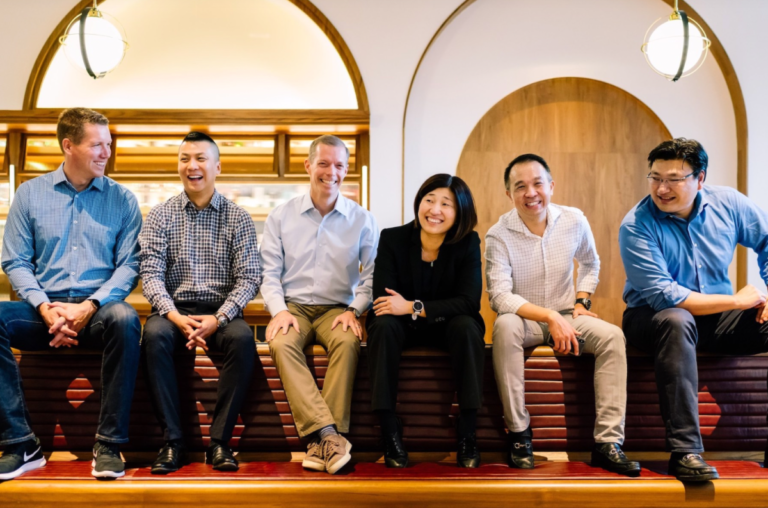

GGV Capital announced last fall that was splitting up its team amid growing tensions between U.S. and China, though it never cited the atmosphere as the explicit driver of the move.

The thinking in abandoning the GGV Capital brand, per a source familiar, was that because both teams are operating separately going forward, they felt it was best to develop new brands.

Oren Yunger, the newest member of GGV Capital, also remains on team Notable.

Another longtime managing director at GGV Capital, Eric Xu, who is based in Shanghai, will continue to oversee the original firm’s independently operated yuan-denominated funds.

Roughly 2.5 years ago, GGV Capital announced it has raised $2.5 billion for its new funds, marking its largest family of funds ever.

Twitch is introducing a new tier to its premium revenue share program — currently known as the “Partner Plus Program” — that would grant a 60/40 revenue split and has lower qualification requirements than the existing tier, expanding access to smaller creators.

Under the existing program, Partner Plus streamers receive 70% of the first $100,000 of net subscription revenue, and then 50% of any revenue after that.

The update also lowers the requirement to qualify for the 70/30 split from 350 Plus Points to 300 Plus Points.

Many streamers argued that the Partner Plus Program excluded the majority of creators because the qualification criteria was so high.

One is informed by the other, he said, but changes to Prime subscription payouts and the Plus Program have been in the works for months.

Helbiz’s reverse stock split should help it get back in compliance with the Nasdaq, which issued a delisting notice last July. The company has also announced plans to expand its…