Steve Burns, the ousted founder, chairman and CEO of bankrupt EV startup Lordstown Motors, has settled with the U.S. Securities and Exchange Commission over misleading investors about demand for the company’s flagship all-electric Endurance pickup truck.

The SEC charged Lordstown Motors in February 2024 with misleading investors about the sales prospects of its Endurance electric pickup truck.

Lordstown Motors was founded in April 2019 as an offshoot of Burns’ other company, Workhorse Group.

During and after the merger, Lordstown received $780 million from investors, according to the SEC.

Lordstown Motors attracted the attention and investment of GM and even acquired the 6.2 million-square-foot assembly plant in Lordstown, Ohio from the automaker.

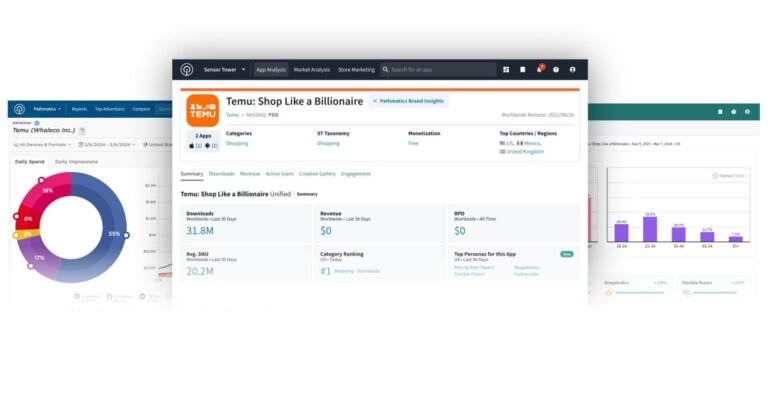

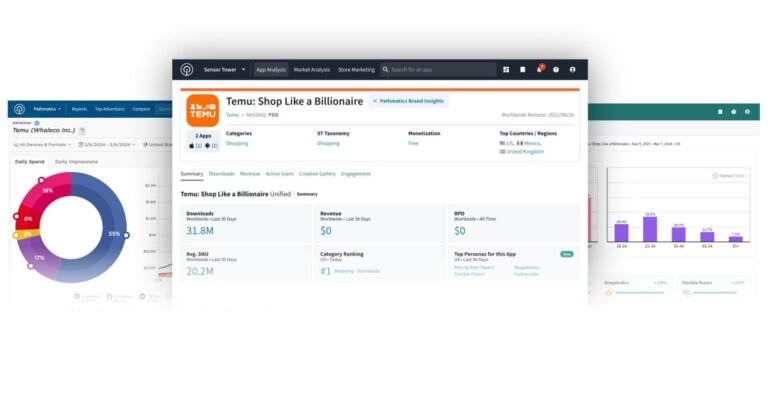

Sensor Tower, a leading app analytics firm, is acquiring rival Data.ai in a move that consolidates the mobile intelligence industry, creating a powerhouse that could dominate the sector and provide aggressively competitive insights into the app economy.

Sensor Tower didn’t disclose the financial terms of the deal but said Bain Capital and Riverwood Capital are providing credit-based financing.

Data.ai had secured over three times the amount of funding compared to Sensor Tower, according to Crunchbase.

Data.ai had raised over $157 million over various rounds, whereas Sensor Tower had raised just $46 million.

Sensor Tower issued an apology in 2020 and said the company had taken the route it did to stay competitive.

The SEC voted on Wednesday to require public companies to report a portion of their greenhouse gas emissions and their exposure to risks from climate change.

While the new rules do not apply to privately held companies like startups, they do create opportunities for those focused on the carbon tracking, accounting, and management space.

Some, like Amazon, Vanguard, Ralph Lauren, and Chevron, supported Scope 3 disclosures; already, many public and private companies voluntarily track those emissions.

In recent years, a number of startups have turned to AI to automate and improve Scope 3 estimates.

In adopting the new rules, the SEC is playing catch-up with other large economies, including China and the EU, which both have greenhouse gas reporting requirements.

The bid would help inform investors about any climate- or energy transition-related risks publicly traded companies face.

And depending on how far the SEC takes the proposed climate disclosure rule, many of these startups stand to benefit.

