Today they are the co-founders of Cherub, a marketplace that pairs angel investors with entrepreneurs.

Johnson likens Los Angeles-based Cherub to Raya, an online membership-based community for dating, in that it matches founders and angel investors based on their preferences.

Or if an entrepreneur’s minimum investment is $25,000 but an angel investor is only investing $10,000 per deal, they can see that and not reach out to connect.

Of those deals, 40% were new angel investors, meaning they were accredited investors that had never written checks before.

Angel investor Allen Orr told TechCrunch that he had used other platforms such as AngelList in the past.

Investors and founders can meet their match with Cherub, the ‘Raya of angel investing’Jaclyn Johnson and Angeline Vuong were on a hike deliberating how hard it can be for people to get started in angel investing when they realized they had stumbled upon a startup idea.

Today they are the co-founders of Cherub, a marketplace that pairs angel investors with entrepreneurs.

Johnson likens Los Angeles-based Cherub to Raya, an online membership-based community for dating, in that it matches founders and angel investors based on their preferences.

Of those deals, 40% were new angel investors, meaning they were accredited investors that had never written checks before.

Angel investor Allen Orr told TechCrunch that he had used other platforms such as AngelList in the past.

Tinder-owner Match Group has appointed two new members to its board of directors and signed an agreement with Elliott Management, the company announced on Monday.

Chief marketing officer at Instacart, Laura Jones, and Zillow co-founder Spencer Rascoff, will be joining the board, effective immediately.

Match said in a press release that the appointments followed a “a constructive dialogue” with the activist investor, as the two companies have entered in an “information-sharing” agreement.

“We appreciate the collaboration with management and the Board over the past several months, and we are confident that Laura Jones and Spencer Rascoff are strong additions to the Board.

The activist investor’s push for change at the dating firm follows board shakeups at Crown Castle and Etsy.

Astera Labs started its life as a public company trading at $52.56 per share, up 46% when the bell rang.

Astera Labs makes connectivity hardware for cloud computing data centers.

Astera Labs’ IPO price valued it at around $5.5 billion, a figure that swells to around $8.9 billion at its current trading price.

The strong performance of Astera in its first hours as a public company could also ameliorate some investor activity that is holding back, or even preventing some public offerings altogether.

If VCs know that the startup could pop on the public market like Astera Labs, maybe they will think about the timeline differently.

In June 2023, Inflection announced it had raised $1.3 billion to build what it called “more personal AI.” The lead investor was Microsoft.

Today, less than a year later, Microsoft announced that it was essentially eating Inflection alive (though I think they phrased it differently).

Co-founders Mustafa Suleyman and Karén Simonyan will go to Microsoft, where the former will head up the newly formed Microsoft AI division, along with “several members” of their team as Microsoft put it — or “most of the staff,” as Bloomberg reports it.

Ultimately Microsoft got a bit of extra leverage on the company instead of eating it alive.

Whether it was OpenAI or Inflection, Microsoft was feeding their cash and compute addictions, whispering in their ear about partnerships, and then as soon as they tripped, out came the hidden fork and knife.

How crypto exchange Backpack climbed its way to success after its major investor FTX died Backpack hit $27.5 billion in total trading volume during its beta phaseBackpack’s founders, who are building a crypto exchange and wallet, have experienced strong growth since launching in 2022.

There’s a bunch of lessons to learn from FTX, Ferrante said.

This is done in hopes that there’s no single point of failure and that the operations of the Backpack crypto exchange can be split up across multiple entities.

At the end of February, Backpack raised $17 million at a $120 million valuation in a Series A round led by Placeholder VC.

But product distribution is top of mind for the exchange as it hopes to get into every country around the world.

Deal of the weekIf you’re looking for yet another example of investor enthusiasm for AI just take a look at the latest fundraise over at autonomous vehicle software company Applied Intuition.

Other deals that got my attention …Anaphite, a battery technology startup, raised £1.6 million ($2 million)via a government-backed grant investment led by Elbow Beach Capital.

