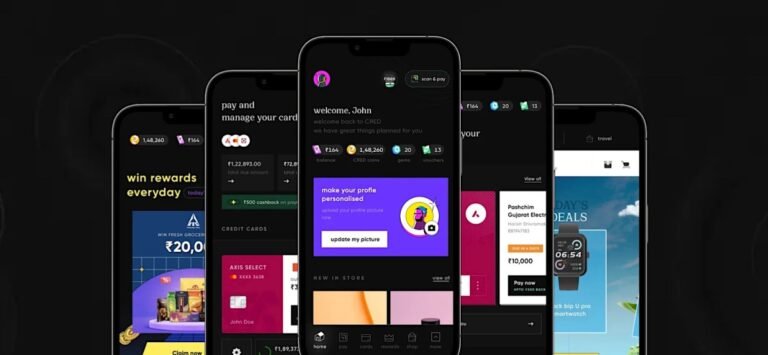

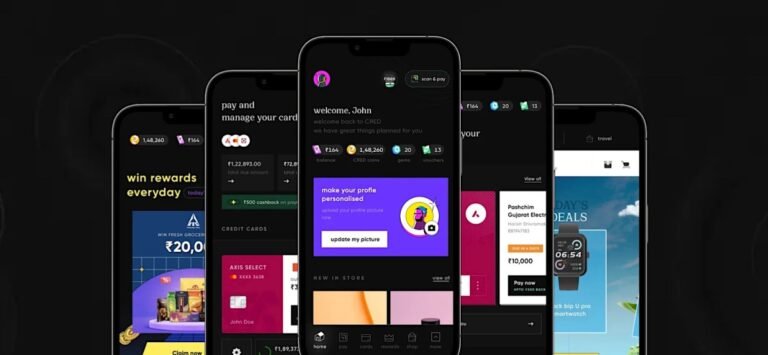

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could help it better serve its customers and launch new products and experiment with ideas faster.

The RBI has granted in-principle approval for payment aggregator licenses to several companies, including Reliance Payment and Pine Labs, over the past year.

Typically, the central bank takes nine months to a year to issue full approval following the in-principle approval.

Without a license, fintech startups must rely on third-party payment processors to handle transactions, and these players may not prioritize such mandates.

Obtaining a license allows fintech companies to process payments directly, reduce costs, gain greater control over payment flow, and onboard merchants directly.

In one of the latest developments, Danish company Flatpay, which builds payment solutions for small and medium physical merchants like shops, restaurants and salons, has raised €45 million ($47 million) led by Dawn Capital.

Founded in 2022, Flatpay currently has just 7,000 customers across its current footprint of Denmark, Finland and Germany.

Perhaps most interestingly, on the sales side, despite its focus on streamlined technology, Flatpay only sells via live sales visits.

No online sales (although there are specialists who will help arrange those in-person sales visits and handle support), no virtual visits, and no plans to introduce either.

And the only way they could understand the products really well was by the company paring down the products themselves.

Some of the files, which TechCrunch has seen, also contain contracts and agreements between Change Healthcare and its partners.

For Change Healthcare, there’s another complication: This is the second group to demand a ransom payment to prevent the release of stolen patient data in as many months.

UnitedHealth Group, the parent company of Change Healthcare, said there was no evidence of a new cyber incident.

What’s more likely is that a dispute between members and affiliates of the ransomware gang left the stolen data in limbo and Change Healthcare exposed to further extortion.

A Russia-based ransomware gang called ALPHV took credit for the Change Healthcare data theft.

Some of the files, which TechCrunch has seen, also contain contracts and agreements between Change Healthcare and its partners.

For Change Healthcare, there’s another complication: This is the second group to demand a ransom payment to prevent the release of stolen patient data in as many months.

UnitedHealth Group, the parent company of Change Healthcare, said there was no evidence of a new cyber incident.

What’s more likely is that a dispute between members and affiliates of the ransomware gang left the stolen data in limbo and Change Healthcare exposed to further extortion.

