Avendus, India’s leading investment bank for venture deals, is looking to raise about $300 million for its private equity unit, according to three sources familiar with the matter.

With its third private equity fund, Avendus plans to write larger checks more frequently, one of the sources said.

The firm raised its second fund, amounting to around $185 million, in 2021.

Avendus employs over 150 bankers and was the top financial advisor in India last year.

In the past decade, similar to financial advisors in other regions, Avendus has diversified its offerings, venturing into wealth management, credit financing, and private equity.

TechCrunch Mobility: Apple layoffs, an EV price reckoning and another Tesla robotaxi promise Plus, more Fisker problems and a Waymo-Uber Eats tie-upWelcome back to TechCrunch Mobility — your central hub for news and insights on the future of transportation.

The average price of an EV in 2023 was $61,702, while all other vehicles stood at $47,450.

This downward pressure has forced automakers like Ford to delay future EV launches and put more resources toward hybrids.

Even Tesla, a bellwether in the EV world, fell well below analysts’ expectations with deliveries down 20% from Q4 2023.

What vehicles — including the two-wheeled variety — are you interested in reading about?

Welcome back to TechCrunch Mobility — your central hub for news and insights on the future of transportation.

Remember in the last edition of TechCrunch Mobility, when I wrote that the wheels were starting to come off the Fisker bus?

Deal of the weekIt ain’t easy being an executive at an EV startup these days.

Amid all of the EV startup bankruptcies and other bleak goings-on, there was a bit of positive news.

It seems that Tesla is turning to FSD as another financial lever to pull as profits on automotive sales shrink.

Maju Kuruvilla is no longer CEO of one-click checkout company Bolt.

Kuruvilla didn’t have much to say about the change but did confirm it both on LinkedIn and X, by posting, simply “One-Click Checkedout from @bolt!

Kuruvilla, the former Amazon executive, took over as CEO in January 2022 after founder Ryan Breslow stepped down.

That is when Bolt was seeking a $355 million Series E round that valued the company at $11 billion.

More recently, Bolt signed a deal with Checkout in which Bolt became Checkout.com’s “exclusive one-click checkout provider” and Checkout.com becoming “Bolt’s preferred payment partner.”Want more fintech news in your inbox?

Global Screening Services (GSS), a London-based regulatory compliance platform that helps financial institutions meet their global sanctions obligations, has raised $47 million in a round of funding.

The raise comes amid a spike in economic sanctions, with the U.S. issuing trade-restrictions and asset-blocking against states including Russia, China, Iran and more.

The company actually raised a similar amount of funding last year from big-name backers including Japan’s Mitsubishi UFJ Financial Group (MUFG), one of the world’s largest banks.

Banks often find themselves at the forefront of sanctions enforcement, given their role in controlling the flow of money around the globe.

GSS sells a sanctions-screening platform to help banks and other financial institutions comply with regulations.

The Coalition for App Fairness (CAF) released a statement on Thursday cheering on the Department of Justice’s antitrust lawsuit against Apple.

The group includes a number of key app makers, including Epic Games, Spotify, Deezer, Match Group, Proton and others.

In 2020, Epic made it possible for Fortnite players to pay Epic directly, rather than giving a cut to Apple.

Then, Apple removed Epic from the App Store, which sparked a slew of legal proceedings.

In a statement, Apple said: “This lawsuit threatens who we are and the principles that set Apple products apart in fiercely competitive markets.

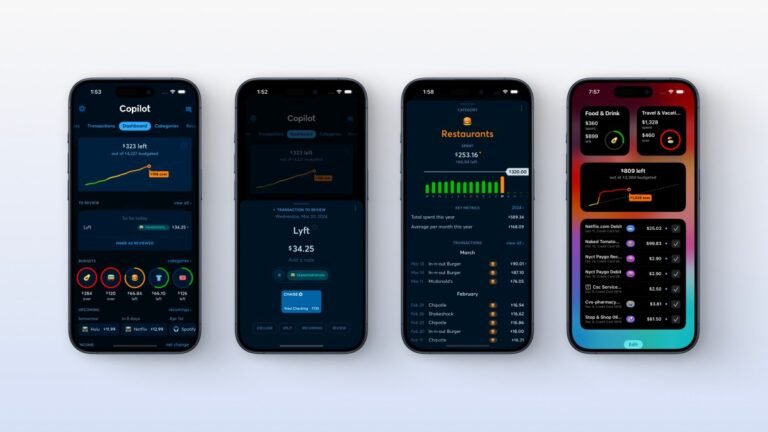

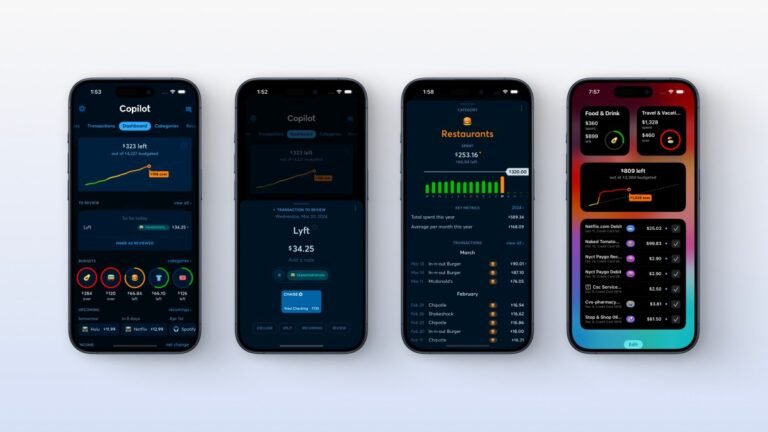

Intuit is winding down budgeting app Mint this week and that’s become good news for competitor Copilot.

