How many AI models is too many?

We’re seeing a proliferation of models large and small, from niche developers to large, well-funded ones.

And let’s be clear, this is not all of the models released or previewed this week!

Other large language models like LLaMa or OLMo, though technically speaking they share a basic architecture, don’t actually fill the same role.

The other side of this story is that we were already in this stage long before ChatGPT and the other big models came out.

The European Data Protection Board (EDPB) has published new guidance which has major implications for adtech giants like Meta and other large platforms.

The guidance, which was confirmed incoming Wednesday as we reported earlier, will steer how privacy regulators interpret the bloc’s General Data Protection Regulation (GDPR) in a critical area.

The full opinion of the EDPB on so-called “consent or pay” runs to 42-pages.

However a market leader imposing that kind of binary choice looks unviable, per the EDPB, an expert body made up of representatives of data protection authorities from around the EU.

“Online platforms should give users a real choice when employing ‘consent or pay’ models,” Talu wrote.

NeuBird founders Goutham Rao and Vinod Jayaraman came from PortWorx, a cloud native storage solution they eventually sold to PureStorage in 2019 for $370 million.

When they went looking for their next startup challenge last year, they saw an opportunity to combine their cloud native knowledge, especially around IT operations, with the burgeoning area of generative AI.

Rao, the CEO, says that while the cloud native community has done a good job at solving a lot of difficult problems, it has created increasing levels of complexity along the way.

“We’ve done an incredible job as a community over the past 10 plus years building cloud native architectures with service oriented designs.

At the same time, large language models were beginning to mature, so the founders decided to put them to work on the problem.

This week in Las Vegas, 30,000 folks came together to hear the latest and greatest from Google Cloud.

What they heard was all generative AI, all the time.

Google Cloud is first and foremost a cloud infrastructure and platform vendor.

From Google’s perspective, the company has built generative AI tools to more easily help data engineers build data pipelines to connect to data sources inside and outside of the Google ecosystem.

Executives, IT pros, developers and others who went to GCN this week might have gone looking for what’s coming next from Google Cloud.

Dubbed ‘Caracal,’ this new release emphasizes new features for hosting AI and high-performance computing (HPC) workloads.

Indeed, as the OpenInfra Foundation announced this week, its newest Platinum Member is Okestro, a South Korean cloud provider with a heavy focus on AI.

But Europe, with its strong data sovereignty laws, has also been a growth market and the UK’s Dawn AI supercomputer runs OpenStack, for example.

“All the things are lining up for a big upswing and open-source adoption for infrastructure,” OpenInfra Foundation COO Mark Collier told TechCrunch.

That’s in addition to networking updates to better support HPC workloads and a slew of other updates.

Now, Coro — one of the startups building tools specifically for smaller businesses — is announcing a big round of funding after seeing its recurring revenues shoot up 300% in the last year.

Sources close to the deal tell TechCrunch that its valuation is over $750 million post-money.

And among SMBs responding to a survey from Digital Ocean, 74% named data privacy a top concern.

The opportunity in the security market for SMBs that Coro has identified is that these businesses typically lack the teams and internal IT budgets to dedicate to building and managing their defenses.

Its round last year, in April 2023, was $75 million at a $575 million valuation (also post-money).

