Mistral AI has closed its much rumored Series B funding round with General Catalyst leading the round.

The company has secured €600 million (around $640 million at today’s exchange rate) in a mix of equity and debt.

As a reminder, Mistral AI is a relatively new entrant in the artificial intelligence space.

It also has distribution partnerships with cloud providers, such as Microsoft Azure — Microsoft is also a minor shareholder in Mistral AI.

According to the Financial Times, Mistral AI raised €468 million in equity and €132 million in debt (around $500 million and $140 million respectively).

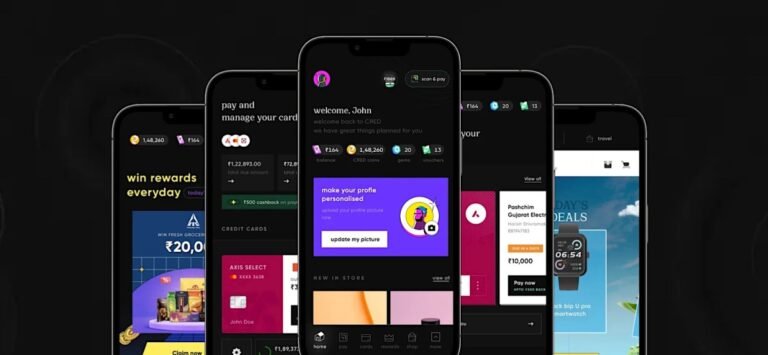

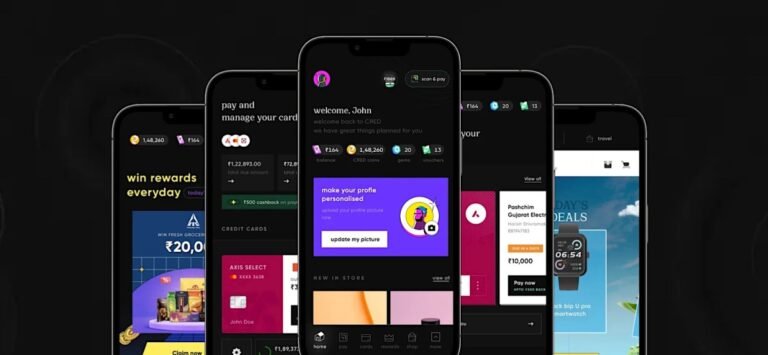

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could help it better serve its customers and launch new products and experiment with ideas faster.

The RBI has granted in-principle approval for payment aggregator licenses to several companies, including Reliance Payment and Pine Labs, over the past year.

Typically, the central bank takes nine months to a year to issue full approval following the in-principle approval.

Without a license, fintech startups must rely on third-party payment processors to handle transactions, and these players may not prioritize such mandates.

Obtaining a license allows fintech companies to process payments directly, reduce costs, gain greater control over payment flow, and onboard merchants directly.

The Linux Foundation last week announced that it will host Valkey, a fork of the Redis in-memory data store.

Valkey is backed by AWS, Google Cloud, Oracle, Ericsson and Snap.

AWS and Google Cloud rarely back an open-source fork together.

At the time, Redis said that despite this change for the modules, “the license for open-source Redis was never changed.

This fork originated at AWS, where longtime Redis maintainer Madelyn Olson initially started the project in her own GitHub account.

In addition, Redis today announced that it has acquired storage engine Speedb (pronounced ‘speedy-bee’) to take it beyond the in-memory space.

Redis license changesIn some way, the licensing move is no surprise.

We’ve seen other open source companies like MongoDB, Elastic and Confluent make similar moves.

He is also quite aware that these new license mean Redis won’t be considered open source, at least according to the definition of the Open Source Institute.

Because of the BSD license, Redis wasn’t able to put its latest innovations into Redis Core, meaning it was missing features like search and query, for example.

This week, we look at Griffin Bank getting its license ahead of some heavy hitters, and we go inside Stripe’s annual letter, some funding rounds, and more!

The banking-as-a-service company managed to do something that even the region’s most valuable fintech company, Revolut, hasn’t been able to do yet — obtain a banking license.

Granted, as Mike Butcher writes, banking licenses are difficult to come by (Griffin’s took a year), but Revolut has talked about securing a banking license for the past three years.

Now that Griffin has a banking license, it offers a full-stack platform for fintech companies to offer banking, payments and wealth solutions via automated compliance and an integrated ledger.

In a new SEC filing, Reddit’s IPO involves around 22 million shares, priced between $31 and $34.

The third-party application provider license will enable Paytm to offer payments through the UPI network even as Paytm’s parent firm One97 Communications’ banking unit — Payment Payments Bank — is scheduled to cease operations on Friday.

The Reserve Bank of India ordered Paytm in late January to cease operations at Paytm Payments Bank, an affiliate of the financial services firm that processed majority of its transactions.

The move created shockwaves through the industry, and also meant that Paytm needed to secure the third-party application provider license to continue many of the Paytm app’s operations.

Axis, HDFC, State Bank of India and Yes Bank will serve as payment system provider to the Paytm app, NPCI said Thursday.

The RBI had advised NPCI to swiftly issue the third-party application provider license, or TPAP, to Paytm to help mitigate disruptions for its customers.

With the issuance of a launch license for SpaceX, the Starship orbital flight test could now take place as soon as Monday. This 150-minute test window would open at 7:00…

This licensing move likely comes as a relief to Wizards of the Coast, which has endured weeks of criticism and protests from Dungeons & Dragons fans and content creators over…

WotC+ has finally responded to the outcry over their alterations to the open gaming license: after a week of silence, they’ve addressed the community’s worries. “The OGL is for content…