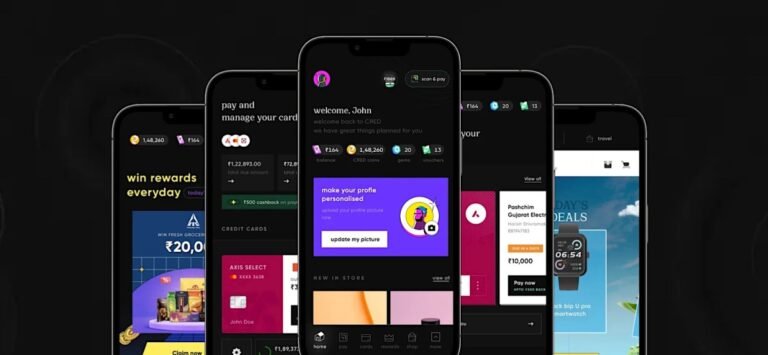

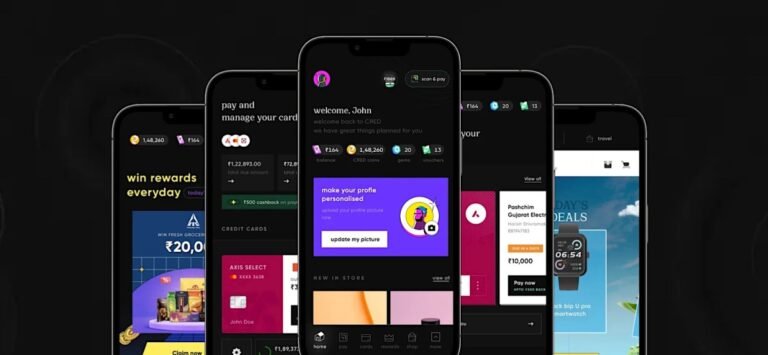

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could help it better serve its customers and launch new products and experiment with ideas faster.

The RBI has granted in-principle approval for payment aggregator licenses to several companies, including Reliance Payment and Pine Labs, over the past year.

Typically, the central bank takes nine months to a year to issue full approval following the in-principle approval.

Without a license, fintech startups must rely on third-party payment processors to handle transactions, and these players may not prioritize such mandates.

Obtaining a license allows fintech companies to process payments directly, reduce costs, gain greater control over payment flow, and onboard merchants directly.

SiMa.ai, named after Seema, the Hindi word for “boundary,” strives to leverage this shift by offering its edge AI SoC to organizations across industrial manufacturing, retail, aerospace, defense, agriculture and healthcare sectors.

As the demand for GenAI is growing, SiMa.ai is set to introduce its second-generation ML SoC in the first quarter of 2025 with an emphasis on providing its customers with multimodal GenAI capability.

The new SoC will be an “evolutionary change” over its predecessor with “a few architectural tunings” over the existing ML chipset, Rangasayee said.

It would work as a single-edge platform for all AI across computer vision, transformers and multimodal GenAI, the startup said.

The second-generation chipset will be based on TSMC’s 6nm process technology and include Synopsys EV74 embedded vision processors for pre- and post-processing in computer vision applications.

The carpooling and bus ticketing company has been around for so long that it’s hard to consider it a startup anymore.

Today, the company is announcing that it’s secured a €100 million revolving credit facility ($108M at today’s exchange rate).

And the good news is that there are BlaBlaCar users all around the world — not just France.

When the war in Ukraine started, BlaBlaCar had millions of users in Russia.

Even if you don’t book your next train ride on BlaBlaCar, the company is also experimenting with last-mile carpooling.

The third-party application provider license will enable Paytm to offer payments through the UPI network even as Paytm’s parent firm One97 Communications’ banking unit — Payment Payments Bank — is scheduled to cease operations on Friday.

The Reserve Bank of India ordered Paytm in late January to cease operations at Paytm Payments Bank, an affiliate of the financial services firm that processed majority of its transactions.

The move created shockwaves through the industry, and also meant that Paytm needed to secure the third-party application provider license to continue many of the Paytm app’s operations.

