Stripe is sufficiently large that when we consider its growth we have to weigh it against the overall growth in the payment space more generally.

Major growth pointsIn its annual missive, Stripe noted that it crossed the $1 trillion total payment volume metric in 2023, a figure that is large, and round, if imprecise.

Certainly the threshold is notable, but when paired with recent growth figures becomes all the more impressive.

Stripe said that in 2023 its payment volume rose 25%.

Any company processing that much total payment volume through Stripe could build their own in-house stack, or pursue a more DIY option.

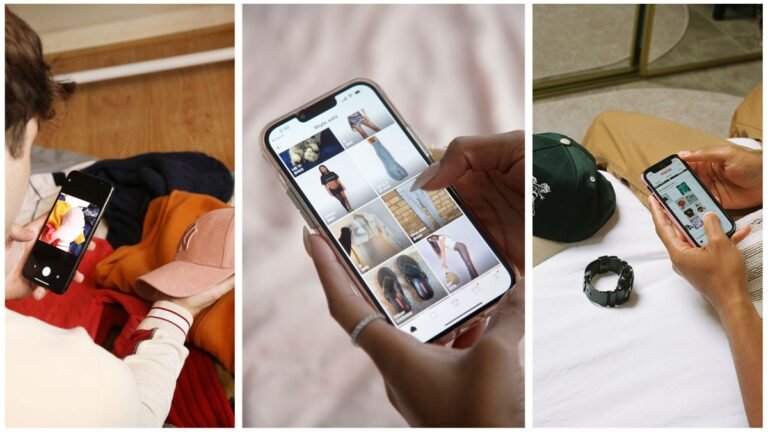

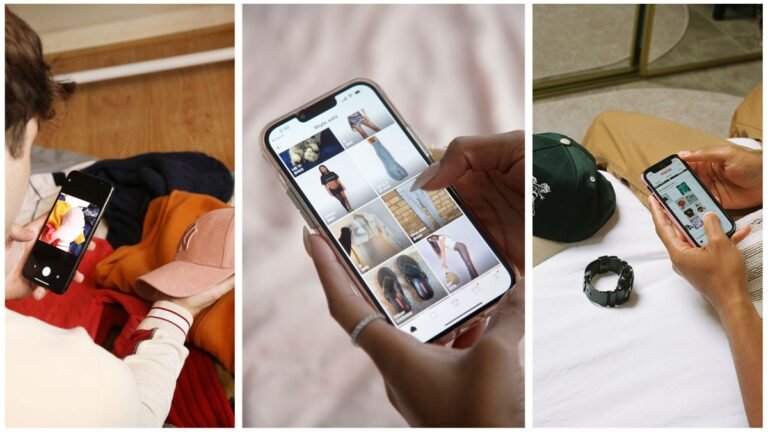

A streetwear seller, whose shop is @fentoozler791, told TechCrunch that they had a payment of $200 for multiple packages pushed back by over a week.

It seemed like they didn’t care until they realized they’d be losing my money from all the fees they’ve charged me,” @fentoozler791 told TechCrunch.

After further requests for comment, Depop told TechCrunch on Wednesday that it had uncovered an issue that caused these delayed payments.

We identified an issue in our automated payouts system that has now been fixed, and all pending payments have been sent out to affected sellers,” Depop said.

Depop told TechCrunch that it gained 5 million registered users last year, bringing its userbase up to 35 million.

A couple of years ago, payments orchestration was a foreign term to many large companies Juan Pablo Ortega would speak to.

Today, Yuno has facilitated transactions in over 40 countries worldwide and is working with enterprise clients like McDonald’s, Rappi, Avianca and inDrive.

The global payments orchestration market is forecasted to reach nearly $7 billion in value by 2032.

Many of Yuno’s competitors focus on solving payment orchestration for small and medium businesses, and not many were building the infrastructure for large enterprises, Ortega says.

That new round of capital gives Yuno a valuation of $150 million, Ortega said.

As cybercriminals continue to reap the financial rewards of their attacks, talk of a federal ban on ransom payments is getting louder.

