Wasoko, Africa’s Leading B2B E-commerce Company, Sees Valuation Cut to $260M as VC Reduces Share

VNV Global attributes its fair value estimate to a valuation model based on trading multiples of public peers rather than historical funding rounds.

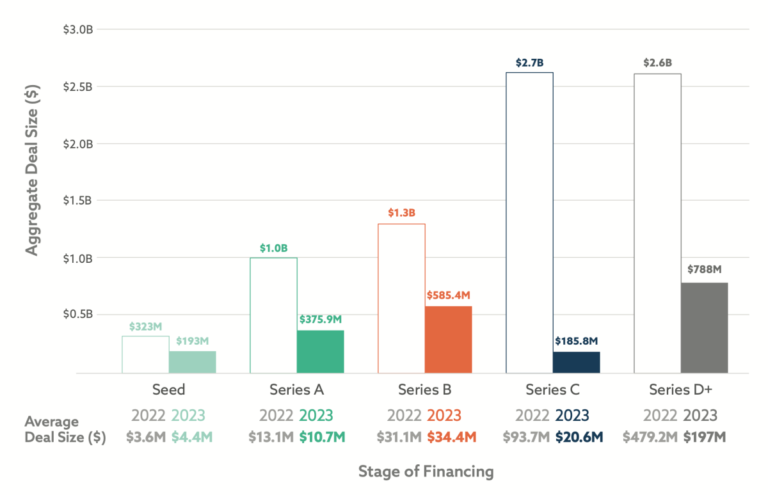

Funding and interest in B2B startups took off in the last decade and saw a bump in the wake of COVID-19.

African startups, including B2B e-commerce platforms like Wasoko, have followed the same playbook as their counterparts further afield: layoffs; cost cuts; and closures are not uncommon.

In the lead-up to its merger with MaxAB, Wasoko shuttered hubs in Senegal and Ivory Coast and laid off staff in Kenya.

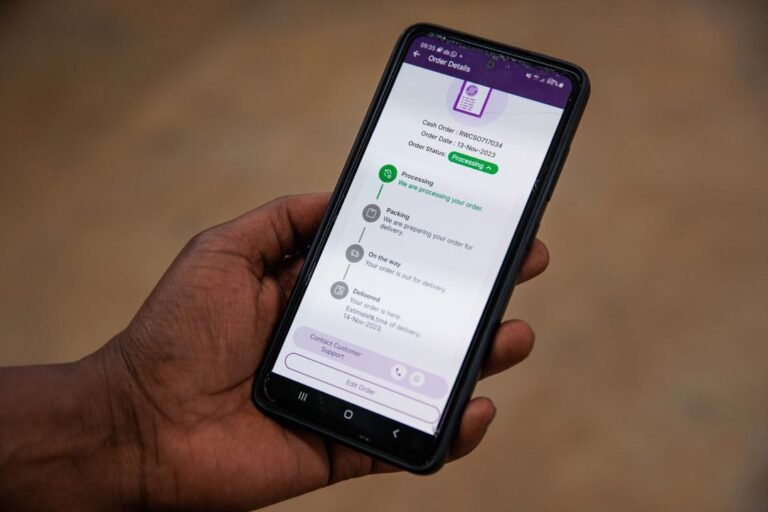

It operates a food and grocery B2B e-commerce platform in Egypt and Morocco, expanding to the latter following its acquisition of YC-backed WaystoCap in 2021.