The UAE is home to most of its customers, and people from Saudi Arabia and Kuwait form the bulk of its international customer base.

Entering Saudi ArabiaStake claims it has surpassed Dubai-based fractional property investment platforms like Smartcrowd, but it will be starting afresh in Saudi Arabia.

Property investment companies therefore set up special purpose vehicles through which they let investors buy real estate.

“Saudi Arabia has properties that are recently completed and under development that are worth billions.

We are going to use [our] experience to offer a similar unified product for investment in Saudi Arabia within the same app,” Mahmassani said.

It’s against this backdrop that Evolution Equity Partners, a growth capital investment firm based in NYC, on Tuesday launched a $1.1 billion cybersecurity and AI fund, the third such fund in Evolution’s history.

The fund, called Evolution Technology Fund III, was oversubscribed, with participation from existing and new endowments, sovereign investors, insurance companies, foundations, fund of funds, family offices and angels.

“The Evolution Technology Fund III has already backed fifteen leading cybersecurity companies, initiating its investment period over 12 months ago,” Seewald said.

“We believe that provides private markets investors with diversified exposure to cybersecurity opportunities.”ESG will be another factor, according to Seewald.

Evolution’s 30-person teams manages around $2 billion in assets and has backed 60 companies to date; its previous fund was $400 million.

And more AI companies are receiving investments than ever before, with 1,812 AI startups announcing funding in 2023, up 40.6% versus 2022, according to the Stanford HAI report.

“There’s been a more deliberate approach by investors in evaluating AI investments compared to a year ago.

According to a PitchBook report compiled for TechCrunch, VCs invested $25.87 billion globally in AI startups in Q1 2024, up from $21.69 billion in Q1 2023.

Despite the general malaise within AI investor circles, generative AI — AI that creates new content, such as text, images, music and videos — remains a bright spot.

“We’ll soon be evaluating whether generative AI delivers the promised efficiency gains at scale and drives top-line growth through AI-integrated products and services,” Kumar said.

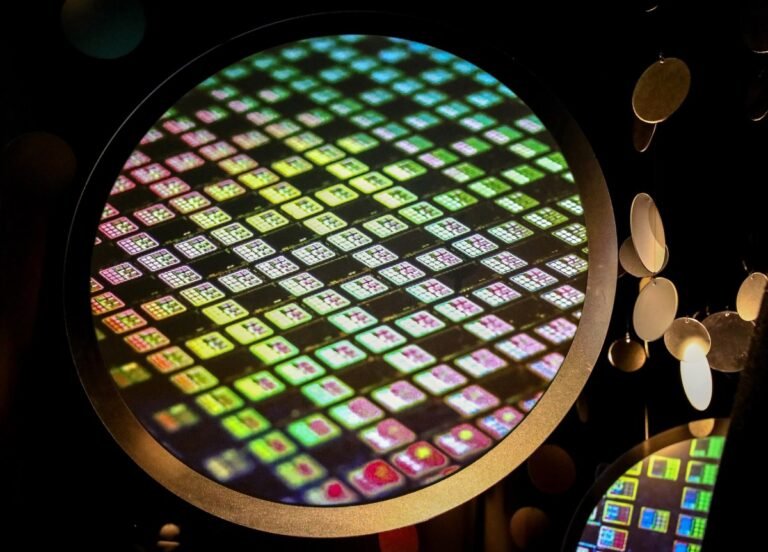

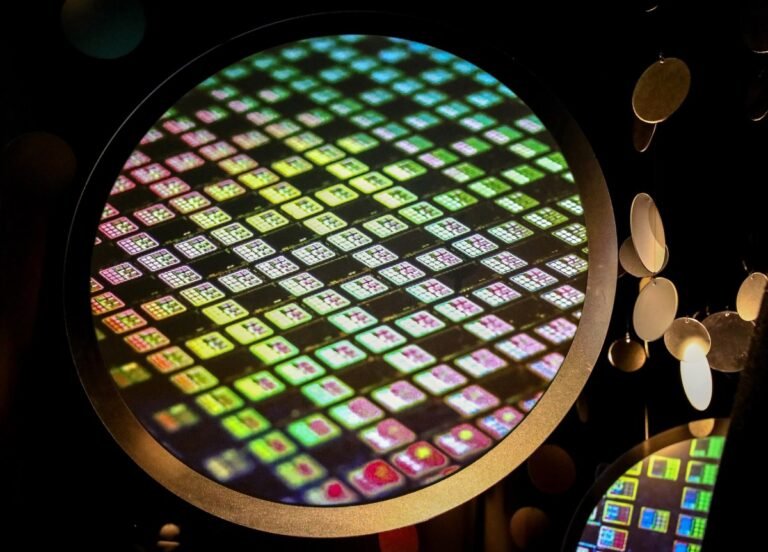

The United States Department of Commerce Monday proposed investing as much as $6.6 billion to fund a third Taiwan Semiconductor Manufacturing Company Limited (TSMC) fab in Arizona.