Since then, just as talk of a potential ransom payment ban has gotten louder, so has the ransomware activity.

Is a ban on ransom payments the solution?

For a ban on ransom payments to be successful, international and universal regulation would need to be implemented — which, given varying international standards around ransom payments, would be almost impossible to enforce.

Given the brazen nature of these attackers, it’s unlikely that they would be deterred by a ban on ransom payments.

The payment landscape in the Middle East and Africa (MEA) region is marked by significant fragmentation, with numerous payment providers and methods in each country, evolving regulations and diverse customer preferences.

This complexity is further compounded by challenges such as payment fraud, low checkout conversion rates, and high transaction failure rates.

Payment orchestration platforms streamline payment processes for merchants through unified payment APIs.

As merchants or companies launch their platforms, they often start by collaborating with one or two payment processing providers.

As their operations grow and expand into multiple regions, they onboard additional payment providers to meet their evolving needs.

Google is sunsetting the Google Pay app in the US later this yearGoogle has announced that Google Pay is shutting down in the United States in June, as the standalone app has largely been replaced by Google Wallet.

Users can continue to access the app’s most popular features right from Google Wallet, which Google says is used five times more than the Google Pay app in the United States.

After June 4, users will no longer be able to send, request or receive money through the U.S. version of the Google Pay app.

Users who used the Google Pay app to find offers and deals can still so do using the new deals destination on Google Search, the company says.

Google says millions of people in over 180 countries use Google Pay to check out when shopping on desktop, mobile and in store.

The new rules prevent “anti-steering” practices, whereby the platform owner — in this case Apple — prevents app developers from informing their users about alternative payment or subscription options.

And the DMA also has provisions for preventing gatekeepers from requiring developers to use their own payment services.

“For years, even in our own app, Apple had these rules where we couldn’t tell you about offers, how much something costs, or even where or how to buy it.

The DMA means that we’ll finally be able to share details about deals, promotions, and better-value payment options in the EU,” Spotify said in a blog post.

One where you can see all subscription pricing, promotions or deals, and even make purchases, all seamlessly within the app.

Although Ripple has been around since 2012, it and the XRP Ledger are doubling down on its global payments journey.

At the same time, it’s also aiming to become the go-to enterprise infrastructure provider, the company’s president, Monica Long, said on TechCrunch’s Chain Reaction podcast.

Distinct from the Ripple network and protocol, the XRP Ledger is a decentralized public ledger with an open source code base that anyone can contribute to or use, Long said.

“Foreign exchange is pretty concentrated in terms of the players who actually have enough capital to provide liquidity for those transactions,” Long said.

“And so when you have a lot of concentration, you have a lack of competitiveness for the pricing.”

The EU suspects Apple of unfairly favoring its own mobile payment tech, Apple Pay, and squeezing out the ability of rivals to develop competing contactless payment offerings on its mobile platform.

It has also committed to applying “fair, objective, transparent, and non-discriminatory” eligibility criteria to grant NFC access to third parties — which will have to conclude an ADP license agreement to gain access.

The Apple Pay competition saga dates back several years at this point.

The Apple Pay case pre-dates ex ante competition legislation the bloc has since enacted and which Apple is subject to; having been designated, in September, as a so-called “gatekeeper” under the Digital Markets Act (DMA).

And although Apple’s payment tech, Apple Pay, has not been designated a “core platform service” the iOS App Store has.

Apple this week updated its App Store rules to comply with a court order after the Supreme Court declined to hear the Epic Games-initiated antitrust case against Apple over commissions.

This seems to skirt the court’s decision requiring Apple to remove the “anti-steering” clause from its agreement with App Store developers.

But in its place is a complicated process that requires app developers to apply for permission to include their desired link or button, via something dubbed the StoreKit External Purchase Link Entitlement.

Apple has used entitlements to set up exceptions to its App Store rules — for example, last year when it allowed “reader” apps (apps that provide access to digital content, like audio, music, video, book, and more) to point to an external website where customers could manage their accounts with the app developers.

In the case of the new U.S.-based Link Entitlement, Apple is again demanding to first vet which applications can include external links and control how they’ve been implemented.