He had been accused of falsely inflating revenues at the UK startup ahead of its $11 billion sale to HP in 2011.

This verdict closes the book on a relentless 13-year effort to pin HP’s well-documented ineptitude on Dr Lynch.

Mr Lynch made £500M from the sale of Autonomy to HP.

Prosecutors accused Lynch and Chamberlain of illegally inflating revenues prior to the acquisition and hiding high-margin software revenues inside unprofitable hardware sales.

In the trial, Lynch successfully argued that he had not been involved in accounting and contract matters, instead focusing on technical and marketing issues.

Sources tell TechCrunch that employees at those companies received no information about the tender offer, but heard about their exclusion through the grapevine.

None of the former employees TechCrunch spoke to were surprised to hear one name on the list: Deel.

“Rippling put together a tender offer for the benefit of its employees, ex-employees, and early investors.

To be sure, as a private company, Rippling certainly has the freedom to place restrictions on participation in its stock sales.

In addition to the price of the stock, employees may face huge tax bills on options they exercise from the paper gains of the value of the stock.

The big idea was to become the transfer agent, brokerage and clearinghouse for all private stock transactions in the world.

Roughly 15 months later, in late 2022, the company’s CEO, Henry Ward, told Axios that Carta was worth even more – $8.5 billion – following a separate secondary sale.

(He did not disclose how many shares were sold at this valuation or who bought them.)

Now, Carta is seemingly returning to its roots – and an earlier valuation that’s probably better suited to the business.

Over the years, Carta has raised roughly $1.2 billion from investors, according to the startups tracker Tracxn.

The U.S. House of Representatives passed a bill this afternoon that would require TikTok-owner ByteDance to sell the popular social media app or see it banned in the United States.

Efforts to ban TikTok go back to the Trump Administration, but the issue has been revived in recent months.

The House already passed a similar bill in March — a bill that the Senate showed little interest in taking up.

The Senate could take up the package this coming week, and President Joe Biden has said he supports the bill and will sign it.

If that happens, TikTok is expected to challenge the bill in court.

Noname Security, a cybersecurity startup that protects APIs, is in advanced talks with Akamai Technologies to sell itself for $500 million, according to a person familiar with the deal.

Noname was co-founded in 2020 by Oz Galan and Shay Levi and is headquartered in Palo Alto but has Israeli roots.

The startup raised $220 million from venture investors and was last valued at $1 billion in December 2021 when it raised $135 million in a Series C led by Georgian and Lightspeed.

While the sale price is a significant discount from that valuation, the deal as it currently stands would be for cash, the person said.

In February, Israeli news outlet Calcalist reported that Noname was in negotiations with several potential buyers, including Akamai.

The secondary market allows for that now.”Stripe’s recent secondary sale is a clear example of this.

Leung said that Sapphire deployed roughly $500 million into the secondary market in 2023, and expects to deploy the same if not more into secondary stakes in 2024.

But given the maturation of the secondary market, it doesn’t need to thaw before the market is really ready.

The secondary market “is playing a huge role,” Leung said regarding companies waiting to go public.

[LPs] are not pressuring the GPs to push out their assets, which reduces the demand for the public market.”

TechCrunch Minute: The TikTok ban, or at least the effort to force its sale, is gaining steamAnd some folks are pretty mad about it!

After a House subcommittee passed a bill that would force a sale of TikTok or ban the app from American app stores, debate reignited around the internet regrading whether or not the social service should face such harsh choices.

On the pro-TikTok side former President Donald Trump flipped his views, and Elon Musk has spoken against the possibility.

On the other hand, there’s a surprisingly united Congress, concerns about data safety, and fears that TikTok could be used to influence the American electorate.

This raises the question: Why not just divest the asset so that we can put the issue to bed?