Motional, the autonomous vehicle technology startup Motional, secured a bridge loan that provides a temporary financial reprieve as the company searches for a longer-term source of funding, TechCrunch exclusively learned.

Phantom Auto, a remote driving startup that launched seven years ago amid the buzz of autonomous vehicle technology, shut down after failing to secure new funding.

You might recall that VW’s autonomous vehicle ambitions were wrapped up in Argo AI, a startup backed solely by the automaker and partner Ford.

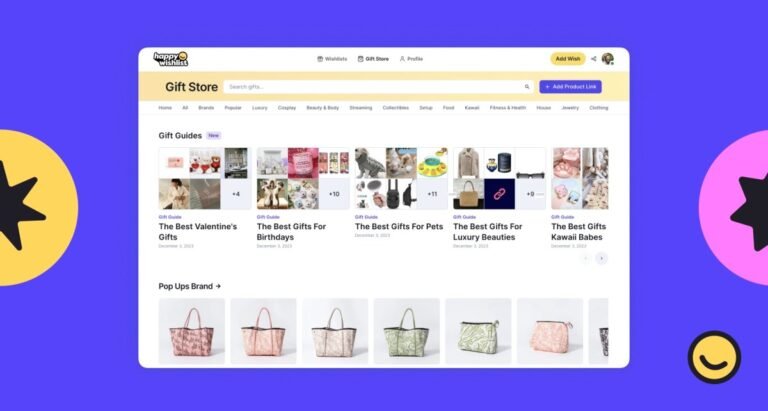

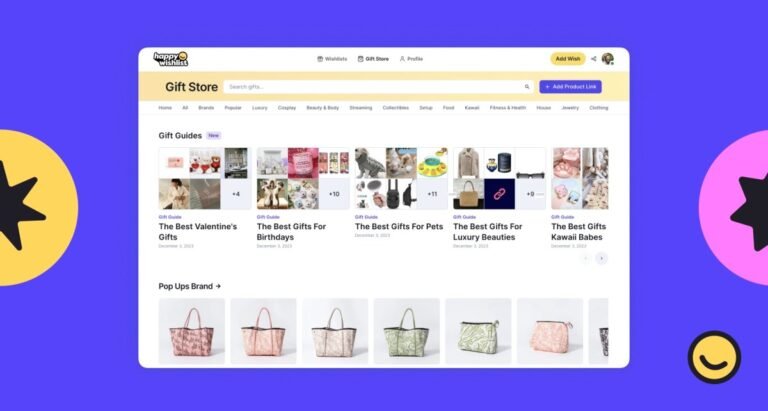

Throne, which lets fans gift items to creators from their wishlist, is launching a new gifting portal for family and friends called Happy Wishlist.

The co-founders started exploring the idea of Throne when some of their creator friends talked about issues like creating a P.O.

Fans can gift creators items from that list.

While the company was about to raise Series A, it decided to turn towards profitability and returned the investor money by December 2023.

Essentially, Throne is diversifying its revenue sources already — instead of raising money, it wants to make money.

Today on The Exchange, we’re digging into continuation funds, counting down through some of our favorite historical Exchange entries, and discussing what we’re excited to report on for the rest of the year!

It is also a very topical one: “The greatest source of liquidity now is going to be continuation funds,” VC Roger Ehrenberg predicted in a recent episode of the 20VC podcast.

If you have been following the last few months of venture capital activity, the “why now?” is easy to answer.

“It’s a viable strategy for a decent swath of the venture industry,” Ehrenberg told 20VC host Harry Stebbings.

We went from tallying monster rounds and a blizzard of IPOs to watching venture capital dry up and startup exits become rarer than gold.

Beat the clock to save $300 on passes to TechCrunch Early Stage 2024Tick tock, it’s now o’clock.

You have less than one day left to get your ticket to TechCrunch Early Stage — April 25 in Boston — at the lowest price.

At TechCrunch Early Stage you’ll walk away with a deeper working understanding of topics and skills that are essential to startup success.

Founders and investors save $300 if you book your pass before the clock strikes 11:59 p.m. PT on January 26.

Is your company interested in sponsoring or exhibiting at TC Early Stage 2024?