Maximize your team’s impact at DisruptWith four conference passes included, ScaleUp Startup Exhibitors can make the most of all three days of the event.

Access to the TechCrunch Disrupt press list.

Upon intent to participate, the ScaleUp Exhibitor Packages are $3,500 and, if your startup is accepted, that fee is non-refundable.

The ScaleUp Startups Exhibitor Program is for Series A to B startups with $35 million or less in funding and costs $3,500 to participate if accepted.

Book your package now to become a ScaleUp Startup Exhibitor at Disrupt and unlock unparalleled opportunities for growth and visibility.

Announced earlier this year, Roku revealed today that its Pro Series TVs, the lineup of high-end televisions, are now available for purchase in the U.S.

Starting today, Roku Pro Series TVs are being sold at Best Buy stores and online at BestBuy.com, Amazon.com, and Walmart.com.

Compared to the Roku Select and Roku Plus Series TVs, which were the first-ever Roku-branded smart TVs that launched in 2023, the Roku Pro Series has a slimmer design that can be flush mounted to the wall.

Like the Roku Plus TVs, the Pro Series has HDR10+ and Dolby Vision for a cinematic viewing experience, as well as 4K QLED displays and local dimming.

In addition to the Pro Series launch, Roku announced new software updates coming to all Roku TVs that aim to enhance the viewing experience.

Sprinto, a security compliance and risk platform, has raised a $20 million Series B round to build more automation into its compliance management platform and widen its customer base to include the wide gamut of companies that operate digitally but aren’t tech-first.

Sprinto is working to automate this aspect of security compliance management, which involves vendor risk management, vulnerability assessment, access control, evidence collection and other filing tasks.

Sprinto uses a mix of AI, GPTs and its own internal large language model to offer efficiencies in compliance management.

The market for automated compliance management solutions already has players such as Vanta and Drata, which Sprinto considers its key competitors.

However, Redekar said Sprinto primarily focuses on automating the entire compliance management process and helping businesses build trust.

The round also includes existing investors, Notable Capital, Bain Capital Ventures, Khosla Ventures, Cowboy Ventures and PLUS Capital.

“To have over 2 million workers on Homebase, which is over 2% of the workforce, is impressive for a private company,” Richards said.

In 2021, sources told TechCrunch’s Ingrid Lunden that the company’s valuation was between $500 million and $600 million.

“We are using technology to give workers superpowers and in fact, make the work more human, not less,” Waldmann said.

Small businesses have always provided that, and this, to me, is why our mission is so important to make these jobs even better.”

