TechCrunch Mobility: Cruise robotaxis return and Ford’s BlueCruise comes under scrutiny Plus, a Faraday Future whistleblower case and humanoid robots in car factoriesWelcome back to TechCrunch Mobility — your central hub for news and insights on the future of transportation.

Sign up here — just click TechCrunch Mobility — to receive the newsletter every weekend in your inbox.

It was another wild week in the world of transportation, particularly in the EV startup and automated driving industries.

Exoes, a French-based startup that developed battery cooling technology for EVs, raised €35 million ($37.5 million) from BpiFrance and Meridiam Green Impact Growth Fund.

Both former employees have filed lawsuits claiming the troubled EV company has been lying about some of the few sales it has announced to date.

Noname Security, a cybersecurity startup that protects APIs, is in advanced talks with Akamai Technologies to sell itself for $500 million, according to a person familiar with the deal.

Noname was co-founded in 2020 by Oz Galan and Shay Levi and is headquartered in Palo Alto but has Israeli roots.

The startup raised $220 million from venture investors and was last valued at $1 billion in December 2021 when it raised $135 million in a Series C led by Georgian and Lightspeed.

While the sale price is a significant discount from that valuation, the deal as it currently stands would be for cash, the person said.

In February, Israeli news outlet Calcalist reported that Noname was in negotiations with several potential buyers, including Akamai.

Guesty — which has built a platform for accommodation managers to manage all aspects of their business on platforms like Airbnb, Vrbo and directly to travellers — has raised $130 million.

Guesty’s close competitor Hostaway raised $175 million in May last year (its first ever big funding round).

And Mews, which like Guesty builds SaaS but for hoteliers, raised $110 million at a $1.2 billion valuation last month (March 2024).

First of all, Guesty wants to continue expanding its existing platform for current customers.

Third of all, Soto said that Guesty wants to consider more acquisitions.

Venture capitalists’ appetite for fusion startups has been up and down in the last few years.

The road to true fusion power remains long, but the kicker is that it’s no longer theoretical.

He added the timeline was to be able to get to fusion energy by the mid-2030s.

If we manage to get to that then the middle of the 2030s is possible.”The startup’s investors are equally convinced.

And there are at least 43 other companies developing nuclear fusion technologies.

It last raised a $50M Series C funding round in 2021.

TransferGo claims the new investment doubles its valuation to around $600M, from the $200M-$300M Dealroom valued it at back in September 2021.

We achieved sustainability of the business and became profitable and we still have proceeds from the last funding round.

We don’t need external capital to grow.”However, he saw the opportunity to raise funding from Asia to expand there.

“We are still taking customers from incumbents: 75% come from cash, banks, and Western Union — that’s still the gorilla in the room.”He puts TransferGo’s growth down to focusing on the consumer experience.

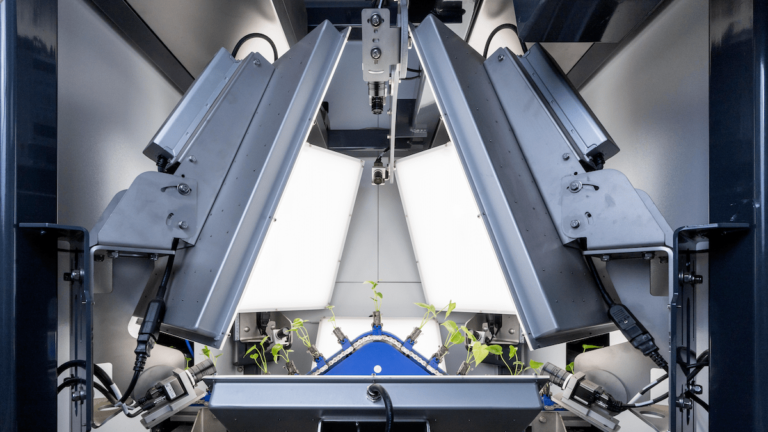

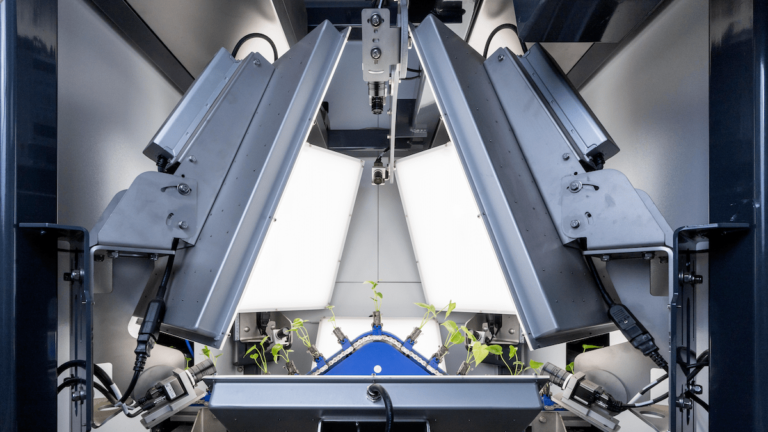

Out of its base in Belgium, Robovision already serves customers in 45 countries, CEO Thomas Van den Driessche told TechCrunch in an interview.