The New York-based CEO started the subscription-based personal finance tracker in January 2020 to offer an alternative to Mint.

Users also save an average of 5% after starting with the app, Copilot calculates.

Beyond MintLike millions of others, Ugarte tried some personal finance apps, including Mint, yet found them to be lacking.

Other personal finance apps show where you are spending, even in categories that might not be relevant, he said.

Globally, a third of the food produced is lost or wasted, and in Kenya, that figure stands at between 20% to 40%.

Farm to Feed, an agri-tech based in Kenya, is one of the fast-risers in the space.

Farm to Feed teams then sort, grade and dispatch the products to clients from its warehouse in Kenya’s Capital, Nairobi.

Data collectionOn top of the e-commerce platform, Van Enk said they are building a data platform by collecting granular data including on climate and drivers of food loss, for better farming outcome and to create a more circular food system.

I do think that food loss is such a huge impact opportunity and also a very good commercial opportunity,” she said.

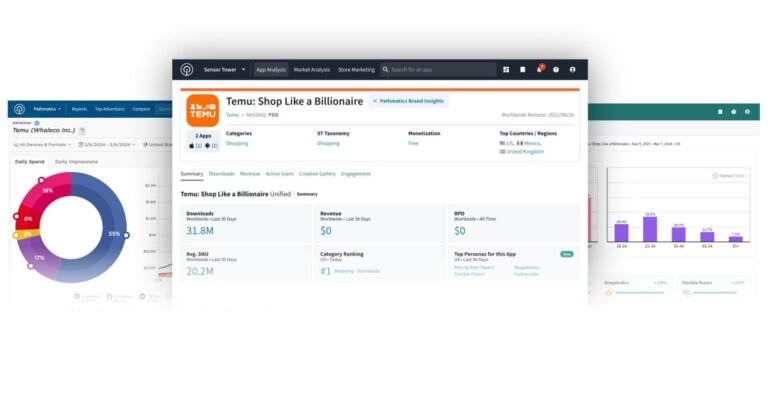

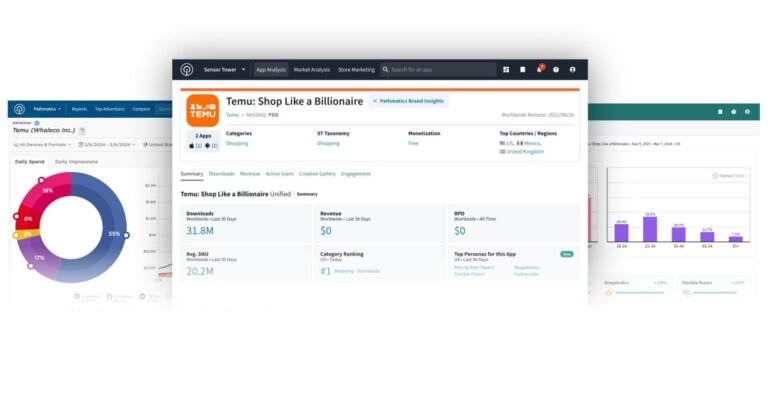

Sensor Tower, a leading app analytics firm, is acquiring rival Data.ai in a move that consolidates the mobile intelligence industry, creating a powerhouse that could dominate the sector and provide aggressively competitive insights into the app economy.

Sensor Tower didn’t disclose the financial terms of the deal but said Bain Capital and Riverwood Capital are providing credit-based financing.

Data.ai had secured over three times the amount of funding compared to Sensor Tower, according to Crunchbase.

Data.ai had raised over $157 million over various rounds, whereas Sensor Tower had raised just $46 million.

Sensor Tower issued an apology in 2020 and said the company had taken the route it did to stay competitive.

Continuous profiling reared its head in a 2010 Google research paper called: Google-Wide Profiling: A Continuous Profiling Infrastructure for Data Centers.

Polar Signals is the main developer behind Parca, a continuous profiling open source project which systematically tracks CPU and memory usage, creating profiles of this data to be queried over time.

“Our mission is to make the world’s datacenters ten times as efficient as they are today,” Polar Signals’ founder and CEO Frederic Branczyk told TechCrunch.

While cutting costs is one of the main benefits that Polar Signals promises, there are other benefits to the technology too — such as incident response efforts around a DDoS attack, for example, as Polar Signals can provide insights on the attack’s impact and identify which parts of a system are under stress.

At the time of writing, Polar Signals claims 11employees with experience at companies including AWS, Meta, Red Hat, and HashiCorp.