Scope 3 emissions are the broadest category, and if the SEC would require their reporting, the effects would ripple far beyond just publicly traded companies.

Look for it to be one of the first climate tech companies to list publicly when the IPO window opens.

Enter Bend, a corporate spend startup that focuses not just on tracking expenses, but also carbon emissions.

Lordstown Motors charged with misleading investors about the sales potential of its EV pickupThe Securities and Exchange Commission has charged bankrupt Lordstown Motors with misleading investors about the sales prospects of its Endurance electric pickup truck.

Lordstown has agreed to pay $25.5 million as a result — money that the SEC says will go towards settling a number of pending class action lawsuits against the company.

“We allege that, in a highly competitive race to deliver the first mass-produced electric pickup truck to the U.S. market, Lordstown oversold true demand for the Endurance,” Mark Cave, Associate Director of the SEC’s Division of Enforcement said in a statement.

“Exaggerations that misrepresent a public company’s competitive advantages distort the capital markets and foil investors’ ability to make informed decisions about where to put their money.”The SEC says its investigation into Lordstown Motors is ongoing.

This story is developing…

Cruise lost the permits it needed to operate commercially in the state of California and has since grounded its fleet elsewhere.

Problems with Cruise began almost immediately after the company received the last remaining permit required to operate its robotaxi service commercially throughout San Francisco.

On that day, a pedestrian crossing a street in San Francisco was initially hit by a human-driven car and landed in the path of a Cruise robotaxi and run over.

Even after obtaining the Full Video, Cruise did not correct the public narrative but continued instead to share incomplete facts and video about the Accident with the media and the public.

This conduct has caused both regulators and the media to accuse Cruise of misleading them.”This story is developing …

Coinbase, one of the largest crypto exchanges globally, bit back on Wednesday during a hearing to decide whether it committed securities violations.

The U.S. Securities and Exchange Commission filed the suit in June 2023, just one day after it sued Binance, the largest crypto exchange by volume, over securities matters.

In the SEC’s claims against Coinbase, it also alleged that the 13 cryptocurrencies available for trading on the exchange were securities.

Although separate, the Binance suit also had 12 crypto assets mentioned as securities.

The judge requested that the securities-focused agency explain what elements of crypto assets constitute investment contracts.

Bankrupt EV startup Lordstown Motors could be on the hook for $45 million for violating federal securities laws.

The SEC first started probing Lordstown Motors in 2021, just days after short-selling research firm Hindenburg Research published a report laying out a number of allegations of fraud.

Lawyers for Lordstown Motors revealed early on in the bankruptcy process that it had held confidential settlement talks with the SEC.

Lordstown Motors and a lawyer for the SEC did not immediately respond to requests for comment.

Some investigations — like the one into Lucid Motors, or struggling EV startup Workhorse — have been dropped without any enforcement action.

SEC’s X account hacked, sharing ‘unauthorized tweet’ regarding spot bitcoin ETF The agency has "not approved" the listing and trading of spot bitcoin ETFs, chair Gary Gensler saysThe U.S. Securities and Exchange Commission’s X account has been hacked, a spokesperson confirmed with TechCrunch on Tuesday afternoon.

The unauthorized tweet regarding bitcoin ETFs was not made by the SEC or its staff,” the spokesperson said.

The unauthorized post has since been deleted.

Around 4:30 p.m. EST, SEC Chair Gary Gensler tweeted, “The @SECGov twitter account was compromised, and an unauthorized tweet was posted.

The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.”After the fake post went out, Bitcoin’s price spiked near $48,000 but has since fallen around $45,700, according to CoinMarketCap data.

The SEC might finally approve spot bitcoin ETFs on Wednesday after denying applications for more than a decade.

Counting market movements, it could be $20 billion total AUM in spot bitcoin ETFs.” Valkyrie is one of 11 applicants for a U.S. spot bitcoin ETF; the other firms are BlackRock, Grayscale and Fidelity, among others.

But it was back in the end of September, beginning of October, when we’re launching our ETH futures ETF.

When we got an inclination that [the] spot bitcoin ETF was coming soon, we said OK, well, bitcoin futures ETFs are basically going to go away when a spot bitcoin ETF launches.

So we converted our bitcoin futures ETF into a strategy to invest in both ETH and bitcoin.