Axis, HDFC, State Bank of India and Yes Bank will serve as payment system provider to the Paytm app, NPCI said Thursday.

The RBI had advised NPCI to swiftly issue the third-party application provider license, or TPAP, to Paytm to help mitigate disruptions for its customers.

As an extension round, the valuation is also remaining flat, at $2.6 billion.

(Prior to that, the company raised a $100 million round in 2021 at a $1.2 billion valuation.)

“I didn’t feel the need to increase the valuation from the last round,” CEO and founder Dean Sysman, answered when asked about the decision.

Axonius is one of a group of specialist firms building platforms to help manage this.

“We’ve been a longstanding partner of Axonius, and we like to double down into our best performing companies.

Inspired Capital is celebrating its fifth birthday with the closing of its Inspired Capital Fund III with $330M in capital commitments.

The New York-based early-stage venture firm was founded in 2019 by entrepreneurs Alexa von Tobel and Penny Pritzker.

They went on to raise $200 million for a debut fund and then $281 million for its second fund in 2021.

“Venture capital, when properly deployed is actually the most powerful economic engine that the world has ever seen.

As part of the new fund, Inspired Capital wrote a manifesto that highlights how the venture capital firm thinks, what it believes in and what it is looking for.

Silence Laboratories, a startup that builds infrastructure using multiparty computation (MPC) to help enterprises keep data private and safe, said it has raised a $4.1 million funding round.

Pi Ventures and Kira Studio co-led the recent funding, which brings its total raised to $6 million, along with angel investors.

The startup will use the funding to scale its teams and beef up its R&D pipeline.

The outfit started as a multifactor authentication (MFA) company and pivoted its business to building a cryptographic security firm.

It also recently launched Silent Compute, which lets corporations collaborate on processing information without revealing their own private data to third parties and enrich insights while maintaining compliance and trust.

Golden Ventures, a Canada-based venture capital firm, closed on over $100 million in capital commitments for its fifth fund targeting high-potential, seed-stage founders working across technologies, including AI, climate, blockchain and quantum.

“This is a continuation of our core thesis and created to be super founder-aligned,” Golden told TechCrunch.

The firm makes both core investments and those that lean more on the angel side.

Over 13 years, Golden Ventures has backed over 100 companies at the seed stage.

Golden Ventures V is backed by a group of existing institutional limited partners, including BDC Capital, ECMC Group, Foundry, HarbourVest Partners, Kensington Capital Partners, Northleaf Capital Partners, RBC, Teralys Capital, University of Chicago and Vintage Investment Partners, and new institutional partner Deloitte Ventures.

Empowerly, an edtech startup that specializes in college counseling and career guidance services, raised $15 million in a recent funding round led by Conductive Ventures, the company announced today.

“Last year was one of the most competitive college admissions seasons of all time,” co-founder Hanmei Wu tells TechCrunch.

Empowerly has a network of over 100 college counselors who focus on areas such as pre-med, engineering, STEM, business, law and humanities, among others.

Empowerly touts its proprietary technology – The Empowerly Score – as the main differentiator between its competitors, which include CollegeWise, Solomon Admission Consulting and AcceptU.

Additionally, Empowerly joined the Sequoia marketplace in July 2023, providing its services as an employee benefit to working parents.

The company provides community and regional banks with end-to-end deposit management capabilities, including a deposit network so bank customers can grow, retain and manage their deposit base by sourcing deposits, sweeping funds and providing additional security to depositors.

In fact, ModernFi, founded in 2022 by Paolo Bertolotti and Adam DeVita, raised $4.5 million in a seed round a month prior to the SVB news.

Canapi Ventures led the round and was joined by Andreessen Horowitz, Remarkable Ventures and a group of banks including Huntington National Bank, First Horizon and Regions.

“On this whole notion of deposit growth, retention management became first, second and third priority for a lot of institutions.

Bertolotti plans to grow in engineering, new product development, compliance and regulatory adherence and in business development.