-backed Indian fintech startup once valued at $450 million, has sold itself to financial services firm DMI Group, the two said late Wednesday, in a fire sale that caps 12 tumultuous months for the once-hot new age lender.

In a statement, DMI Group said the deal grants it with the exclusive right to the use of all Zest brands and make the NBFC arm DMI Finance a preferred lender on the Zest platform.

“DMI will also bring its customer base, balance-sheet strength and significant risk-management experience to drive growth across Zest’s online and offline merchant network,” DMI said in a statement.

ZestMoney founders quit the startup in May last year after acquisition talks with fintech giant PhonePe didn’t materialize.

We firmly believe that this acquisition will be an important step in our journey to provide digital financial inclusion at scale across India.”