AT&T has begun notifying U.S. state authorities and regulators of a security incident after confirming that millions of customer records posted online last month were authentic.

According to AT&T the records contained valid data on more than 7.9 million current AT&T customers.

AT&T took action some three years after a subset of the leaked data first appeared online, which prevented any meaningful analysis of the data.

The full cache of 73 million leaked customer records was dumped online last month, allowing customers to verify that their data was genuine.

AT&T eventually acknowledged that the leaked data belongs to its customers, including about 65 million former customers.

Waymo’s application to expand its robotaxi service in Los Angeles and San Mateo counties has been suspended for 120 days by the California Public Utilities Commission’s Consumer Protection and Enforcement Division.

The decision doesn’t change Waymo’s ability to commercially operate driverless vehicles in San Francisco.

However, it does put an abrupt halt to the company’s aspirations to expand where it can operate — at least until June 2024.

The CPED said on its website that the application has been suspended for further staff review.

San Mateo County Board of Supervisors Vice President David J. Canepa issued a statement following the ruling.

Apple does not enjoy this, which should surprise exactly no one.

Somehow, despite that, society remains intact and people are mostly ok with using those platforms with reasonable success.

What isn’t so understandable is just how petulant the company is being about prying open fingers on its tightly closed fist when it comes to compliance here.

At best, it seems short-sighted: Yes, doing so will mean Apple’s revenue picture doesn’t materially change in the near-term.

And developers are increasingly irate at Apple’s antics.

Cruise lost the permits it needed to operate commercially in the state of California and has since grounded its fleet elsewhere.

Problems with Cruise began almost immediately after the company received the last remaining permit required to operate its robotaxi service commercially throughout San Francisco.

On that day, a pedestrian crossing a street in San Francisco was initially hit by a human-driven car and landed in the path of a Cruise robotaxi and run over.

Even after obtaining the Full Video, Cruise did not correct the public narrative but continued instead to share incomplete facts and video about the Accident with the media and the public.

This conduct has caused both regulators and the media to accuse Cruise of misleading them.”This story is developing …

I don’t know that anyone expected such a massive deal to simply skate past regulators — particularly with all of the heat Amazon has received for privacy concerns and noncompetitive practices over the last decade.

At the same time, I don’t think too many of us assumed that we would be barreling into 2024 with this big, open question mark.

The deal has already been greenlit by a number of governmental bodies, but the process has felt drawn out at every step.

If you’re a regular Actuator reader, you likely already know my feelings about outside scrutiny of business practices (I’m generally pro), but I expected something definitive by now.

Amazon will be just fine, of course, but I can’t imagine this waiting game has been easy on iRobot, which underwent two rounds of layoffs in mid-2022 and early 2023.

The dramatic fall of First Republic Bank is a troubling example of the consequences of risky business practices and weak regulation. The bank was on the brink of collapse after…

But technical differences could be harder to regulate As cloud infrastructure vendors become increasingly competitive, it is important for customers to be able to easily move their workloads between different…

The CEO of Coinbase stated that the company intends to put up a fight against the SEC, stating that they have not violated any federal securities laws. This is in…

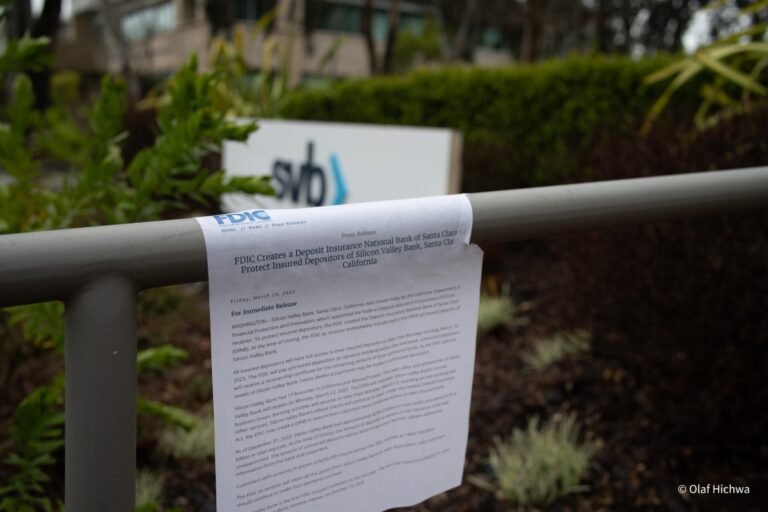

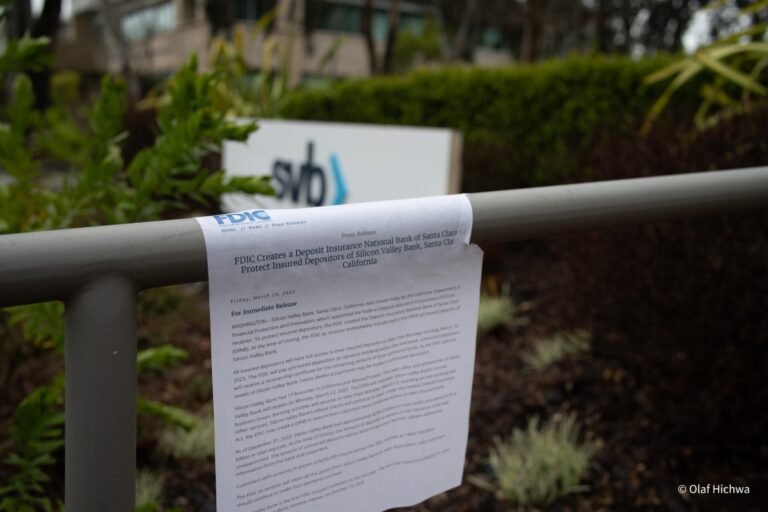

The Justice Department and SEC are investigating whether officers of Silicon Valley Bank used their positions to artificially inflate the stock prices shortly before the institution failed. If proven, this…

Late last night, Silicon Valley Bank – a major player in the tech industry – closed down after its executives were caught red-handed embezzling millions from the company. While employees…