The initial traction Robovision gained was in agtech, which represents 50% of its activities, Van den Driessche said.

But other verticals are growing faster for Robovision, Van den Driessche said.

According to Van den Driessche, Robovision is seeing strong traction in life sciences and tech.

Van den Driessche became Robovision’s CEO in 2022, and Berte moved his focus to fundraising, partnerships and global expansion.

Paris-based startup Pigment has raised a $145 million funding round just five years after its inception.

This funding round comes as a bit of a surprise as large rounds have been few and far between in France.

Before Pigment, Crespo worked for VC firm Index Ventures and Google.

We’ve developed a lot of modules that enable us to serve HR teams, supply chain teams and sales teams,” Crespo said.

Like many software companies, Pigment has also added AI features.

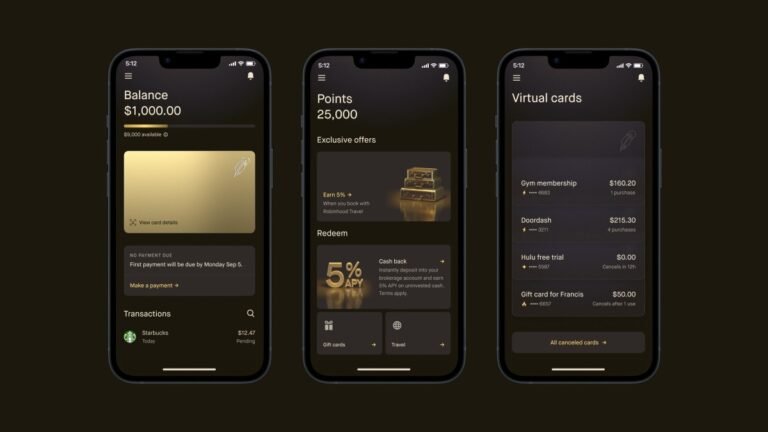

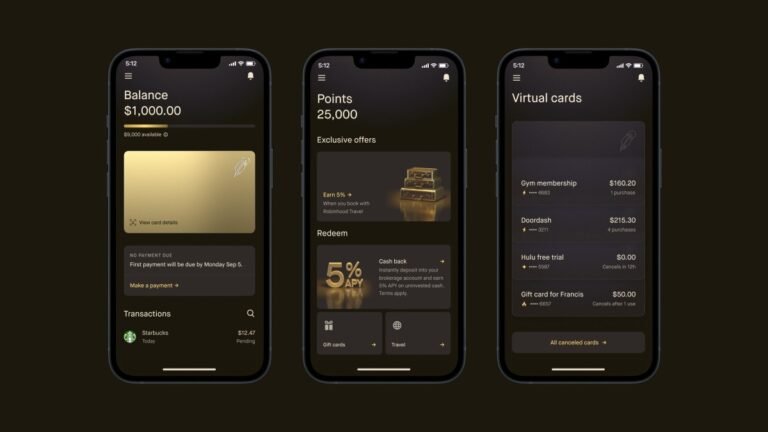

This week, we’re looking at Robinhood’s new Gold Card, challenges in the BaaS space and how a tiny startup caught Stripe’s eye.

BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees.

The startup is not the only VC-backed BaaS company to have resorted to layoffs to preserve cash over the past year.

MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

It has more primary customers than ChaseInside a CEO’s bold claims about her hot fintech startup, which TC previously covered here.

The deal is interesting on a number of fronts including the round’s structure and how Skyflow has been impacted by growth of AI.

The new capital comes after Skyflow expanded its data privacy business to support new AI technologies last year.

(In its latest news dump, Skyflow said that it expanded its support of China and that market’s particular data rules.)

This Skyflow round slots neatly into several trends we’ve observed recently.

The explosive growth in AI is creating healthy businesses for LLM infrastructure and support companies.

Now, Coro — one of the startups building tools specifically for smaller businesses — is announcing a big round of funding after seeing its recurring revenues shoot up 300% in the last year.

Sources close to the deal tell TechCrunch that its valuation is over $750 million post-money.

And among SMBs responding to a survey from Digital Ocean, 74% named data privacy a top concern.

The opportunity in the security market for SMBs that Coro has identified is that these businesses typically lack the teams and internal IT budgets to dedicate to building and managing their defenses.

Its round last year, in April 2023, was $75 million at a $575 million valuation (also post-money).