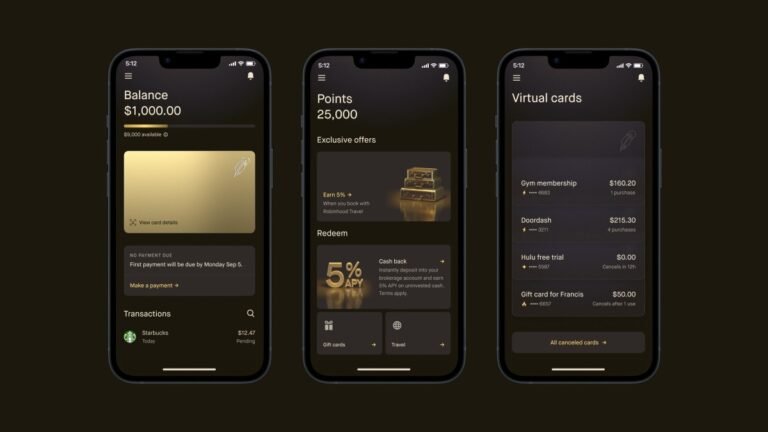

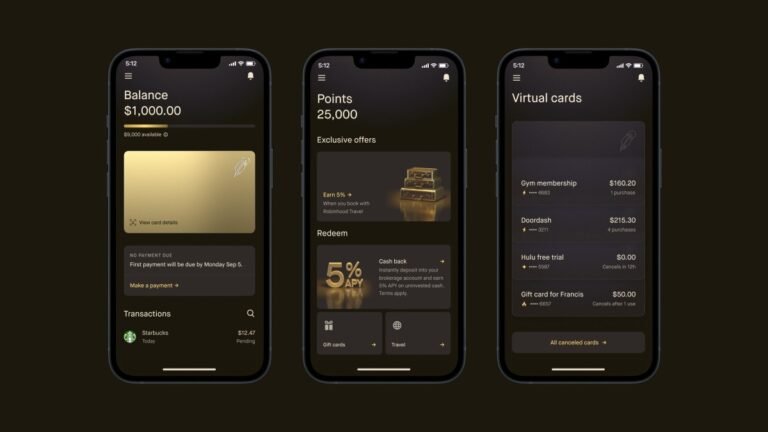

This week, we’re looking at Robinhood’s new Gold Card, challenges in the BaaS space and how a tiny startup caught Stripe’s eye.

BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees.

The startup is not the only VC-backed BaaS company to have resorted to layoffs to preserve cash over the past year.

MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

It has more primary customers than ChaseInside a CEO’s bold claims about her hot fintech startup, which TC previously covered here.

Zaver now has $30 million to make it a realityWe last checked in on Zaver, a Swedish B2C Buy-Now-Pay-Later (BNPL) provider in Europe, when it raised a $5 million funding round in 2021.

The company has now closed a $10 million extension to its Series A funding round, bringing its total Series A to $20 million.

Total investment to date stands at $30 million.

In Europe, Zaver competes on BNPL with Klarna, PayPal, and incumbents such as Santander and BNP Paribas.

However, Zaver’s schtick is it claims it can assess the risk on BNPL cart sizes of up to €200,000 in real time due to its risk assessment algorithms.

SBF sentenced, Worldcoin hit with another ban order and big web3 pre-seed rounds are backWelcome to TechCrunch Crypto, formerly known as Chain Reaction.

This week in web3Crunching numbersThis week the crypto market prices were a bit more chipper, with the top cryptocurrencies being green on the week.

The second-largest crypto, ether, increased 2.6% on the week to $3,550, according to CoinMarketCap data.

Zero-knowledge proofs are a cryptographic action used to prove something about a piece of data, without revealing the origin data itself.

Scott and I discuss Space and Time’s origin story, how data warehouses work in Web 2.0 versus web3 and the importance of data transparency.

The deal is interesting on a number of fronts including the round’s structure and how Skyflow has been impacted by growth of AI.

The new capital comes after Skyflow expanded its data privacy business to support new AI technologies last year.

(In its latest news dump, Skyflow said that it expanded its support of China and that market’s particular data rules.)

This Skyflow round slots neatly into several trends we’ve observed recently.

The explosive growth in AI is creating healthy businesses for LLM infrastructure and support companies.

Most recently, the company expanded its offer its virtual therapy sessions to services for adolescents across its footprint.

The virtual clinic’s medication-assisted treatment for substance use disorders is available across 50 states for adults and teens.

Since its Series B, Pelago has experienced an impressive 11x revenue surge and claims to have 100% client retention.

Pelago members have regular sessions with virtual care teams in the app, consisting of health coaches or licensed drug and alcohol counselors.

In addition to its virtual therapy interface, the company is investing in bringing more tech to bear on its business.

StealthMole, an AI-powered dark web intelligence startup that specializes in monitoring cyber threats and detecting cybercrime, announced Thursday that it has raised a $7 million Series A funding round.

The startup serves over 50 clients across 17 countries in Asia, Europe, and the Middle East.

One differentiator from its competitors in the cybersecurity industry is its unique expertise in Asia-related threats, Kevin Yoo, chief operating officer (COO) at StealthMole, told TechCrunch.

“The high demand for Asia-oriented threat information underscores the uniqueness and value of our dataset for customers worldwide, within and beyond Asia,” Yoo said.

Korea Investment Partners led the Series A round with participation from Hibiscus Fund (a joint venture between RHL Ventures, Penjana Kapital and KB Investment) and Smilegate Investment.