The move represents a broader push to bring more manufacturing to the U.S., but unspoken in the fanfare around today’s announcement is the potential escalation of tensions with China.

TSMC Arizona — the subsidiary behind the proposed construction — has stated that it will build the facility before the end of the decade.

The United States and allies would be at a massive disadvantage should China seize control of Taiwan and its manufacturing capabilities.

For all the money the United States government continues to invest, Intel is simply playing catch-up to TSMC’s multiyear technological head start.

This grant, pegged for the company’s U.S. subsidiary, TSMC Arizona, is the latest step by the U.S. to strengthen its domestic supply of semiconductors as it seeks to reshore manufacturing of chips amid escalating geopolitical tensions between the U.S. and China.

The Act is primarily aimed at attracting manufacturing stateside, and also prohibits recipients of the funding from increasing their semiconductor manufacturing footprint in China.

With the new investment, Taiwan-based TSMC, which is the world’s largest producer of semiconductors, is broadening its plans for its fabrication plants in Arizona.

Intel could receive approximately $20 billion in grants and loans from the CHIPS and Science Act for its semiconductor manufacturing.

Meanwhile, Samsung, which announced a $17 billion additional investment in Taylor, Texas, is expected to receive more than $6 billion in grants for its chip facility in Texas.

Discover the forefront of hard tech innovation in an exclusive session sponsored by HAX at TechCrunch Early Stage 2024.

Duncan and Susan will share insights into HAX’s investment philosophy and the exciting opportunities they see in hard tech sectors.

TechCrunch Early Stage 2024 is your opportunity to engage with the leaders shaping the future of hard tech.

Join HAX at TechCrunch Early Stage 2024 and be part of the movement driving meaningful change in hard tech innovation — buy your tickets now before prices go up at the door.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

Autism Impact Fund (AIF) was a pioneer when it emerged in 2021, three years after the son of its co-founder and managing partner, Chris Male, was diagnosed with ASD.

A joint effort of Male and others, its ambition was to become “the investment and innovation arm of the autism community,” Male told TechCrunch.

Since then, startups in the neurodiversity space gathered momentum, and so did AIF, which recently closed its first fund at $60 million.

AIF’s decision to broaden its scope has to do with autism itself, Male said.

It’s also global, with healthtech Genial Care raising $10 million to help kids with autism and their families in Brazil.

Amazon invested a further $2.75 billion in growing AI power Anthropic on Wednesday, following through on the option it left open last September.

The $1.25 billion it invested at the time must be producing results, or perhaps they’ve realized that there are no other horses available to back.

Lacking the capability to develop adequate models on their own for whatever reason, companies like Amazon and Microsoft have had to act vicariously through others, primarily OpenAI and Anthropic.

Right now the AI world is a bit like a roulette table, with OpenAI and Anthropic representing black and red.

We know Anthropic has a plan, and this year we’ll find out what Amazon, Apple, Microsoft and other multinational interests think they can do to monetize this supposedly revolutionary technology.

New Summit Investments is raising a new $100 million impact fund, according to documents filed with the SEC.

This is the firm’s fifth fund and marks a sizable jump from the $40 million its previous fund, which closed back in 2022.

New Summit has supported marginalized fund managers by launching initiatives like its partnership with investment firm Gratitude Railroad to source and underwrite underrepresented fund managers.

New Summit Investments’ was founded in 2016 as an impact investment firm focusing on climate, health, and economic opportunities.

New Summit Investments’ first fund closed for $20 million in 2016, followed by $36 million in 2018, according to Pitchbook.

Borderless Capital, an investment firm that specializes in web3, announced Tuesday that it is acquiring CTF Capital, a quantitative trading and asset management firm headquartered in Miami, with technology and operation teams in Latin America.

With this acquisition, Borderless Capital will add AI-infused quant trading expertise to its own business.

After combining with CTF Capital, Borderless will have over $500 million in assets under management (AUM).

All the existing funds managed by CTF Capital will be merged into Borderless’s Multi-Strategy Fund V LP., launched last year with $100 million under management today.

“Borderless already has significant exposure through several portfolio companies from this geography [Latin America].