A Russia-based ransomware gang called ALPHV took credit for the Change Healthcare data theft.

Zaver now has $30 million to make it a realityWe last checked in on Zaver, a Swedish B2C Buy-Now-Pay-Later (BNPL) provider in Europe, when it raised a $5 million funding round in 2021.

The company has now closed a $10 million extension to its Series A funding round, bringing its total Series A to $20 million.

Total investment to date stands at $30 million.

In Europe, Zaver competes on BNPL with Klarna, PayPal, and incumbents such as Santander and BNP Paribas.

However, Zaver’s schtick is it claims it can assess the risk on BNPL cart sizes of up to €200,000 in real time due to its risk assessment algorithms.

Amazon announced Thursday the launch of its new app for Amazon One, its contactless palm recognition service that allows customers to hover their palm over a device in order to purchase from select places, including over 500 Whole Foods Market stores, Amazon stores, and more than 150 third-party locations.

Instead of signing up for Amazon One at a physical retail location, users can now download the Amazon One app (available for iOS or Android devices) and take a photo of their palm right at home.

The company explains that all palm images taken via the new app are encrypted and sent to a secure Amazon One domain in the AWS cloud.

Amazon says that Amazon One has been used over 8 million times.

The app launch follows Amazon’s expansion of the technology for enterprise identity purposes, which gives companies the ability to authenticate employees when entering.

The one time that Europe is explicitly mentioned, however, is in relation to Apple’s grip on digital wallets, NFC and mobile payment technology within its iOS ecosystem.

For context, the EU filed charges against Apple in May 2022, concluding that Apple “abused a dominant position” around mobile wallets by preventing rival services from accessing the iPhone’s contactless NFC payment functionality.

For example, Apple allows merchants to use the iPhone’s NFC antenna to accept tap-to-pay payments from consumers.

Then there is cross-platform smartwatch compatibility, which the DOJ says Apple impedes by restricting certain features from third-party smartwatch makers.

However, NFC, digital wallets, and mobile payments are where they seem to be most neatly aligned on.

Apple Pay is no stranger to regulatory controversy.

PayPal — the payments behemoth that has substantial businesses in mobile transactions and point-of-sale technology — was apparently instrumental in the original EU complaint around Apple’s payment monopoly.

The DOJ’s argumentApple today takes a 0.15% fee on any transaction made via Apple Pay.

In the meantime, Apple has continued to develop Apple Pay, launching — for example — its own buy now, pay later offering last autumn (pictured above).

Apple Pay and Apple Wallet are both a small part of Apple’s services revenues — which were upwards of $90 billion in 2023 — or indeed overall revenues.

Nala set out to offer remittance services, it’s building a B2B payment platform too It says, this is to guarantee reliability to its app users and businesses making payments into and out of AficaPayments company Nala pivoted to offer remittance service in 2021, tapping the growing money transfer market in Africa, and demand for reliable and affordable services.

For markets like Kenya, they have integrated with mobile money service M-Pesa enabling users living in the diaspora to pay local bills directly.

However, building the service on the payment rails of other providers meant that the fintech could not guarantee dependability.

This drove the decision to develop its own platform that directly integrates with banks and mobile money providers.

The remittance business growth coincides with reports that remittance flows to sub-Saharan Africa will continue on a growth trajectory.

Appzone is one of the standout local fintech software providers for banks and fintechs, providing better pricing and flexibility.

As such, it rebranded to Zone, a licensed blockchain-enabled payment infrastructure company–and carved out its original banking-as-a-service business into a separate standalone company, Qore.

Today, Zone, its blockchain network that enables payments and acceptance of digital currencies, is announcing that it has raised $8.5 million in a seed round.

Therefore, the fintech is developing an interoperable payment infrastructure using blockchain technology — known for its ability to scale infinitely — to connect banks and fintech companies, facilitating transaction flow without intermediaries.

“We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.