The financial reporting and auditing process is not often on the list of sexy topics that technology startups want to go after.

After years of performing reporting and auditing work for companies like Miro, Autodesk, Dropbox, Flexport and Yelp, Mary Antony and Kelsey Gootnick decided reporting and auditing needed some technology love, too.

So they started San Francisco-based InScope in 2023, leveraging machine learning and large language models to provide financial reporting and auditing processes for mid-market and enterprises.

We make it possible for our customers to have effortless, but accurate and reliable financial statements every time.”InScope’s financial report drafting tool.

So much so that they could be customers, Gootnick said.

That’s according to Jonathan Sanders, CEO and co-founder of fledgling Danish startup Light, which exits stealth Wednesday with $13 million in a seed round of funding led by European VC giant Atomico.

The Copenhagen-based startup is reimagining general ledger software from the ground up, replete with AI to cleanse transactional data, while also enabling finance teams to ask plain-English questions and receive straightforward answers from their data.

Enterprise resource planning (ERP) software is king, packing support for CRM (customer relationship management), HR (human resources), project management, and perhaps the most crucial component of all, the general ledger.

And it’s this element of the ERP that Light is focused on dragging into the modern digital era, where AI increasingly rules the roost.

“Our mission is to be the first automated ledger for global companies,” Sanders told TechCrunch.

“I couldn’t get a credit card because my parents couldn’t co-sign,” Kobe recalls, “and I didn’t want to put down a large security deposit.

Scott points out that New York-based Fizz set out to offer college students a different entry ramp into building credit.

And if you ask any of them, they’ll tell you that they’re credit card averse, but they’re not necessarily credit averse,” he told TechCrunch.

”Fizz is one of several fintechs aiming to serve the expansive Gen Z market.

For instance, Frich, a financial education and social community for Gen Z, just raised $2.8 million in seed funding.

Clay Canning had an idea while in high school: smartphone screen protectors that featured logos, right on the screen.

“In December 2022, I resigned from my job to pursue building Screen Skinz with Clay full time.”Now, Screen Skinz can officially announce the closing of a $1.5 million seed round led by South Loop Ventures and Abo Ventures.

The company produces custom, patent-pending phone screen protectors that feature personalized logos or slogans that are visible when the phone screen is black and then disappear when the phone is in use.

The latest fundraise allowed Screen Skinz to move manufacturing from Asia to the U.S., allowing it to more easily control its supply chain.

Screen Skinz next has some partnerships lined up and is focused on customer acquisition and deepening licensing relationships.

The capital, which brings total funding raised by the startup to $6.2 million, will enable it to serve more brands.

For diverse brands in particular, there are a lot of economic hurdles that these groups face, which makes it even harder for them to access capital.

Its other offering is a labor marketplace for brands not in a position to hire full-time teams but require talent occasionally.

Its community of brands recommends the talent or manufacturer, who are listed on the marketplace after several stages of vetting.

Brands gain access to the labor marketplace, capital and other resources, upon signing up (at a cost) on the startup’s main product, the B2B marketplace and SaaS product.

The startup charges a listing fee (subscription fee) to publish jobs on the platform and a success fee when a hire is made.

“The listing fee ensures buy-in from startups to the two-way marketplace and a commitment to the recruiters they’re working with,” Kim said.

In addition to early- and late-stage startups, Kim said the platform also works with larger in-house talent teams to fill challenging roles.

“More than 50% of our customers have great in-house talent teams, but they continue to post roles on Paraform.

“We’re already branching out into research, science, manufacturing and defense roles due to the demand we’re seeing from potential customers,” Kim said.

There’s a big difference between a “solution” and a “product” slide.

The biggest problem with the Xpanceo deck isn’t what is in there, but rather what isn’t.

The market sizing fallacyWhen assessing the potential market size for Xpanceo’s contact lenses, it’s crucial to differentiate the nature of the product from traditional contact lenses.

The full pitch deckIf you want your own pitch deck teardown featured on TechCrunch, here’s more information.

Also, check out all our Pitch Deck Teardowns all collected in one handy place for you!

Cendana, Kline Hill have a fresh $105M to buy stakes in seed VC funds from LPs looking to sellIf you ask investors to name the biggest challenge for venture capital today, you’ll likely get a near-unanimous answer: lack of liquidity.