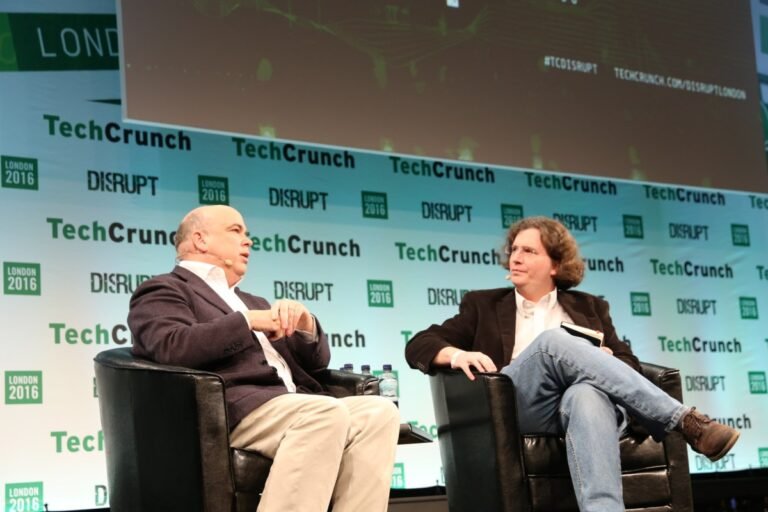

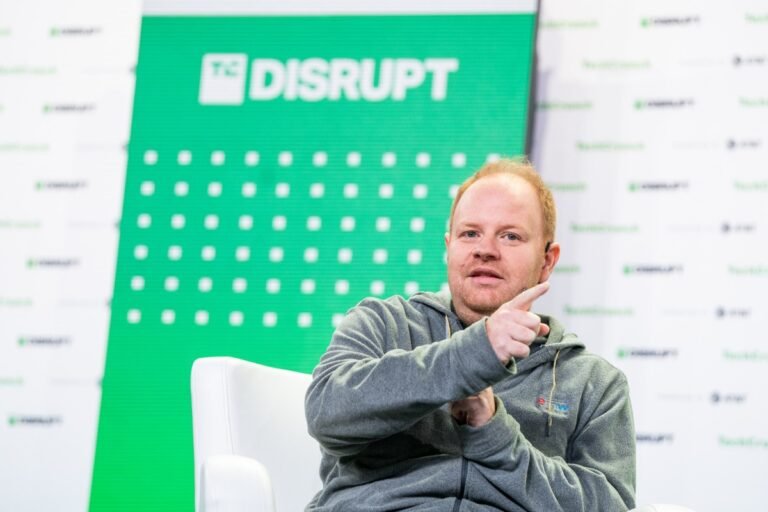

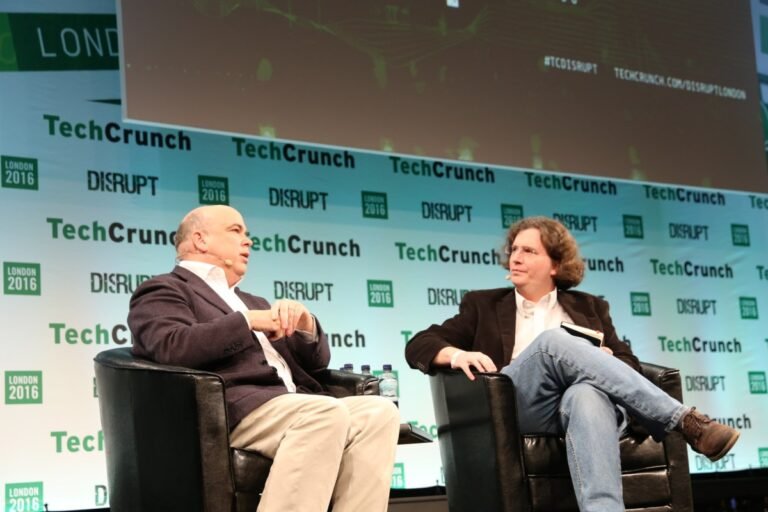

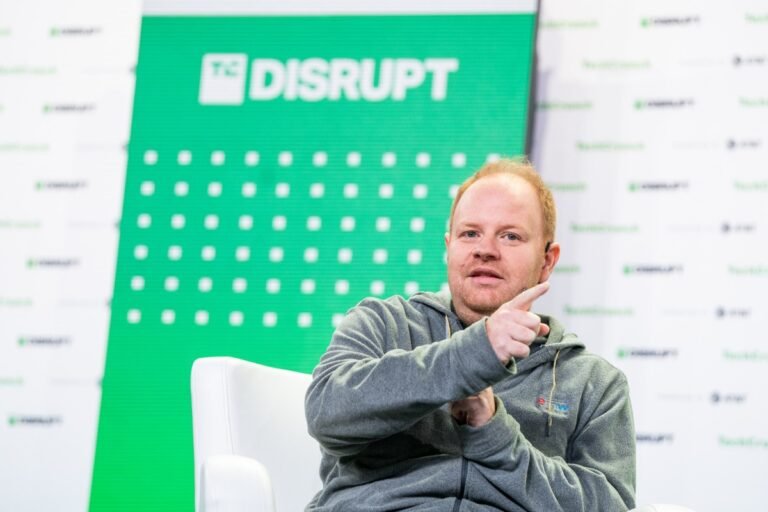

The clock is ticking on your chance to seize a scorching deal: TechCrunch Disrupt is returning to San Francisco from October 28–30, and the 2-for-1 ticket offer ends tonight at midnight!

What’s in store at TechCrunch Disrupt?

Prepare for three electrifying days packed with the latest startup breakthroughs, trends, and products, tailored for every step of your entrepreneurial journey.

From startup founders to venture capitalists, Disrupt attracts a diverse crowd eager to explore trends in SaaS, fintech, AI, and space.

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2024?

As winter continues to grip much of the world, here’s some hot news to thaw the chill from every entrepreneur’s heart: TechCrunch Disrupt will be back in San Francisco from October 28–30.

Secure your 2-for-1 pass now and unlock savings of over $1,000 on select passes.

What awaits you at TechCrunch Disrupt?

TechCrunch Disrupt will continue our goal of covering the latest pioneering founders, CEOs, and venture capitalists who will share their invaluable perspectives and wisdom.

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2024?

With Twilio under activist pressure, Segment could be put up for sale But recovering the 2020 purchase price could be impossibleTwilio’s foray into the customer data (CDP) business could be heading for an early conclusion.

During the last quarters of Lawson’s tenure atop the company, Twilio came under pressure from activist investors Anson Funds and Legion Capital to divest assets to bolster shareholder value.

With all that value and an eye toward expanding its market, Twilio went out and spent $3.2 billion to acquire Segment.

What is Segment worth?

According to Twilio, its Segment unit generated $75 million worth of revenue in Q4 2023, up 4% from a $73 million result in the year-ago quarter.