PayPal Ventures’ latest investment is in an Indonesian startup that provides personal insurance products covering a variety of risks, including accidents, phone screen damage, and ticket cancellations.

Qoala has secured $47 million in a new round co-led by PayPal Ventures and MassMutual Ventures, the five-year-old startup said Wednesday.

Qoala, headquartered in Jakarta, is an insurance broker that works with top local insurers and e-commerce firms to offer customers personalized and affordable products.

The startup sells these insurance both through its website and app as well as through offline engagements.

“It is commendable to see what Qoala has achieved in a short period of time,” said Alexandros Bottenbruch, Principal at PayPal Ventures in a statement.

PayPal launches Tap to Pay on iPhone for businesses using Venmo and Zettle in the USPayPal announced today that it’s launching “Tap to Pay” for merchants with an iPhone through the Venmo and Zettle apps in the U.S. PayPal, which owns both Venmo and Zettle, says the feature will allow businesses to accept contactless card and digital wallet payments directly on their iPhones with no additional cost or hardware.

In addition to being able to accept payments from cards or digital wallets like Apple Pay or Google Pay, Tap to Pay allows merchants to add taxes, accept tips, send receipts and issue refunds without any additional hardware.

Funds from sales are quickly put into a business’s Venmo or PayPal Zettle account, the company says.

With Tap to Pay on iPhone, Venmo business profile users will be able to reach for customers by accepting payments from buyers even if they don’t have a Venmo account.

A year later, Strip enabled businesses to carry out Tap to Pay transactions on NFC-equipped Android devices, as well.

This week, we’re looking at a new finance-based dating app, Robinhood’s earnings results and the startup in which PayPal Ventures made its first investment.

Launched by financial platform Neon Money Club, Score is a dating app for people with good to excellent credit, and it seeks to help raise awareness about the importance of finances in relationships.

Dollars and centsFinom, a European challenger bank aimed at SMEs and freelancers, has raised €50 million ($54 million) in a Series B equity round of funding.

Rasa, an enterprise-focused conversational generative AI platform with financial services companies as clients, raised $30 million in a Series C round co-led by StepStone Capital and PayPal Ventures.

Cash App announced it will now offer “up to” a 4.5% APY (annual percentage yield) for its Cash App Savings customers, with a few caveats.

It’s a story as old as time: Startup founder raises giant sack of that sweet, sweet VC money.

If you throw enough money at advertising, anyone can get the growth chart to go up and to the right.

But the thing is, you need to find the right way to do growth, and that’s a lot harder.

In his new book, “Growth Levers and How to Find Them,” he makes a case for finding the right way to sell your product.

And that actually worked.

Prometeo, a startup out of Uruguay building channels to enable open banking across Latin America, is today announcing that it has picked up $13 million in funding to expand its business.

A lot of open banking these days focused on national rollouts — not least because banking conventions and regulations are often very localized.

(It’s not the only company that believes that open banking has a big role to play in financial services in the future: last year, the open banking startup Ivy raised funding specifically to expand to Latin America; and Christine wrote here extensively on Finerio, an ambitious open banking startup out of Mexico.

More recently, last year it led a $14 million round into nocnoc, a Latin America cross-border commerce specialist.

It also owns the point-of-sale payments company Zettle, which has been making very big inroads into Latin America for years now.

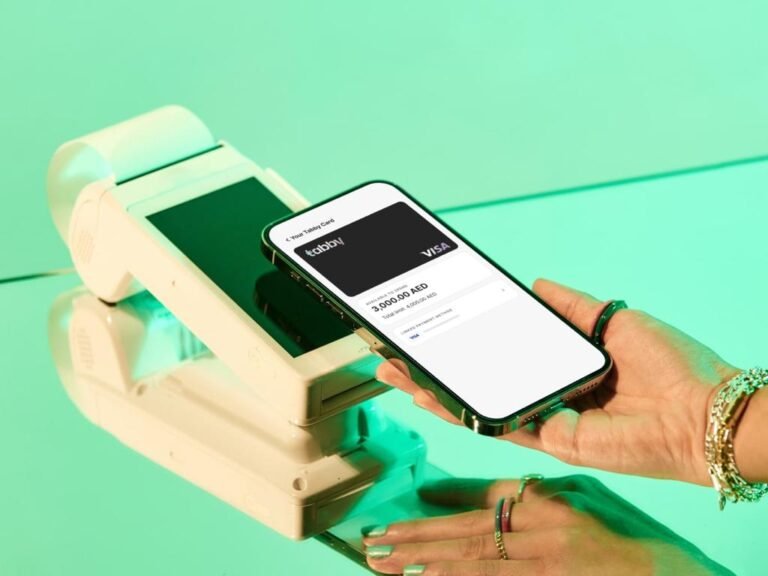

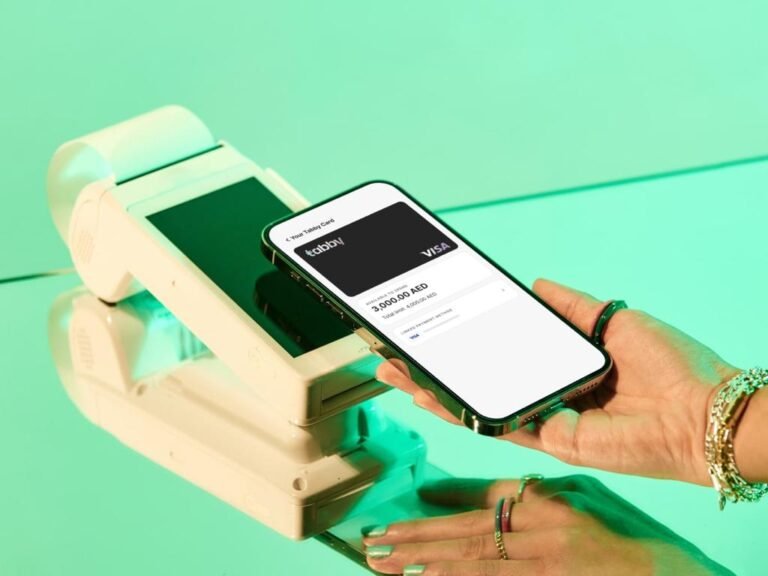

Tabby offers consumers the ability to pay for purchases using a tab on their smartphone, instead of carrying around a separate payment method. The firm has ambitions to become India’s…