“Big tech companies have ‘mis-set’ expectations when it comes to AI,” Heltewig told TechCrunch.

According to one survey, over half of businesses have already invested in AI capabilities to support their customer service operations.

Per market research firm Markets and Markets, revenue in the market for call center AI alone is set to climb from $1.6 billion in 2022 to $4.1 billion by year-end 2027.

And it’s scalable; Cognigy manages AI agents that can handle up to tens of thousands of customer conversations at once.

Image Credits: Cognigy“Cognigy provides a platform to build, operate and analyze AI agents for customer experiences in the contact center,” Heltewig said.

The funding climate for AI chip startups, once as sunny as a mid-July day, is beginning to cloud over as Nvidia asserts its dominance.

AI chip company Mythic ran out of cash in 2022 and was nearly forced to halt operations, while Graphcore, a once-well-capitalized rival, now faces mounting losses.

But one startup appears to have found success in the ultra-competitive — and increasingly crowded — AI chip space.

“I co-founded Hailo with the mission to make high-performance AI available at scale outside the realm of data centers,” Danon told TechCrunch.

“In recent years, we’ve seen a surge in demand for edge AI applications in most industries ranging from airport security to food packaging,” he said.

Plenty of major corporations have announced net-zero emissions targets.

Those are the companies Greenly has targeted.

It takes that information and, coupled with its own data and algorithms, calculates carbon emissions by category and scope for customers.

It came into the round with an advantage: it’s applying SaaS to climate tech, and SaaS a business model that’s well understood.

But it does suggest that venture investors are warming to climate tech more broadly, proving that there’s a market for businesses focused on sustainability.

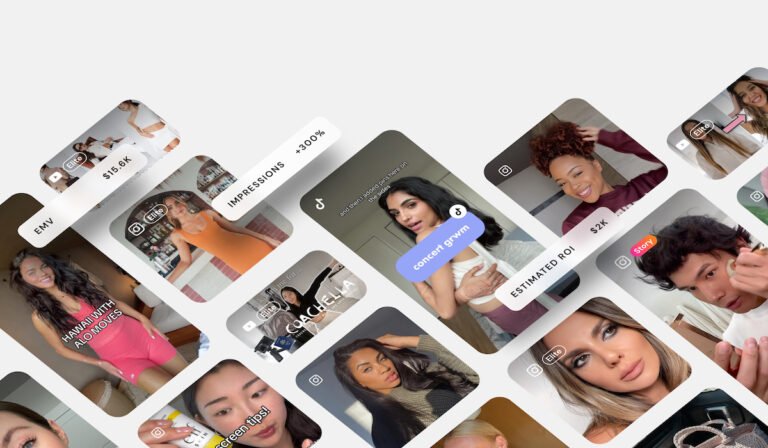

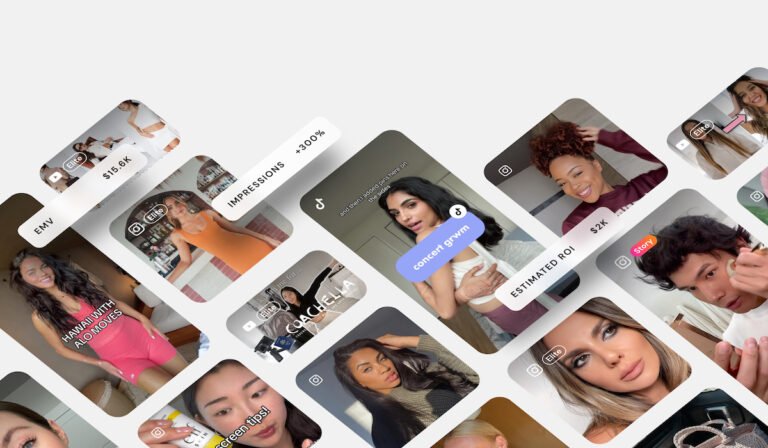

ShopMy, a marketing platform for content creators to connect with brands and monetize their content, announced today that it raised $18.5 million.

To date, creators have earned “tens of millions in commissions” on the platform, the company tells TechCrunch.

“He observed a significant disconnect in the social media ecosystem: influencers struggled to monetize their product recommendations effectively, and their followers didn’t have an easy path to purchase.

Chris viewed ShopMy as the solution, a bridge that transformed how influencers share and monetize their product recommendations,” Rein explains.

Even Instagram has embraced creator marketing, launching a marketplace tool for paid partnerships in 2022.

