Kenyan B2B e-commerce company MarketForce is winding down its B2B e-commerce business that served informal merchants (mom-and-pop stores) after a turbulent two-year period that saw it scale down operations severely.

The shutdown of the B2B e-commerce arm dubbed RejaReja comes months after MarketForce withdrew the service from all its markets, including Nigeria and Kenya, save for Uganda.

At its peak, it employed more than 800 people and served 270,000 informal merchants.

MarketForce had raised $42.5 million, including $40 million debt-equity in a Series A round in 2022 at over $100 million valuation, to fuel the business.

Several B2B e-commerce companies in Africa have also scaled back operations as the funding crunch persists.

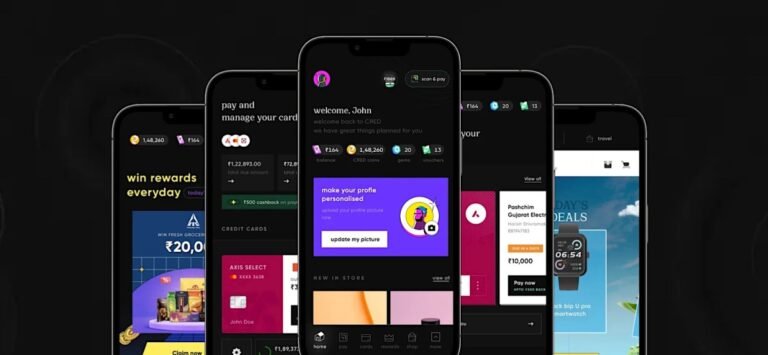

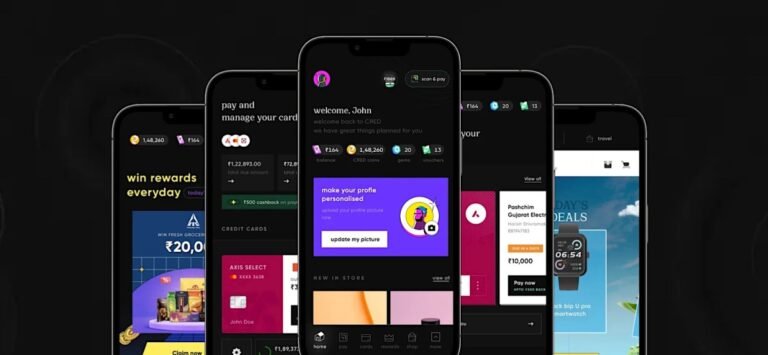

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could help it better serve its customers and launch new products and experiment with ideas faster.

The RBI has granted in-principle approval for payment aggregator licenses to several companies, including Reliance Payment and Pine Labs, over the past year.

Typically, the central bank takes nine months to a year to issue full approval following the in-principle approval.

Without a license, fintech startups must rely on third-party payment processors to handle transactions, and these players may not prioritize such mandates.

Obtaining a license allows fintech companies to process payments directly, reduce costs, gain greater control over payment flow, and onboard merchants directly.

In one of the latest developments, Danish company Flatpay, which builds payment solutions for small and medium physical merchants like shops, restaurants and salons, has raised €45 million ($47 million) led by Dawn Capital.

Founded in 2022, Flatpay currently has just 7,000 customers across its current footprint of Denmark, Finland and Germany.

Perhaps most interestingly, on the sales side, despite its focus on streamlined technology, Flatpay only sells via live sales visits.

No online sales (although there are specialists who will help arrange those in-person sales visits and handle support), no virtual visits, and no plans to introduce either.

And the only way they could understand the products really well was by the company paring down the products themselves.

TikTok ban could harm Amazon sellers looking for alternatives The ban could prematurely end TikTok's e-commerce dream and hit sellers seeking new channelsIn March, the U.S. House of Representatives overwhelmingly passed a bill that could force ByteDance to divest TikTok or face a ban in U.S. app stores.

Research from Jungle Scout, an Amazon data intelligence provider, provides some idea of TikTok’s e-commerce impact, however.

It found that 20% of Amazon sellers, brands, and businesses have plans to expand to TikTok Shop this year.

TikTok isn’t the only platform on the list for merchants looking for more channels beyond Amazon to expand their customer bases.

But if TikTok Shop’s strategy is mainly focused on bringing offline businesses online for the first time, that could be a very big move.

PayPal launches Tap to Pay on iPhone for businesses using Venmo and Zettle in the USPayPal announced today that it’s launching “Tap to Pay” for merchants with an iPhone through the Venmo and Zettle apps in the U.S. PayPal, which owns both Venmo and Zettle, says the feature will allow businesses to accept contactless card and digital wallet payments directly on their iPhones with no additional cost or hardware.

In addition to being able to accept payments from cards or digital wallets like Apple Pay or Google Pay, Tap to Pay allows merchants to add taxes, accept tips, send receipts and issue refunds without any additional hardware.

Funds from sales are quickly put into a business’s Venmo or PayPal Zettle account, the company says.

With Tap to Pay on iPhone, Venmo business profile users will be able to reach for customers by accepting payments from buyers even if they don’t have a Venmo account.

A year later, Strip enabled businesses to carry out Tap to Pay transactions on NFC-equipped Android devices, as well.

The payment landscape in the Middle East and Africa (MEA) region is marked by significant fragmentation, with numerous payment providers and methods in each country, evolving regulations and diverse customer preferences.

This complexity is further compounded by challenges such as payment fraud, low checkout conversion rates, and high transaction failure rates.

Payment orchestration platforms streamline payment processes for merchants through unified payment APIs.

As merchants or companies launch their platforms, they often start by collaborating with one or two payment processing providers.

As their operations grow and expand into multiple regions, they onboard additional payment providers to meet their evolving needs.

Google said Thursday it plans to roll out the SoundPod, its portable speaker designed to instantly validate and announce successful payments, to small merchants across India over the coming months.

The Google Pay expansion in India, where the company is among the mobile payment market leaders, comes even as the firm winds down some of its payments apps in the U.S.

The sound-box was invented to serve small Indian merchants unable to afford regular point-of-sale devices but accepting of UPI payments.

The company said merchants who use SoundPod to process 400 payments in a month will get $1.5 in cashback.

Reliance, India’s largest firm by market cap, also began testing a similar device at its campus last year, TechCrunch earlier reported.

TUNL, a South African parcel shipping platform, has secured $1 million in pre-seed funding from investors, including Founders Factory Africa, Digital Africa Ventures, E4E Africa, and Jozi Angels.

The current challenges in cross-border shipping cost African businesses an estimated $50 billion annually in missed opportunities.

TUNL’s founders identified a recurring issue among small- and medium-sized South African merchants during the pandemic: Shipping costs sometimes surpassed the value of their products.

On the TUNL platform, merchants offer customers various shipping options during checkout.

South Africa is known for its wine industry, with exports reaching 368.5 million liters last year.

The new bill pay tool allows U.S.-based merchant customers to manage their expenses and vendors via Shopify’s platform, which could be helpful for those who want to keep track of…

In a sea of traditional memo boards adorned with tightly packed Tokyo nightclub tabs and densely crunched pencil graphs, Jay Nelson stands out. The owner and operator of KK AirPlan…