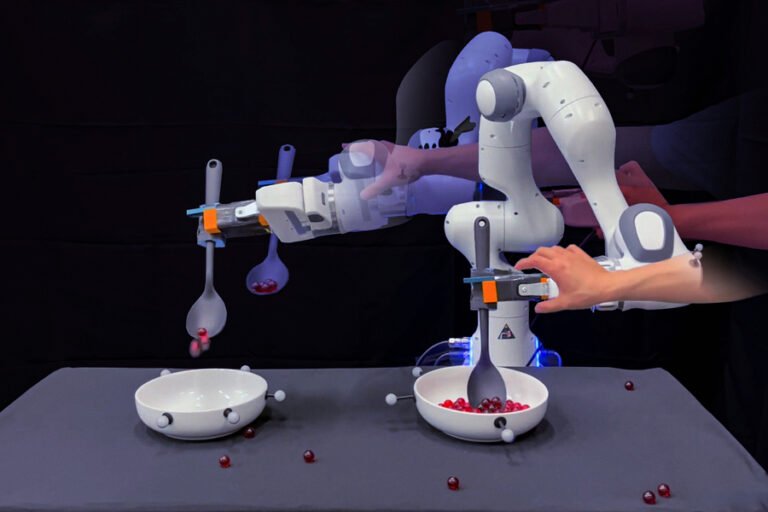

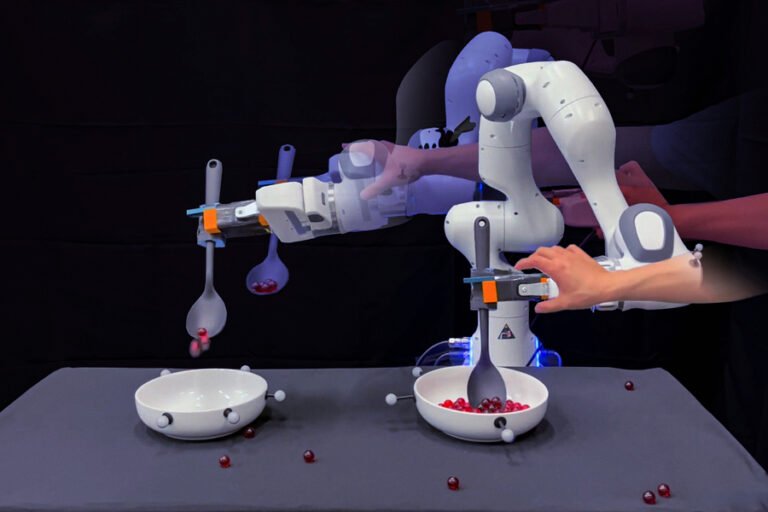

The no-code development platform previously focused its outreach on robotics firms.

They were like, ‘we’re not a robotics company — we do food processing, we do PLC automation, we do boats, we’re not robots.’”Further complicating messaging was the fact that — while the company is simply named “Viam” — its various social media platforms are “Viam Robotics,” owing to the fact that it was unable to secure the four-letter word.

Viam’s large office overlooking New York City’s Lincoln Center has a lab space, where members of the local robotics community are invited in to use its platform to develop automation applications.

“When people ask me what I do and what [Viam’s software] does, I usually use an example from their life.

We are a platform that lives at the intersection of real-world hardware and real-world software and the cloud and machine learning.

Even when some or all of those are addressed, there remains the question of what happens when a system makes an inevitable mistake.

We can’t, however, expect consumers to learn to program or hire someone who can help any time an issue arrives.

Thankfully, this is a great use case for LLMs (large language models) in the robotics space, as exemplified by new research from MIT.

“LLMs have a way to tell you how to do each step of a task, in natural language.

It’s a simple, repeatable task for humans, but for robots, it’s a combination of various small tasks.

That’s one way to think about direct air capture, a technology which uses machines to pull carbon dioxide straight from the atmosphere.

The ability to use heat from geothermal energy, Cyffka said, is helpful.

Geothermal is a really promising pathway for where DAC needs to go.”Along those lines, the company is working with Fervo, pairing its carbon capture system with the geothermal startup’s advanced geothermal project in Utah.

In 2026, AirMyne is planning to deploy its carbon capture technology to a sequestration site in San Joaquin County, California, where it will be injected underground.

Still, the demand for carbon capture is likely to be so large that the market will have space for several different companies.

A couple of years ago, payments orchestration was a foreign term to many large companies Juan Pablo Ortega would speak to.

Today, Yuno has facilitated transactions in over 40 countries worldwide and is working with enterprise clients like McDonald’s, Rappi, Avianca and inDrive.

The global payments orchestration market is forecasted to reach nearly $7 billion in value by 2032.

Many of Yuno’s competitors focus on solving payment orchestration for small and medium businesses, and not many were building the infrastructure for large enterprises, Ortega says.

That new round of capital gives Yuno a valuation of $150 million, Ortega said.