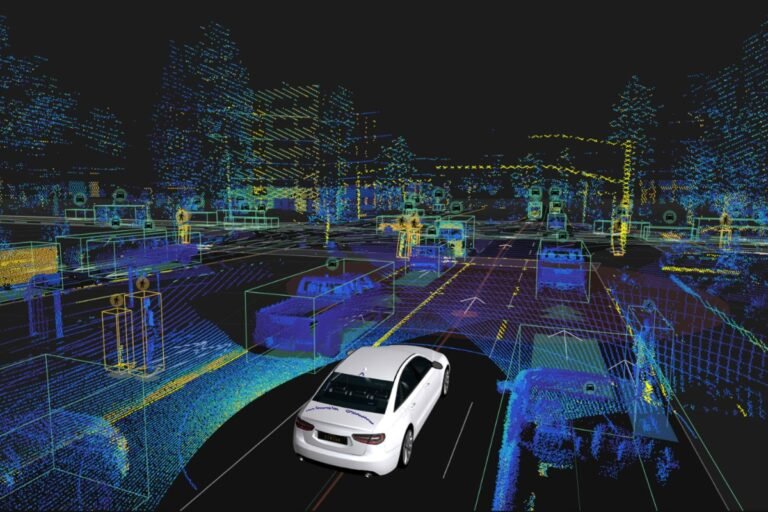

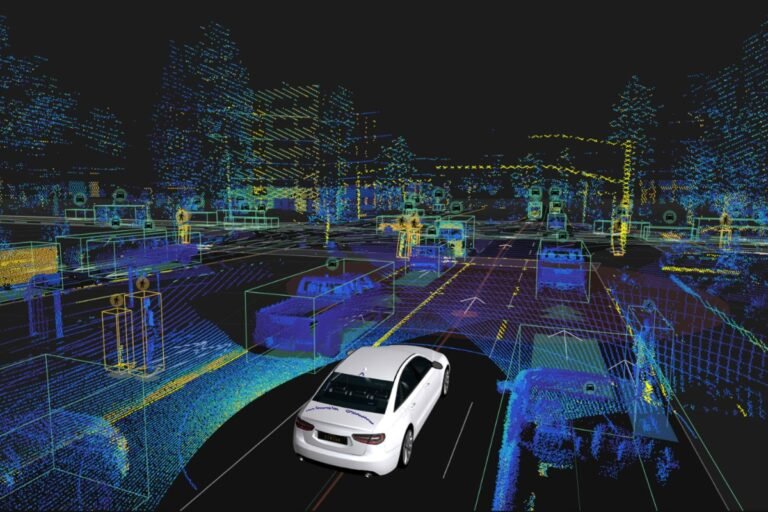

Autonomous vehicle software company Applied Intuition has raised $250 million in a round that values the startup at $6 billion, as it pushes to bring more artificial intelligence to the automotive, defense, construction and agriculture sectors.

The eye-popping funding round is the latest example of investor fervor for AI.

Lux Capital, Elad Gil, and Andreessen Horowitz all previously led funding rounds for Applied Intuition.

Founded in 2017, Applied Intuition creates software that automakers and others use to develop autonomous vehicle solutions.

“When they think like, ‘I have this software or AI problem,’ we generally want them to think about us,” Younis says.

It has solutions to address blockchain transactions and solutions for data exchange around artificial intelligence training and usage.

It has also built and posted four libraries to carry out that work on GitHub and claims that 3,000 developers are using these.

Zama’s technology is the key to build multiplayer, privacy-preserving applications,” said Kyle Samani, managing partner of Multicoin Capital, in a statement.

That still doesn’t represent useful speeds for most of the world’s transactions, but given that blockchain transactions themselves are typically slow-moving, that presented an opportunity to offer Zama’s solutions to crypto developers.

In the meantime, companies like Zama are continuing to work on algorithms and techniques to compress the work involved to carry out homomorphic encryption on existing infrastructure.

Kurs Orbital, a startup founded by Ukrainian space industry veterans, has closed a new tranche of funding to accelerate the commercialization of its satellite servicing technology.

The two-year-old company aims to unlock a new era for human activities in space by enabling capabilities like satellite relocation and inspection, de-orbiting and space debris removal.

Unlike other firms developing in-space servicing tech, Kurs Orbital’s module will be able to attach to “non-cooperative” targets, or target spacecraft that aren’t fitted with any hardware in advance.

On-orbit servicing has gained attention in recent months after the failure of a handful of high-cost, high-profile satellite missions.

We believe that one of the next big steps in space will be multimodality, as we know it on Earth.

Polestar secured a $950 million loan from a dozen banks, critical funds needed to keep its EV plans moving forward following Volvo’s decision to pull back its financial support of the electric automaker.

Polestar, which has cut 10% of jobs since mid-2023, said it plans to make another 15% cut this year.

Polestar currently produces the Polestar 2, Polestar 3, which recently started production in China, and the Polestar 4.

The company said it has successfully completed test production runs for the Polestar 3 at its factory in South Carolina.

The $950 million loan follows Volvo Cars’ decision last month to reduce its 48% holding in Polestar and let parent company Geely take over financial responsibility.

Rebellions, a South Korean fabless AI chip startup, said today it has closed $124 million (165 billion KRW) in a Series B round of funding to develop its third AI chip, called Rebel.

Rebellions’ fundraise comes at a key moment in the chip industry, specifically around the development and use of AI chips.

Nvidia is the AI chip market leader, its name synonymous with the AI boom that is currently sweeping the technology world.

In May 2023, Rebellions’ strategic investor, KT, installed Atom, Rebellions’ data-center targeted AI chip, in its cloud-based neural processing units (NPU) infrastructure.

Rebellions CEO Sunghyun Park, a former quant developer at Morgan Stanley in New York, and four co-founders set up the AI chip startup in 2020.

The proceeds bring Clerk’s total raised to $55.5 million, and co-founder and CEO Colin Sidoti says that they’ll be put toward expanding Clerk’s service beyond authentication and into authorization — i.e.

Clerk builds developer tools for authentication, offering drop-in components coded in React, the open source frontend JavaScript library.

“Despite authentication and authorization being ubiquitous challenges across every software company, they have been exceptionally slow to become outsourced,” Colin said.

“When you ask developers why, they often highlight that authentication and authorization are too tightly-coupled to the rest of their application to outsource.

The integration is motivated in part by the investment from Stripe, which Colin says marks the beginning of a “strategic partnership” between the two firms.