Cash-hungry venture investors, whether VCs themselves or their limited partners are increasingly looking to sell their illiquid positions to secondary buyers.

“We simply passed the hat around to our existing LPS at Kline Hill and Cendana,” said Kim.

It then passes these opportunities to Kline Hill, which values, underwrites and negotiates the transaction price.

Traditional secondary investors, such as Lexington Partners and Blackstone, recently raised their largest secondary funds ever.

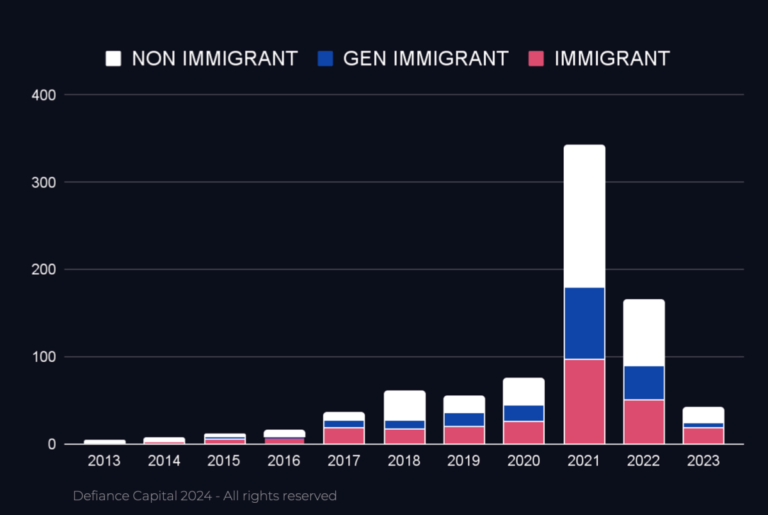

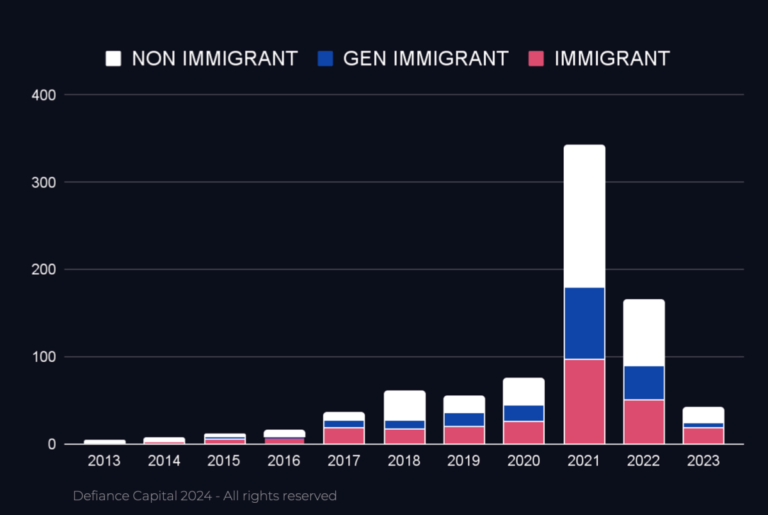

The study (“Unicorn Founder DNA Report) by Defiance Capital of 845 unicorns and 2,018 unicorn founders set out to look at the “DNA” of unicorn founders, concentrating on the US and UK (no EU/European) from 2013 to 2023, to define the common traits of these kinds of founders.

During the last decade, all top Seed funds were generalist funds, and the market for Seed funds is highly fragmented.

Only 34% of unicorn founders had worked at an elite employer prior to founding a unicorn, suggesting a McKinsey or similar background is not a prerequisite to success.

Dorffer, who intends now to produce a podcast with many of the unicorn founders surveyed, said: “The stories that are coming out show crazy determination.

As a female founder, you have to work twice as hard and take twice as many meetings to raise the money.

With only 4 days left, the clock is ticking on your chance to snag the early-bird savings for TechCrunch Early Stage 2024.

Don’t miss out — secure your ticket now and save $200 before the 11:59pm PT deadline on Friday, March 29.

Explore the pros and cons of convertible notes, simple agreements for future equity (SAFE), and series seed financing rounds, and equip yourself with the knowledge to navigate these alternatives with confidence.

Don’t let this opportunity slip away — secure your early-bird ticket to TechCrunch Early Stage 2024 today and position yourself for startup success.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?